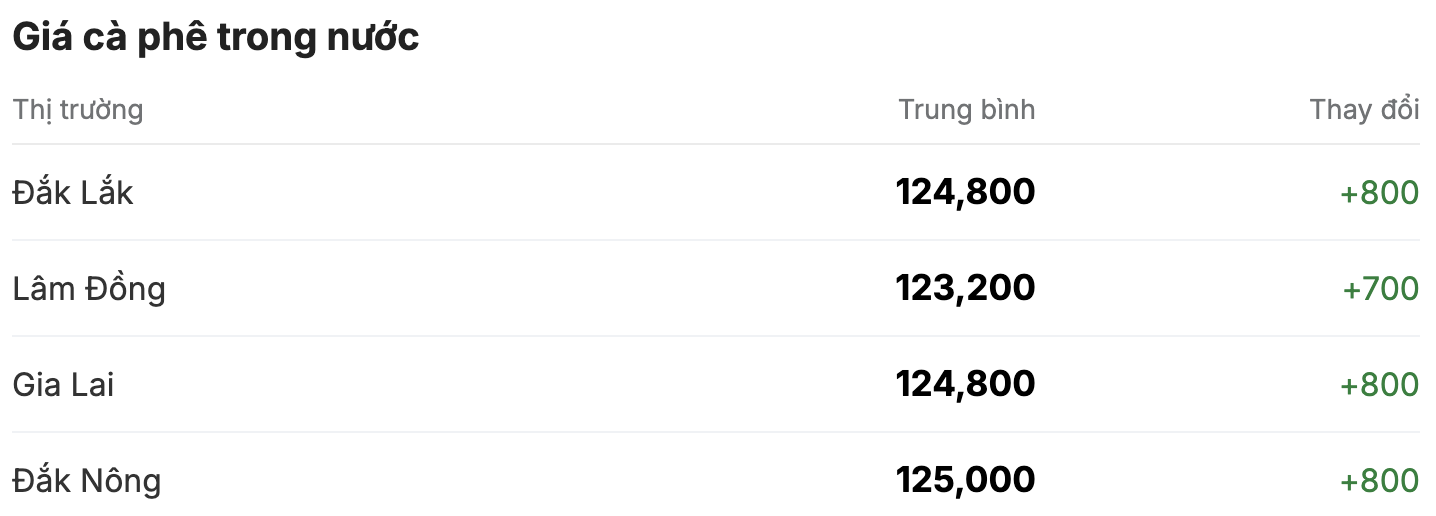

As of 1:30 p.m. today (December 17), the domestic coffee market has slightly increased, increasing by an average of VND800/kg per session, currently fluctuating between VND123,200 - VND125,000/kg. The average coffee purchase price in the Central Highlands provinces today is VND124,900/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands. Compared to the closing price last weekend, coffee prices in this region increased by 700 VND/kg, currently hovering at 123,200 VND/kg.

In the same direction, coffee purchasing prices in Gia Lai and Dak Lak provinces today ranked second on the chart, both increasing by 800 VND/kg, listed at 124,800 VND/kg.

Notably, Dak Nong has always maintained a stable performance, firmly holding the leading position in the province and city with the highest coffee purchasing price in the country, setting the mark of 125,000 VND/kg.

Thus, domestic coffee prices in the first session of the week witnessed alternating increases and decreases around the 125,000 VND/kg mark.

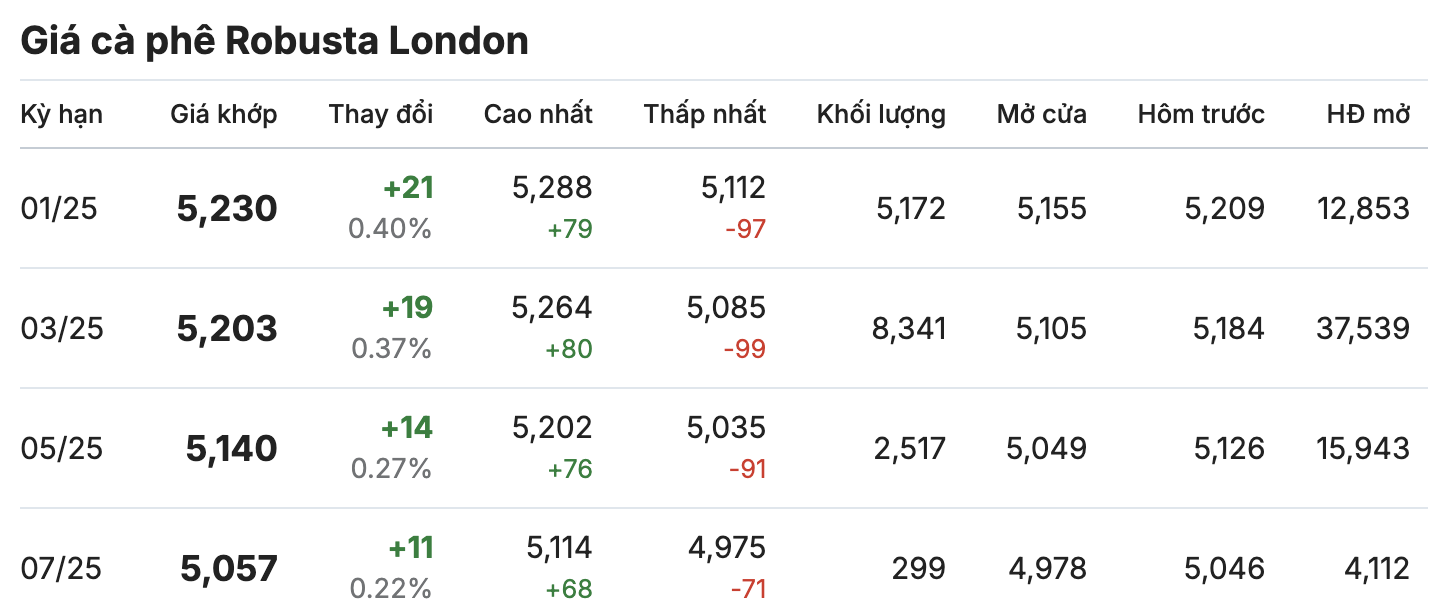

On the London and New York exchanges, the coffee market moved in an upward trend across all terms. The January 2025 contract increased by 0.40%, standing at 5,230 USD/ton. The March 2025 contract moved in the same direction, standing at 5,203 USD/ton.

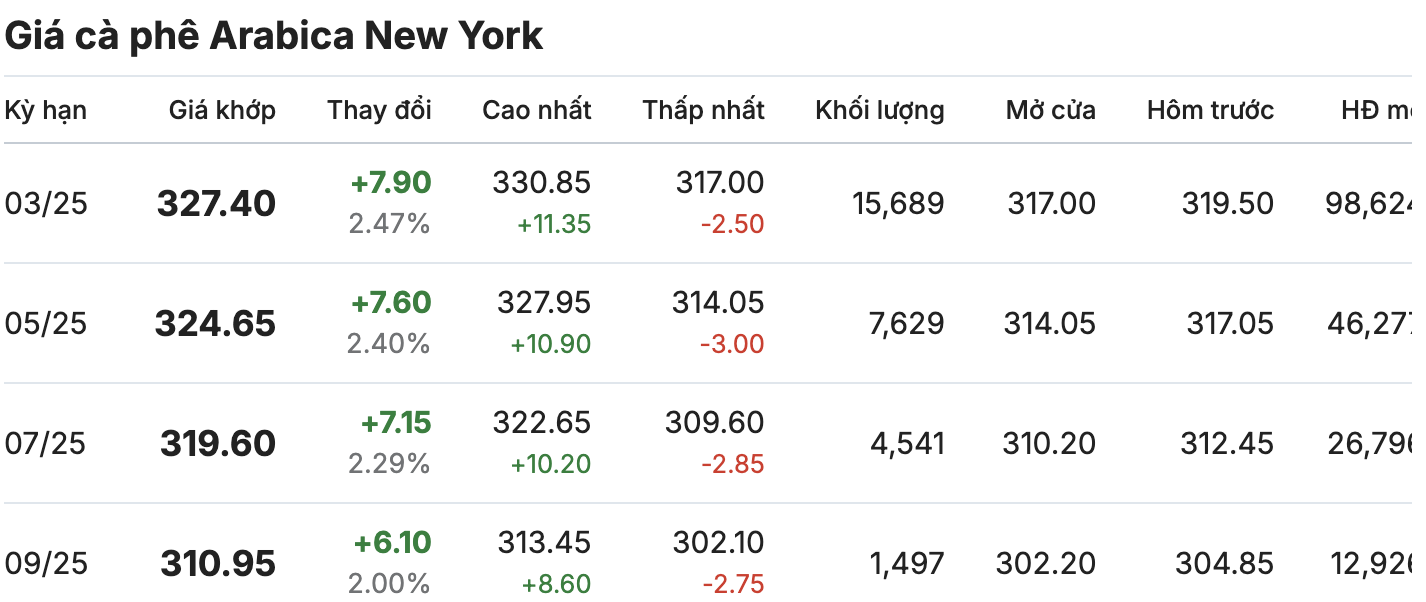

Notably, the New York Arabica coffee market saw a sharp increase after a stagnant session at the beginning of the week. The March 2025 and May 2025 delivery periods were anchored at 327.40 cents/lb and 324.65 cents/lb, respectively, up 7.60 - 7.90 cents/lb.

Coffee prices recorded positive gains today, especially Arabica coffee. Below-average rainfall in Brazil's main coffee growing region has raised concerns about supply in Brazil amid mixed fundamentals. This has also negatively affected the development of coffee trees in the 2025-2026 crop year, thereby making the supply outlook not very optimistic.

Currently, Vietnam's coffee consumption market is not only focused on European countries, America, Japan but also on emerging markets such as China and Southeast Asian countries.

Previously, the Chinese market mainly favored instant coffee, reaching over 70%, and brewed coffee at nearly 20%, and ready-to-drink coffee at 10%. However, this ratio has changed to 52%; 36% and 11% respectively. Of which, the trend of drinking brewed coffee at the spot has increased significantly.

The average coffee consumption per capita in this country is still low compared to neighboring countries such as Japan and South Korea, so the growth potential of the Chinese coffee market is very fertile. The reason for this is that the majority of Chinese people have the habit of drinking tea, but the young generation born in 1990 and later are gradually switching to drinking coffee.