This is a very strong and drastic step by the State Bank of Vietnam (SBV) to enhance security and safety in online payments, thereby creating a healthy environment to promote the widespread and sustainable development of cashless payments.

According to information from the State Bank of Vietnam’s Payment Department, after implementing Decision 2345, the number of fraud cases decreased by 50% compared to the average of the first 7 months of the year, and the number of accounts involved in fraud decreased by 72%. These results show the effectiveness of Decision 2345 in enhancing security and preventing fraudulent acts, bringing peace of mind and safety to customers in financial transactions.

Continue to strengthen requirements for identification and authentication when conducting banking transactions

In order to continue to increase security and safety in payment transactions, in Circular 17/2024/TT-NHNN dated June 28, 2024 on Regulations on opening and using payment accounts at payment service providers and Circular 18/2024/TT-NHNN dated June 28, 2024 on Regulations on bank card activities, the State Bank of Vietnam has continued to add new regulations on: Checking and updating biometric information; Checking the validity period of identity documents; Checking the residence period for payment account holders and cardholders...

The new regulations require customers to update their biometric information, update expired identification documents, and update information on documents proving their residence period (applicable to foreign residents). This information ensures that the account owner/cardholder is the one using banking and financial services, thereby contributing to limiting fraud and fraudulent money transfers into rented/purchased/borrowed accounts of scammers, while minimizing damage to customers in case of fraud and theft of confidential information.

Customers need to update biometric information and update valid identification documents to avoid transaction interruption.

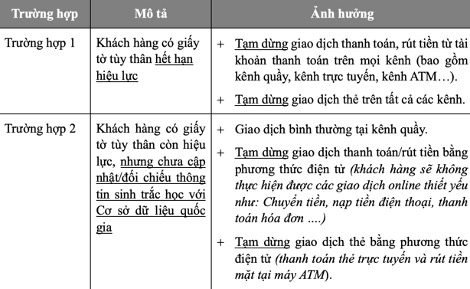

According to the provisions of the two Circulars mentioned above, from January 1, 2025, payment account holders/bank card holders will be TEMPORARILY SUSPENDED from performing banking transactions in the following cases:

In particular, according to the provisions of the 2023 Law on Identification (Law No. 26/2023/QH15), the ID card (including 9-digit and 12-digit types) is only valid for use in procedures and transactions until December 31, 2024. Currently, many customers are using 9-digit and 12-digit ID cards/ID cards at banks and will have their transactions suspended from January 1, 2025. These customers need to update their ID card/ID card information with chip as soon as possible.

The provisions of Circular 17 and Circular 18 will also affect foreign and corporate customers. Accordingly, banks will have to update information on the length of residence when opening and providing payment account/card services to foreigners. In addition, when opening a payment account/card for a business, banks must collect and monitor information on: (i) identification documents of the representative/related person of the business; (ii) biometric information of that person in case of conducting transactions electronically.

Instructions for updating biometric information and expired identification documents

To avoid transaction interruptions, Vietcombank recommends that individual customers who have not updated their biometric information and/or have not updated their ID card/CCCD with chip (still valid) at the bank:

+ Update biometric information right on the VCB Digibank application in just a few minutes. (During the process of updating biometric information, customers will simultaneously be updated with the latest identity document information).

+ Or update biometric information and/or identification documents at Vietcombank transaction points nationwide.

For customers whose identification documents have expired, Vietcombank will notify customers via email/SMS/OTT within 30 days before the identification documents expire. Customers can also go to Vietcombank transaction points to check the information.

For customers who have not updated their biometric information, Vietcombank will have specific notifications when customers log in to VCB Digibank and through other appropriate channels.

If you do not know whether you need to update biometric information or not, customers can proactively check according to the instructions: Log in to VCB Digibank >> Search for the feature "Update biometrics" >> Click on the feature (If the customer has updated biometrics, the system will notify on the screen. If the customer has not updated, the system will display detailed instructions).