Morgan Stanley expects gold prices to rise to $4,500/ounce by mid-2026, driven by strong physical gold holdings from ETFs and central banks amid uncertain global economic outlook.

In a report to customers, Morgan Stanley said that the record gold price increase this year has pushed gold into the "overbought" zone according to the RSI index, but the recent adjustment has helped the market return to a healthier state, opening up room for the next uptrend.

The bank expects capital flows into gold ETFs to remain positive as global interest rates gradually decline, while central banks continue to buy, although the pace may slow down. Demand for jewelry is said to be more stable after a period of decline.

However, Morgan Stanley also warned that the risk of adjustment still exists, especially if price fluctuations are too strong, causing investors to shift to other assets, or many central banks reduce the proportion of gold in reserves.

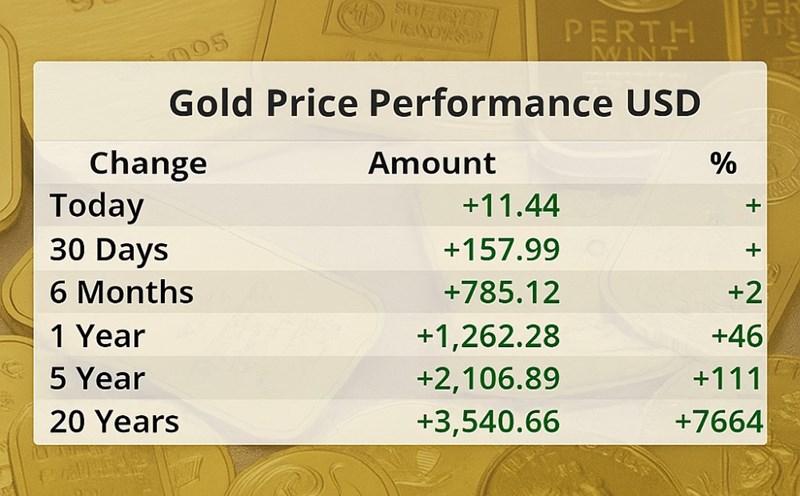

Since the beginning of 2025, world gold prices have increased by more than 54%, reaching a historical peak of 4,381.21 USD/ounce on October 20, before falling sharply by more than 8%. This increase was driven by geopolitical tensions, expectations of lowering interest rates, a wave of central bank gold purchases and strong capital flows into ETFs.

Not only Morgan Stanley, but a series of other major banks are also betting on the upward prospect of gold next year.

JP Morgan forecasts gold prices to average $5,055/ounce in the fourth quarter of 2026.

ANZ forecasts gold prices at $4,600/ounce in June 2026.

Bank of America and Societe Generale raised their gold price forecast for 2026 to $5,000/ounce.

Goldman Sachs believes gold could reach $4,900/ounce by the end of 2026.

Deutsche Bank forecasts gold prices to reach $4,300/ounce in the fourth quarter of 2026.

According to analysts, banks are reflecting the consensus that gold is still the number one safe haven asset in the period of global geopolitical fluctuations.

If real interest rates fall further, even negative, gold prices could head toward $4,700 an ounce, UBS said in its mid-October report.

In that context, the $4,500/ounce threshold will become an important psychological milestone, signaling the possibility of gold entering a new price stage after more than half a decade of intense fluctuations.

Regarding domestic gold prices in Vietnam, SJC gold bar prices are currently trading around 147.2 - 148.2 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is trading around 145.7 - 148.7 million VND/tael (buy - sell).