Sharply increase tobacco taxes to achieve a winning policy

On May 9, the National Assembly discussed a number of contents with different opinions of the draft Law on Special Consumption Tax (amended). Many delegates were concerned about the issue of increasing tobacco taxes.

Delegate Nguyen Anh Tri - Hanoi National Assembly Delegation - said: According to the World Health Organization (WHO), tobacco tax is the fastest and most cost-effective measure to reduce tobacco consumption, thereby significantly reducing the number of diseases and premature deaths due to diseases related to tobacco consumption.

WHO also recommends that tobacco taxes should account for at least 75% of retail prices to achieve optimal results in reducing consumption of these products. Evidence from many countries shows that adjusting tobacco taxes is a solution that brings double benefits, both increasing revenue and ensuring people's health.

Stable revenue from tobacco taxes ensures funding for community health programs. For example, in the Philippines, after a strong tobacco tax increase in 2012, the smoking rate decreased from 27% (in 2009) to 19.5% (in 2021), while tobacco tax revenue increased from 680 million USD (in 2012) to 2.9 billion USD (in 2022).

In Thailand, from 1993 to 2017, tobacco taxes were increased 11 times, leading to a reduction in the smoking rate from 32% to 19.1%, and budget revenue increased more than 4 times (US$500 million to US$2.3 billion).

Therefore, increasing tobacco taxes high and increasing regularly is considered by countries around the world to be a policy of winning (won - win), winning in health protection and winning in increasing revenue for the State budget.

Compared to countries in the ASEAN region, Vietnam has a very low tax rate, the tax on retail price of cigarettes is lower than many countries such as: Thailand is 78.6%, Phillipines is 71.3% and Singapore is 67.5%. This makes the price of cigarettes in Vietnam still among the cheapest in Southeast Asia.

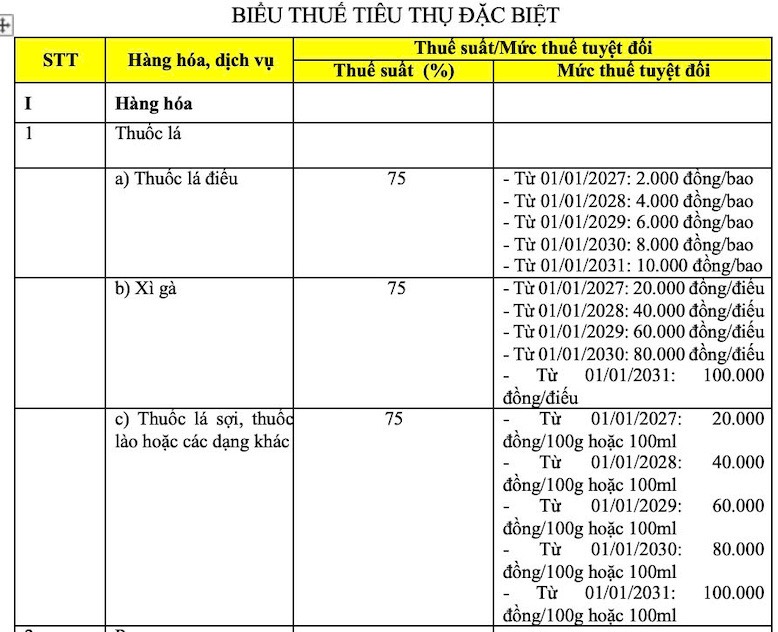

From the experience of countries and recommendations of the World Health Organization, National Assembly Delegate Nguyen Anh Tri suggested that the National Assembly consider immediately increasing, increase sharply, and regularly increase tobacco taxes. Specifically, according to the Special Consumption Tax rate (Article 8, Draft).

"There are some opinions that need to be adjusted. This is 75% of the retail price. In Vietnam, the concept of factory prices is unreasonable because the WHO recommends 75% of retail prices. With the absolute tax rate, I agree with the increase roadmap from January 1, 2027 to January 1, 2031, but I would like to propose a different level. Specifically, the starting price is 5 thousand VND/bag of 20 cigarettes, because there are places that sell 30 - 40 cigarettes. The roadmap is to increase by 3 thousand VND per year, by 2031 it will be 15 thousand VND/bag/20 cigarettes" - Mr. Tri proposed.

Increasing taxes on life-threatening cigarettes

Delegate Nguyen Anh Tri also added some information received from the Ministry of Health. Vietnam currently has more than 15 million smokers, ranking among the 15 countries with the highest number of smokers in the world. It is estimated that each year, there are more than 100,000 deaths from diseases caused by active smoking and exposure to secondhand smoke.

According to the research report of the Health Economics Association in 2022, the cost of health care for treatment and disability due to illness and premature death related to tobacco use in Vietnam is estimated at 108 trillion VND (about 4.5 billion USD), equivalent to 1.14% of GDP.

"For the people's lives, I hope the drafting committee will pay attention and accept it" - Delegate Nguyen Anh Tri said.

Sharing this view, answering the press at the National Assembly hall, Delegate Tran Khanh Thu - National Assembly Delegation of Thai Binh Province - said: "With tobacco products, the harmful effects of tobacco, the risk of causing diseases of tobacco to smokers and people around have been studied. No one can see the harmful effects of tobacco, it is immediately harmful, not only to smokers but also to those around them. Therefore, the Law on Tobacco Harm Prevention was established.

The issue of tax increase has also had a roadmap, but in recent years, the adjustment has increased quite slowly, so I think a strong enough boost is needed to reduce the current smoking rate. I think we should choose option 2, which is to apply a tax rate of 75% plus VND 10,000/pack by 2030, bringing a more significant impact".

A representative of the Tobacco Harm Prevention Fund - Ministry of Health said that both options proposed by the Ministry of Finance are still not strong enough to achieve health goals.

WHO recommends that in order to achieve the National Strategy target of reducing tobacco use rates by 2030 and creating additional government budget revenue, the absolute tax should be applied at the highest optimal level of at least VND 5,000/pack by 2026 and gradually increase to VND 15,000/pack by 2030, in addition to the 75% tax rate.

This option is expected to bring outstanding benefits. The rate of male smokers will decrease to 35.8%, equivalent to a reduction of more than 696,000 smokers compared to 2020, achieving the target of the National Strategy for Tobacco Harm Prevention. Not only that, budget revenue will also increase by VND29,000 billion per year by 2030, about 25% higher than option 2.