Selling prices are adjusted simultaneously

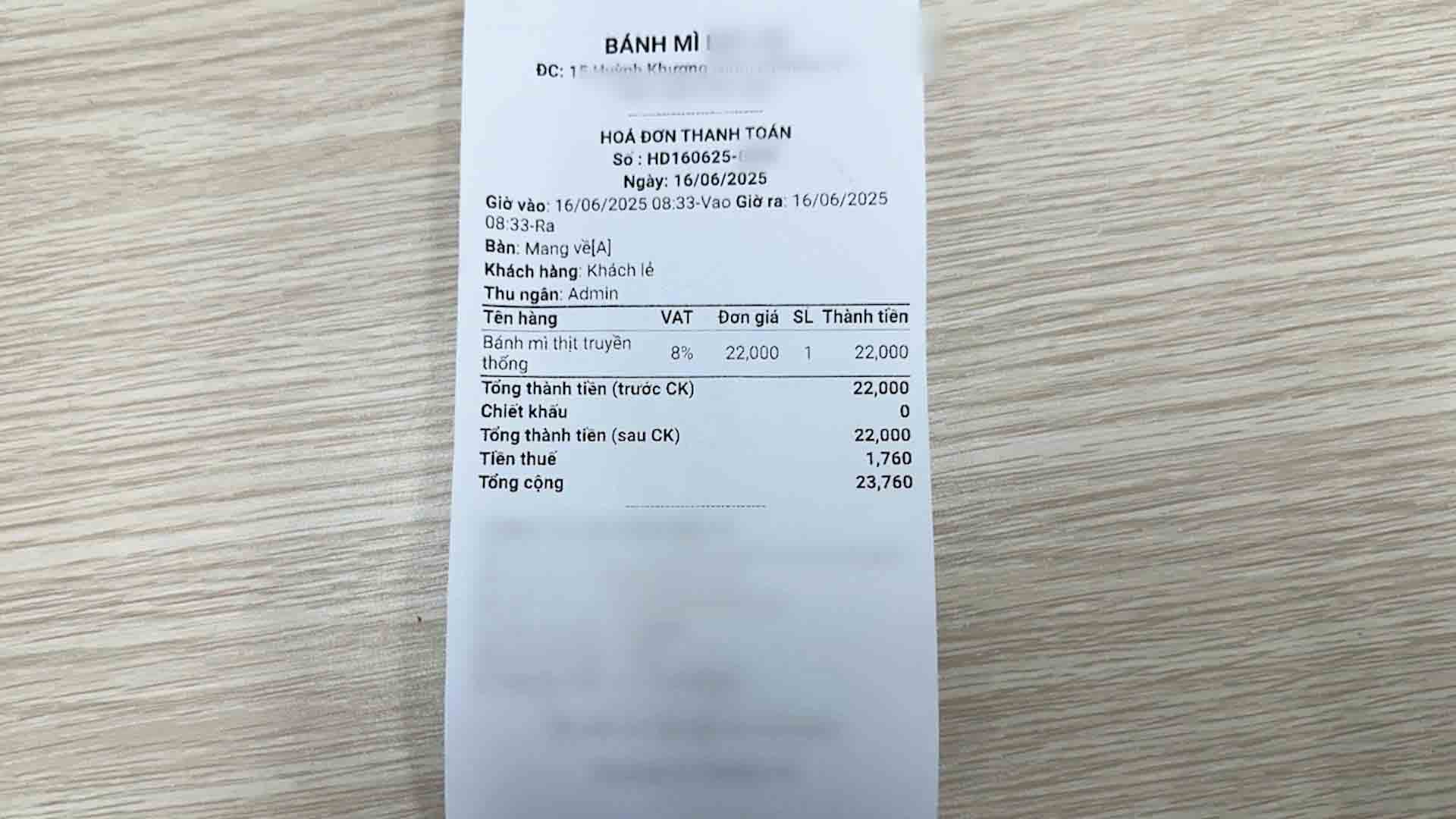

According to Lao Dong, a famous banh mi shop on Huynh Khuong Ninh Street (District 1) has just announced an increase in price from 22,000 VND to 24,000 VND/bowl, immediately affixing the glass: "From June 1, 2025, 24K banh mi/1 bowl has included VAT".

Not only this bakery, but also beverage brands have begun to increase prices. P. beverage company announced an increase in price from 25,000 VND to 29,000 VND from June 16. The company said that the adjustment is to cope with the cost of raw materials and operations.

Having stopped by to eat at a restaurant on Dien Bien Phu Street (Binh Thanh District), Ms. Kim Ngan, who lives in Binh Thanh District, shared: "The day before, I stopped by the restaurant and ordered the dish as usual. The restaurant owner said that the prices of the dishes had just increased. I asked them and they just said because now they have to issue invoices.

In addition to price increases, some establishments also apply "strange" payment methods, prioritizing the use of cash that will not be subject to VAT. For customers who want to transfer money, they must pay an additional 8% of the total bill - equivalent to VAT applied to the restaurant and beverage industry.

Mr. Minh Duc - a technology driver said: "The increase in prices is understandable, due to the general increase in prices. However, many people rarely carry cash, but now not accepting a transfer is really inconvenient".

Struggling to adapt, waiting for support

According to Ms. Nguyen Anh My Hoang - Vice President of the Ho Chi Minh City Food Association (FBA), since Decree 70 took effect, FBA has recorded a widespread anxiety in the food business community, especially small business households.

Some traders even have to temporarily close their doors to listen and find ways to comply. They hope to receive specific guidance and support on technology and digital transformation to work with peace of mind in accordance with legal regulations" - Ms. Hoang said.

In addition, F&B businesses must strictly implement food hygiene and safety because it is directly related to consumer health. Not only households with large revenues but also small households or mobile business households need to pay attention to this issue. The traceability of input food is also to meet the invoice requirements of the tax sector.

Mr. Nguyen Tien Dung - Deputy Head of the Tax Department of Region II said that the fact that some businesses refuse to pay without cash, even collect additional fees or only receive cash is an isolated phenomenon that only occurs in a few business households. According to him, the reason may be that households do not clearly understand the State's policies or are still hesitant about the obligation to declare and pay taxes.

Although there are currently no specific regulations to punish the act of refusing to pay without cash, Mr. Dung said that this goes against the major policy of the Party and the Government on promoting cashless payments, moving towards a digital economy and transparency of transactions.

Mr. Dung emphasized that whether transacting in cash or by bank transfer, business households must issue invoices and fulfill tax obligations according to regulations. The tax industry currently has many modern tools for monitoring, such as an electronic invoice system that helps compare input and output, thereby detecting unusual signs such as low revenue not commensurate with costs, or exceeding the tax contract.