Gold prices became the focus of discussion at the Vancouver Resources Investment Conference (VRIC) Canada held at the end of January, when a series of leading experts shared the view that the current upward momentum is not temporary.

At the "Gold Price Forecast" discussion session co-chaired by Ms. Daniela Cambone - Global Communications Director of ITM Trading - the opinions all revolved around a common point that the long-term support forces of gold prices are still intact.

Participating in the discussion session were many big names such as Mr. Alastair Still - CEO of GoldMining, Mr. David Garofalo - Chairman and CEO of Gold Royalty, Mr. Matthew Piepenburg - partner of Von Greyerz, famous author Robert Kiyosaki and Mr. Ronald-Peter Stöferle of Incrementum.

Central bank continues to "pump strength" for gold prices

One of the key factors pushing gold prices to increase sharply from 2025 to early 2026 is the large-scale buying activity of central banks.

According to the World Gold Council (WGC), last year central banks purchased a total of 863 tons of gold. Although lower than the level of over 1,000 tons 3 years earlier, this figure is still significantly higher than the historical average.

Experts at VRIC believe that this trend will continue in 2026, continuing to play a "supporting" role for gold prices. The root cause is the desire to diversify foreign exchange reserves, reduce dependence on USD-denominated assets, especially US Treasury bonds - which were once considered safe havens.

Mr. Piepenburg pointed out that since 2014, central banks have net sold US bonds and increased gold hoarding, this trend became more apparent after the US imposed tough financial measures on Russia in 2022.

US public debt and the monetary role of gold

Mr. David Garofalo emphasized that the US debt-to-GDP ratio in the past 50 years has increased from about 100% to 350%, putting the US Federal Reserve (FED) in a difficult position when managing interest rates.

The US total public debt exceeding $34,000 billion along with a prolonged budget deficit is weakening the confidence of central banks in US bonds.

According to Mr. Garofalo, it is the decline in confidence in sovereign public debt that is pushing capital to gold.

Stablecoin also pours money into gold

Another notable point is the increasing participation of stablecoin issuing organizations. Typically, Tether currently holds about 16 tons of gold, worth more than 2.5 billion USD.

According to Mr. Piepenburg, the paradox lies in the fact that stablecoins are created to support the USD, but profits from them are being converted into gold - a more stable asset than legal tender.

Experts believe that capital flows from the cryptocurrency sector to gold will help expand the "patch" of investors, while promoting the restructuring process in the gold mining industry.

The $7,000 mark is no longer a distant prospect

Regarding the question of whether gold prices are "too high", Mr. Garofalo said that investors should see gold as a channel to retain long-term value, rather than just a speculative tool.

Regarding price prospects, Mr. Garofalo frankly gave the figure of 7,000 USD/ounce. Meanwhile, Mr. Piepenburg said that the current price increase cycle has only gone about halfway through an 8-year cycle. "Based on fundamental factors, the long-term trend of gold prices is still upward," he affirmed.

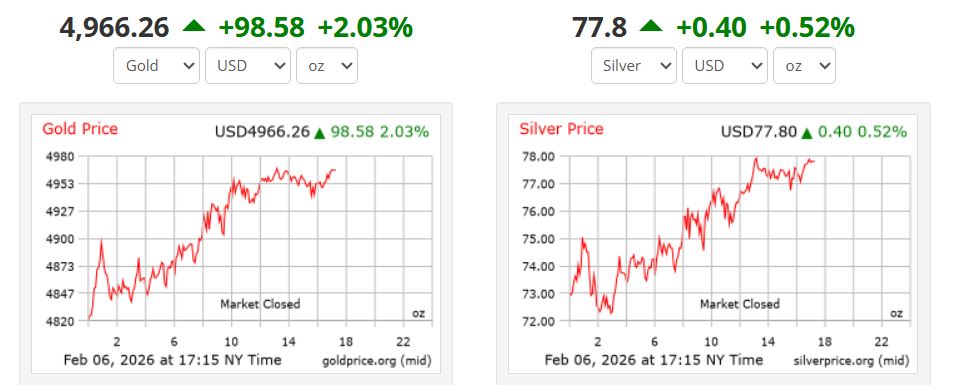

World gold prices closed last week at 4,966.26 USD/ounce.

Regarding domestic gold prices, SJC gold bar prices and Bao Tin Minh Chau 9999 gold ring prices traded around 176.3-179.3 million VND/tael (buying - selling).