Registration fee

Houses and land are exempt from registration fees but still have to declare dossiers from February 14

|

Decree 373/2025/ND-CP (effective from February 14, 2026) specifically regulates dossiers for declaration of house and land registration fees that are exempt.

Details of the price list for calculating housing registration fees in Can Tho will be applied from November 1, 2025

|

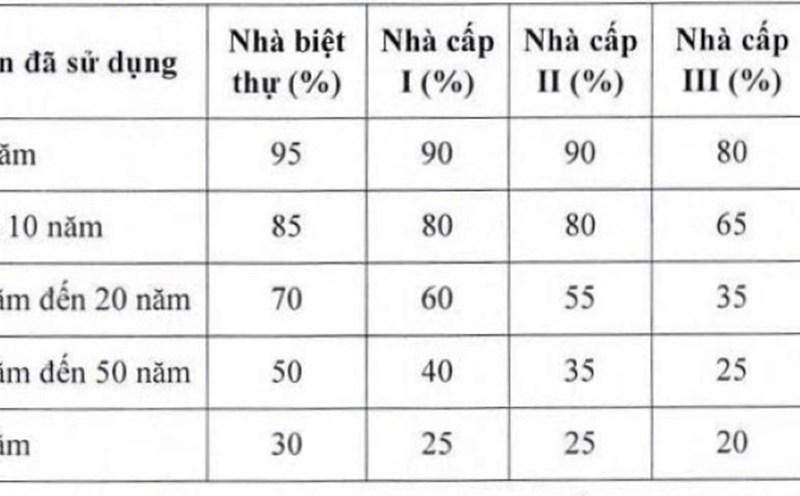

Can Tho - From November 1, 2025, Can Tho City will apply a new price list to calculate registration fees for houses and the remaining percentage (%) of house quality.

From November 1, houses in Can Tho apply a new price list for calculating registration fees

|

Can Tho - The City People's Committee issued new regulations on the price list and the remaining quality ratio of houses as a basis for calculating registration fees, applicable from November 1, 2025.

The Tax Department implements new regulations on registration fees for cars and motorbikes

|

The Tax Department has just issued Official Letter 3316/CT-CS implementing Decree 175/2025/ND-CP and Circular 67/2025/TT-BTC on registration fees.

Cases of real estate exempted from registration fees from July 1, 2025

|

Decree 175/2025/ND-CP effective from July 1, 2025 stipulates that many subjects will be exempted from registration fees when registering home ownership and land use rights.

Regulations on the price for calculating registration fees for real estate

|

In case the price of real estate in the sale contract is higher than the price issued by the Provincial Party Committee, the price for calculating the registration fee (LPTB) is the price in the sale contract.

A proposed change to the motorbike registration fee after the merger of provinces and cities

|

Currently, the registration fee (LPTB) in the city is 5%, in rural areas is 2%. Many people are worried that when merging into the city, they will have to pay higher LPTB for motorbikes.

From today, 50% reduction in registration fee for domestic cars is over

|

From December 1, 2024, the policy of reducing 50% of registration fees for domestically produced cars will end. The collection rate will be reapplied according to Decree 10/2022/ND-CP.