Gold and silver prices closed the trading week in a record high zone, but the upward momentum showed signs of slowing down.

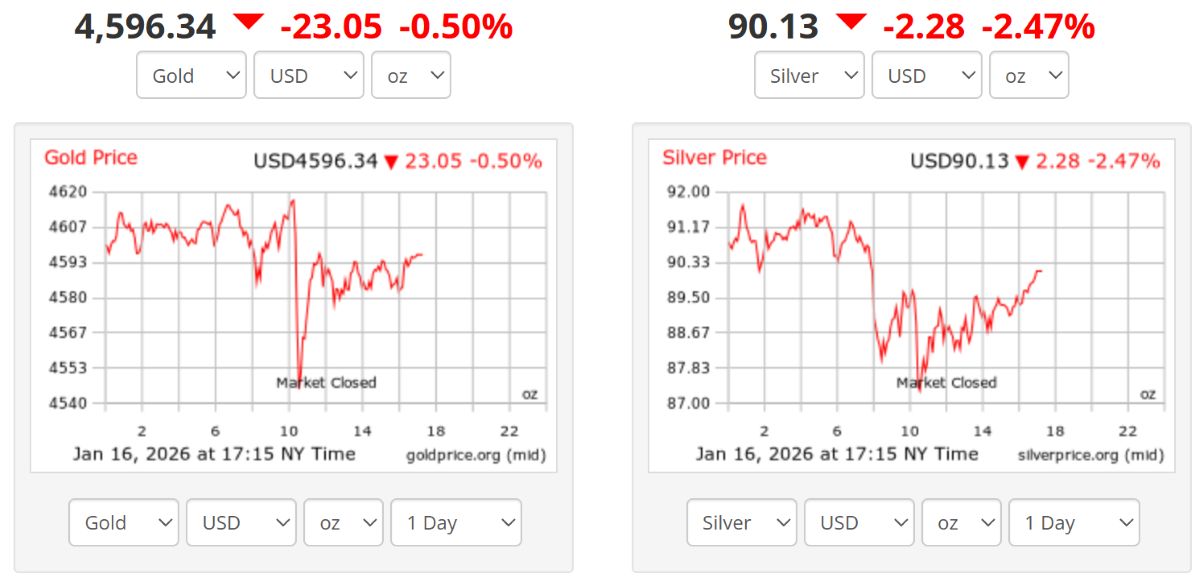

After a strong escalation streak, spot gold ended the last session of the week at 4,596.34 USD/ounce, down 23.05 USD, equivalent to a decrease of 0.50%.

This price level increased by 1.6% compared to the previous week but decreased by about 1.2% compared to the peak in the mid-week session.

Failing to maintain the highest level shows that buying forces are more cautious after the hot increase period.

Silver prices have similar developments but fluctuate much more strongly. This metal ended last week's session at 90.13 USD/ounce, up nearly 11% in the week but down about 5% compared to the peak reached on January 14.

The large fluctuation range reflects the excited and cautious sentiment of investors when prices have increased too quickly in a short time.

However, looking at it more broadly, the precious metal market is still recording a historic start to the year.

In the first half of January 2026 alone, gold prices increased by a total of 256 USD, equivalent to 5.6% - the second strongest year-on-year increase ever recorded, after the increase of more than 7% in January last year, but enough to affirm the special attraction of gold right from the early days of the new year.

With silver, the increase is even more impressive when the price has increased by nearly 17.5 USD, equivalent to more than 24%, approaching the 26% record that occurred in January 1983.

Because of this too strong and continuous increase, many experts believe that the market temporarily "slowing down" is a healthy thing.

Mr. Neil Welsh, Head of Metals at Britannia Global Markets, said that the fact that gold prices are maintained around the 4,600 USD/ounce mark reflects a typical accumulation period after 1 year of continuous growth.

Mr. Welsh also said that the temporary suspension of gold and silver's upward momentum is understandable, because recent economic data has not created enough pressure to force the US Federal Reserve (Fed) to change its monetary stance "waiting and observing".

According to CME's FedWatch tool, the possibility of the Fed cutting interest rates in the first quarter is very low, a factor that may limit the short-term upward momentum of the precious metal.

From a technical perspective, Mr. Lukman Otunuga, senior analyst at FXTM, said that the major trend of gold still leans towards price increases, despite the possibility of entering a sideways phase. The underlying factors such as concerns about the independence of the Fed, trade tensions and regular gold buying activities of central banks continue to support the market.

However, the RSI indicator is in the overbought zone, increasing the risk of correction. If gold prices weaken sustainably below 4,570 USD/ounce, the market may retreat to the 4,500-4,450 USD zone before buying force returns. Conversely, if it exceeds the 4,645 USD mark, the target of 4,700 USD will be quickly targeted.

Some other opinions are more cautious. Mr. Elior Manier, an expert at OANDA, warned that the market is becoming "too crowded with buyers". When banks, hedge funds and even investors who pay little attention to the market continuously make increasingly high price forecasts, it is often a sign of extreme excitement.

In the context of the buying position leaning completely to one side, just a small adjustment can trigger a chain of selling cut-loss wave.

However, not everyone believes that gold prices will soon adjust deeply. Mr. Naeem Aslam, Investment Director at Zaye Capital Markets, said that geopolitical risks are still high and gold continues to be a priority hedge.

According to him, it is entirely possible for gold prices to reach the 4,700 USD mark this month.

Regarding domestic gold prices, SJC gold bar prices are currently trading around 160.8 - 162.8 million VND/tael (buying - selling). 9999 Bao Tin Minh Chau gold ring price is trading at 159.8 - 162.8 million VND/tael (buying - selling).