Social insurance

Responsibility for determining the act of late payment and evasion of compulsory social insurance payment

|

The social insurance agency directly managing is responsible for determining the behavior of late payment, evasion of social insurance and unemployment insurance payment, calculating the amount and interest of 0.03%/day.

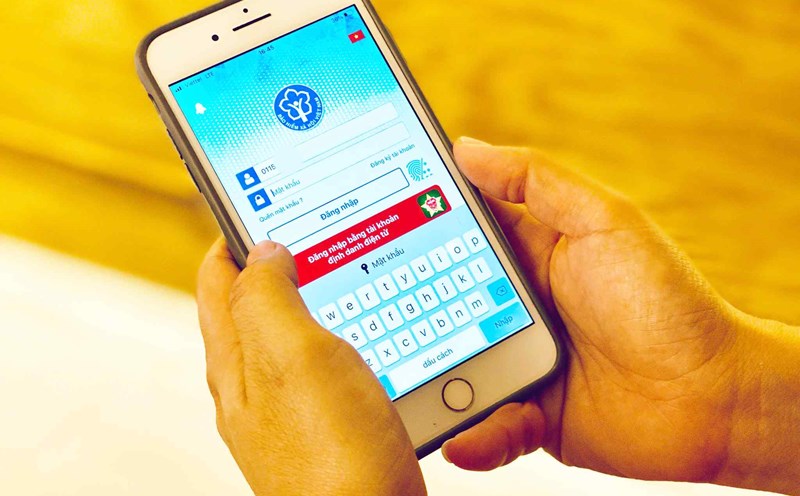

Medical facilities require patients to present paper health insurance cards, which is not in accordance with regulations

|

Hanoi Social Insurance affirmed that the request for a paper health insurance card by a medical facility is not in accordance with regulations, people can use CCCD, VNeID level 2 or electronic cards instead.

It is necessary to clearly qualify the responsibilities of individuals and social insurance collection units

|

Law on Social Insurance No. 41/2024/QH15 and Law on Health Insurance No. 51/2024/QH15, effective from July 1, 2025, have added many new and stricter regulations on urging and handling acts of late payment and evasion of compulsory social insurance (SI), unemployment insurance, and health insurance.

Responsibility for determining the act of evading compulsory social insurance payment

|

Reader khuecacxxx@gmail.com asked: Which agency is responsible for determining the act of evading compulsory social insurance and unemployment insurance payments?

Latest regulations on not being considered an evasion of compulsory social insurance payment

|

Reader thuthaoxxx@gmail.com asked: In which cases is it not considered an evasion of compulsory social insurance and unemployment insurance?

How to pay compulsory social insurance when employees work at many companies at the same time

|

If working at multiple companies at the same time, employees must pay compulsory social insurance (SI) as follows.

In the first 8 months of the year, Dong Thap had 6,533 units late in paying insurance

|

Dong Thap - There are 6,533 employers that are late in paying social insurance, health insurance, and unemployment insurance, with a total amount of more than 388 billion VND.

Proposal to consider signs of violations to prosecute a business that evades social insurance payments

|

HCMC - The City Labor Federation (LDLD) recommends reviewing signs of violations to criminally prosecute the act of evading social insurance payment by a business

Fake website appears online public service portal of Vietnam Social Insurance

|

Vietnam Social Security (VSS) discovered a fake website with a domain name, interface, and image similar to the Vietnam Social Security Online Public Service Portal.

Not organizing grassroots social insurance at the location where the provincial social insurance headquarters is located

|

The Director of Vietnam Social Insurance (VSS) has just signed and issued a Decision regulating the functions, tasks and powers of the grassroots social insurance.

Social insurance guides how to close books when companies owe social insurance money

|

Vietnam Social Security has just responded, providing information guiding how to close the book when the company owes social insurance (SI).

Early retirement regime for medical staff born in 1967

|

The Ministry of Home Affairs has just clarified the early retirement regime for medical staff born in 1967,

Procedures for proposing to continue receiving monthly pensions and social insurance benefits according to new regulations

|

In some cases, the Social Insurance agency requires pensioners and monthly allowances to complete procedures to request continued payment of the regime to avoid incorrect or overlapping payments.

Guidelines for business households to handle the latest electronic social insurance registration incident

|

Ho Chi Minh City Social Insurance has just guided business households to handle electronic social insurance registration incidents.

The Ministry of National Defense talks about adding the time to pay social insurance for demobilized soldiers

|

The Ministry of National Defense has just responded to the proposal of voters of Hanoi City on adding the social insurance payment period for soldiers discharged from the army after January 1, 1995.