The ruling coalition of Italian Prime Minister Giorgia Meloni is pushing a controversial proposal when it affirmed that the entire gold reserve of the Bank of Italy (Bank of Italy) is actually owned by the state.

Senator Lucio Malan - a member of the Italian Brotherhood party - said the goal of the proposal is to ensure that this gold is not misused in the future.

Even the Central Bank of Italy cannot want to do anything with that amount of gold, President Malan told Radio 24.

With 2,452 tons of gold, equivalent to about 13% of national GDP, Italy currently holds the third largest gold reserve in the world, after the US and Germany. World gold prices are continuously climbing, causing the value of this gold warehouse to surpass 300 billion USD, further heating up the debate.

A government official said Rome would seek opinions from both the Bank of Italy and the European Central Bank (ECB) before submitting the bill to the National Assembly for approval.

The 2026 draft budget proposed by Mr. Malan and 4 other lawmakers clearly states: "The reserve gold reserve, managed and held by the Central Bank of Italy, belongs to the State, on behalf of the people of Italy".

This proposal is not the first time it has appeared. Over the past 20 years, many Italian politicians have wanted to clarify their ownership of gold depots, even considering selling a part to reduce public debt or increase spending.

However, the ECB warned in 2019 that any action to limit the central bank's autonomy - including its intervention in gold management - was not in line with EU treaties. The European Central Bank System (ESCB) law prohibits central banks from receiving government instructions.

However, Mr. Malan denied any plans to sell gold. He affirmed that the alliance only wants to "eliminate the risk" of gold being sold in the future, but did not give specific details.

According to the Bank of Italy, this gold could be used as collateral for borrowing or - in the final scenario - for selling to buy euros, supporting the value of the currency. In the context of global economic fluctuations and high gold prices, the role of reserves becomes even more sensitive.

As gold prices continue to peak, Italy's world's third largest gold warehouse is not only a huge financial asset, but also the focus of a continental political debate.

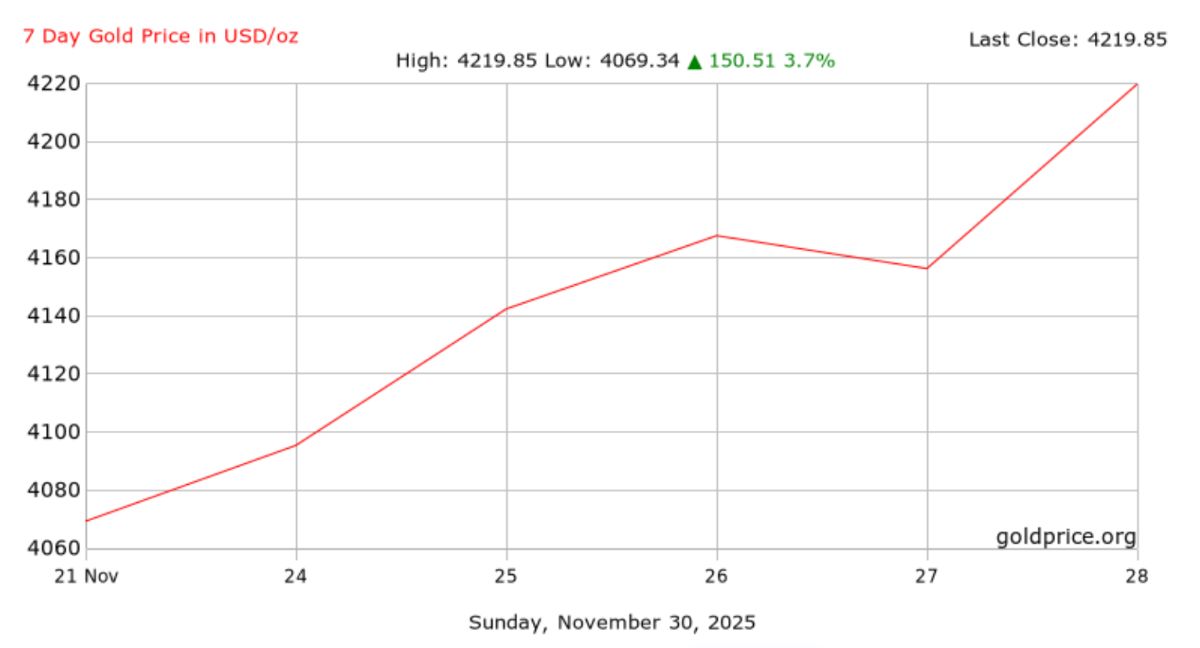

World spot gold prices increased by 1.51% in the last session of the week (at 5:15 p.m. on November 28, New York time, USA), jumping to the highest level since November 13, reaching 4,219,23 USD/ounce.

Overall last week, gold prices rose 3.6% and for the whole month rose 5.2%, marking the fourth consecutive month of increase - a series of rare climbs since the beginning of the year.