The increase is becoming unreasonable

Heraeus Industrial and precious metals Group (Germany) believes that the global gold - silver market is in a state of "excessive heat", when prices and supply are under great pressure. However, according to market rules, "the price will be adjusted automatically" and the cooling cycle may soon begin.

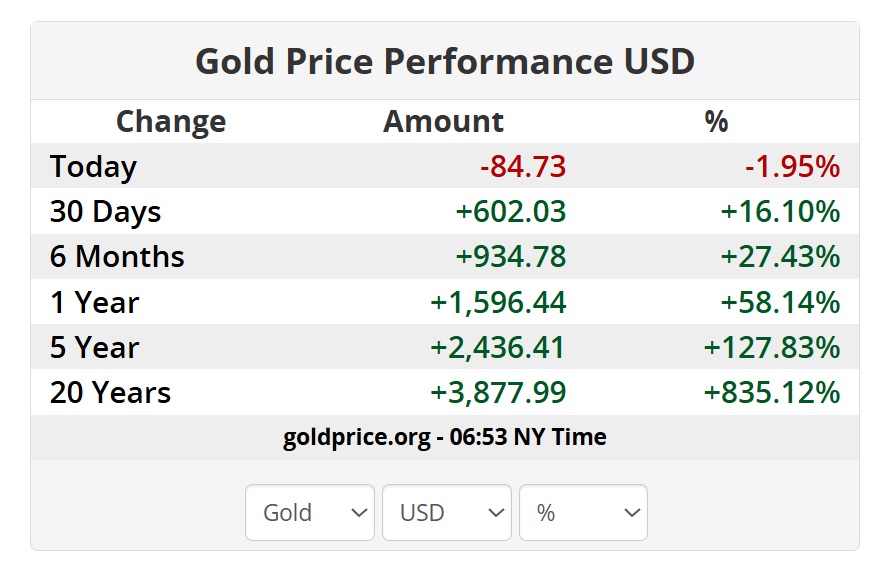

According to Heraeus' October report, world gold prices have increased by more than 200 USD/ounce in just 1 week - the strongest increase in many months - making the market "too overbuy".

Heraeus experts say that the conflict in Gaza has signs of cooling down that should have caused gold prices to fall, but in reality, the opposite is true. The fear of missing out (FOMO) is making the rally unreasonable, Heraeus said.

In India, the Diwali light festival - an occasion when people often buy gold as gifts - does not bring "light" like every year. Gold prices at a record level caused jewelry sales to decrease by 17% compared to the same period last year, down to 88.8 tons in the second quarter of 2025. However, the demand for gold investment has increased sharply, causing the domestic gold fee gap to reach 25 USD/ounce. Heraeus said India's gold imports fell 44% compared to last year, due to limited supply.

In the US, the Federal Reserve (Fed) is signaling that interest rates may be cut at the end of October, as the labor market weakens, losing 32,000 jobs in September, while official data is delayed due to the government's temporary suspension. This information further strengthens the gold rally, with prices surpassing $4,300/ounce earlier this week.

Meanwhile, the silver market is also hot. Spot silver prices have been trading above $54 an ounce at times, before cooling down slightly. Heraeus said physical silver supply remains extremely tense, despite signs of cooling down in the futures market. COMEX's Treasury stock fell more than 10 million ounces as investors switched to difference-denominated trading.

The activities of silver ETF funds also fluctuated strongly: In just a few days, 9 million ounces were purchased and immediately after that, 10 million ounces were withdrawn, marking the largest withdrawal since February. In India, the shortage of silver has forced domestic ETFs to temporarily stop accepting new registrations, while silver imports have decreased by 46% compared to last year.

High prices will automatically adjust high prices

According to Heraeus, the market is entering a period where high prices will adjust to high prices - meaning demand will soon decrease because buyers cannot bear the current price. For example, during the 2011 price increase, the silver content in solar cells decreased by up to 70% due to manufacturers being forced to save raw materials.

The current pressure cannot last forever. When the cost is too high, the market will adjust itself" - the conclusion report. However, Heraeus warned that geopolitical tensions and loose monetary policy could still leave gold and silver prices volatile before they actually cool down.

In the domestic market, some gold trading enterprises also note that the market is benefiting from uncertainty, but there are also great risks due to strong fluctuations. Gold prices in the "hot" zone may suddenly reverse, causing losses to inexperienced investors.

In the short term, developments in US financial and trade policies and government shutdowns are still key factors dominating the global gold price trend.

In fact, by 10:00 p.m. on October 21, Vietnam time, world gold prices witnessed a terrible plummet, from a peak of nearly 4,375 USD/ounce to only 4,132 USD/ounce, equivalent to a decrease of more than 240 USD - the strongest in the history of a trading session.

Regarding domestic gold prices, SJC gold bar prices are trading around 152 - 152.5 million VND/tael (buy - sell).

Bao Tin Minh Chau's 9999 gold ring price is trading around 156.5 - 159.5 million VND/tael (buy - sell).