As of 1:30 p.m. today (December 15), the domestic and international coffee markets have been moving in opposite directions. Domestically, this commodity continues to increase strongly in each session, trading at 123,500 - 125,200. At the end of the week, domestic coffee prices increased by 500-1,200 VND/kg compared to the previous trading session.

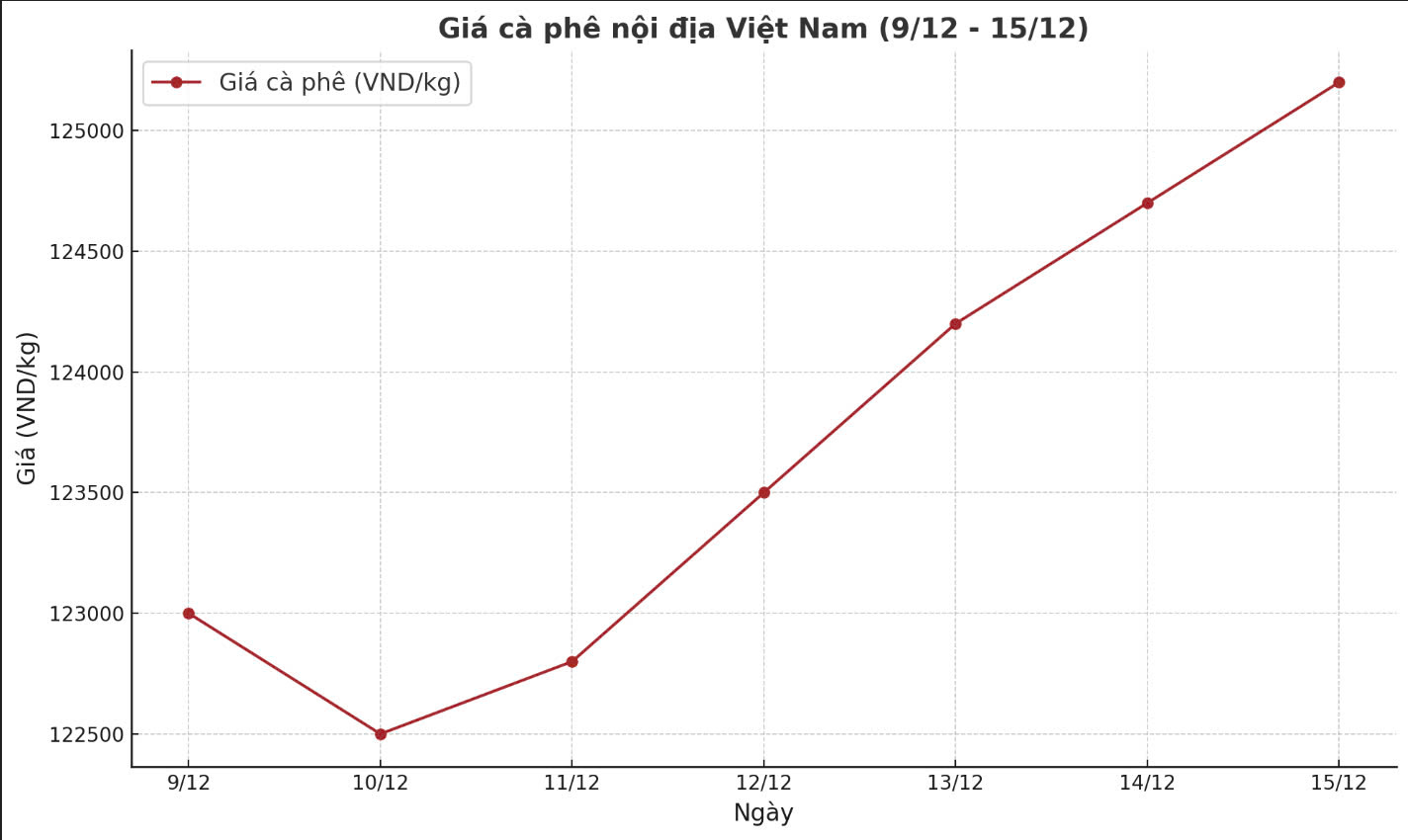

Despite a slight decrease at the beginning of the week, domestic coffee prices in Vietnam this week from December 9 to December 15 still recorded a significant increase compared to the previous week. At the end of last week, coffee prices reached a peak of VND124,000/kg, compared to the closing price this week, domestic coffee prices increased by VND1,000/kg.

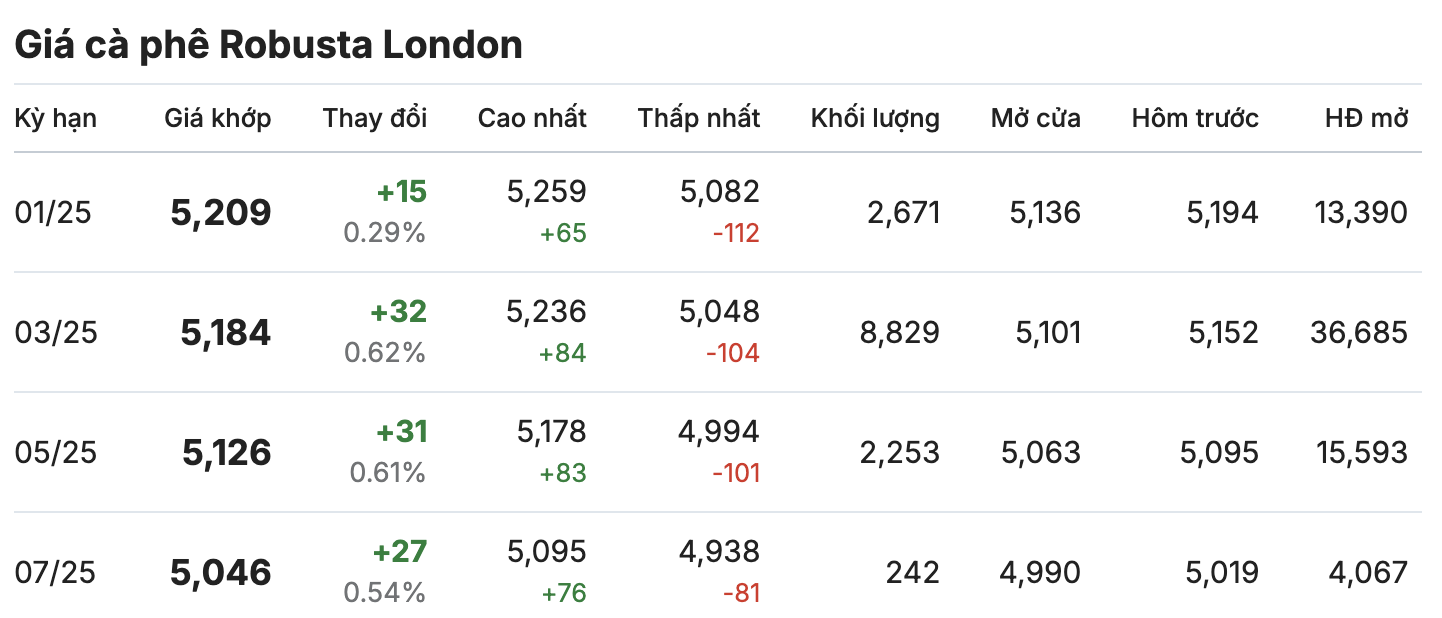

On the London and New York exchanges, the coffee market moved in opposite directions across terms. The January 2025 contract increased slightly by 0.29% (equivalent to 15 USD/ton), standing at 5,209 USD/ton. The March 2025 contract increased by 0.62%, remaining at 5,184 USD/ton.

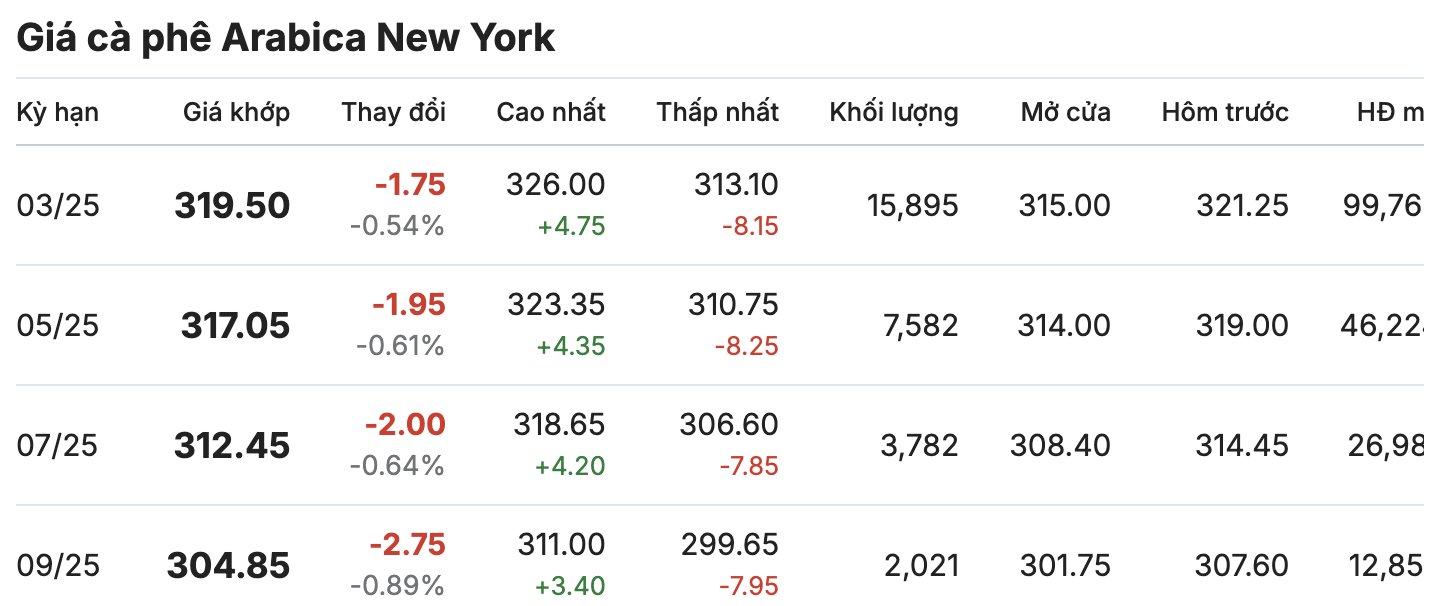

Meanwhile, the New York Arabica coffee market showed red, with slight decreases in all terms. The March 2025 delivery term decreased by nearly 1% (equivalent to 1.75 cents/lb), listed at 319.50 cents/lb. The May 2025 delivery term decreased by 0.61% (equivalent to 1.95 cents/lb), trading around 317.05 cents/lb.

In summary, the world coffee price week, both London and New York exchanges fluctuated in opposite directions. Accordingly, the price of Robusta futures for delivery in January 2025 increased by 56 USD/ton; while the price of Arabica futures for delivery in March decreased by 10.75 cents/lb.

According to the International Coffee Organization (ICO), global coffee exports reached more than 11.1 million bags in October – the first month of the 2024-2025 crop year, up 15.1% compared to nearly 9.7 million bags in the same period last year. Of which, green Arabica coffee accounted for 89.4% of total global exports with a volume of 9.9 million bags, up 15.8% over the same period last year. Notably, this was the 12th consecutive month of positive growth for global green coffee exports.

In Vietnam, according to the Vietnam Coffee - Cocoa Association (VICOFA), in the 2023-2024 crop year alone, in terms of import volume, Germany is the number 1 market purchasing Vietnamese coffee with 179,006 tons, accounting for 12.3%; Italy imported 127,724 tons; Japan 106,900 tons; Spain 105,386 tons, etc. These markets not only import more coffee but also have higher unit prices than familiar markets such as the EU or the US.

The reason why Vietnamese coffee is the optimal choice for these countries is because these new markets need to import a lot of finished coffee products (processed such as roasted and ground coffee, instant coffee). This is what the Vietnamese market does by diversifying the types of processed coffee products.