China's decision not only affects fluctuations in gold prices in the international market but also causes stocks in the jewelry industry to plummet and shook the psychology of investors in the world's largest gold market.

Previously, Beijing announced the end of the mechanism to allow some businesses to completely deduct VAT when selling gold purchased from the Shanghai Gold Exchange (SGE) and the Shanghai Securities Exchange (SHFE) - a move seen as a possible cooling of domestic retail gold demand.

Under the new regulations, companies that produce gold for non-investment purposes such as jewelry or electronic components are only entitled to a 6% VAT deduction, instead of 13% as before. Enterprises not under SGE or SHFE must also apply this new deduction when selling investment products such as gold.

The above information immediately shocked the market, causing stocks of large jewelry corporations to plummet: Chow Tai Fook Jewellery Group decreased by 12% in Hong Kong (China), Chow Sang Sang Holdings lost more than 8%, andopu Gold decreased by over 9%. Citigroup analysts said that this tax change could force the entire industry to adjust up selling prices to cover costs.

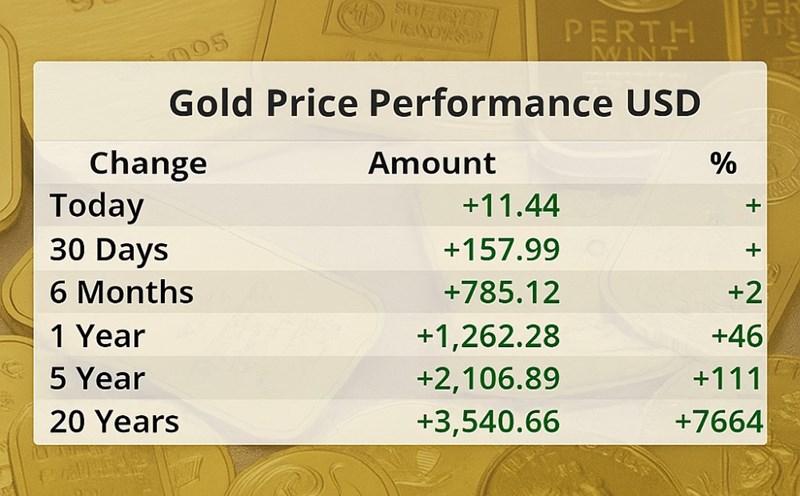

In October, gold prices set a new record partly due to the huge wave of retail sales in China, before falling sharply in recent weeks. However, since the beginning of 2025, gold prices have increased by more than 50% - reflecting the sustainable attractiveness of the precious metal in the context of global instability and reserve demand from central banks.

Changing tax policy in the worlds largest gold consumer will certainly reduce investor excitement, said Adrian Ash, research director at Bullion Vault.

Gold prices currently reflect a US dollar correction rather than a safe haven, said Kelvin Wong, senior analyst at OANDA. He said that the risk-off sentiment in the stock market and the cooling of US-China trade tensions are also reducing demand for gold as a defensive asset.

Experts say the global gold market is still in a testing period: both under pressure from China's tax policy and supported by low interest rates and the need to hold safe assets. In the short term, gold prices are likely to fluctuate around $4,000/ounce.

The decline in gold on November 3 was mainly due to the recovery of the USD and short-term profit-taking activities of investors after prices continued to increase.

Analysts also predict that every time gold prices increase to the $4,000/ounce range, they will be under strong profit-taking pressure from the market. Gold is likely to fall into a correction cycle in the last 2 months of the year, after a series of consecutive strong increases.

After a trading day with many fluctuations of fluctuations compared to last weekend's session, until 5:44 p.m. on November 3, Vietnam time, the world gold price was trading around 3,998 USD/ounce, down about 3.88 USD/ounce.

Regarding domestic gold prices, as of 4:50 p.m. on November 3, SJC gold bar prices were trading around 147.5 - 149 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is listed at 146.5 - 149.5 million VND/tael (buy - sell).