Domestic coffee prices continue to decrease for the third consecutive session

The domestic coffee market continued to decline, losing an additional 500 VND/kg compared to yesterday. This is the third consecutive session of price decline, raising the total decrease from the beginning of the week to about VND 2,500/kg.

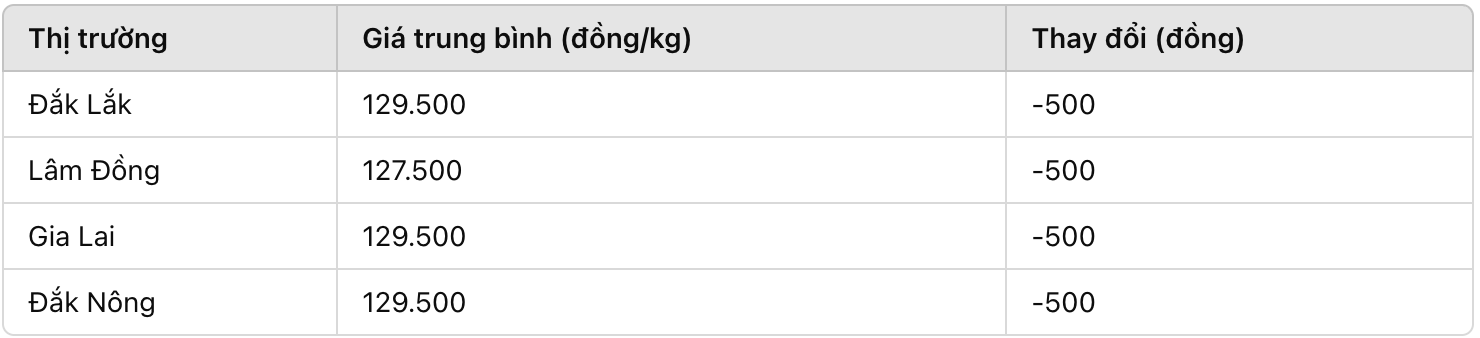

Currently, coffee prices in key areas such as Dak Lak, Gia Lai, Dak Nong remain at 129,500 VND/kg, down 500 VND compared to yesterday. Lam Dong has the lowest price, reaching 127,500 VND/kg.

World coffee prices are still under pressure to decrease

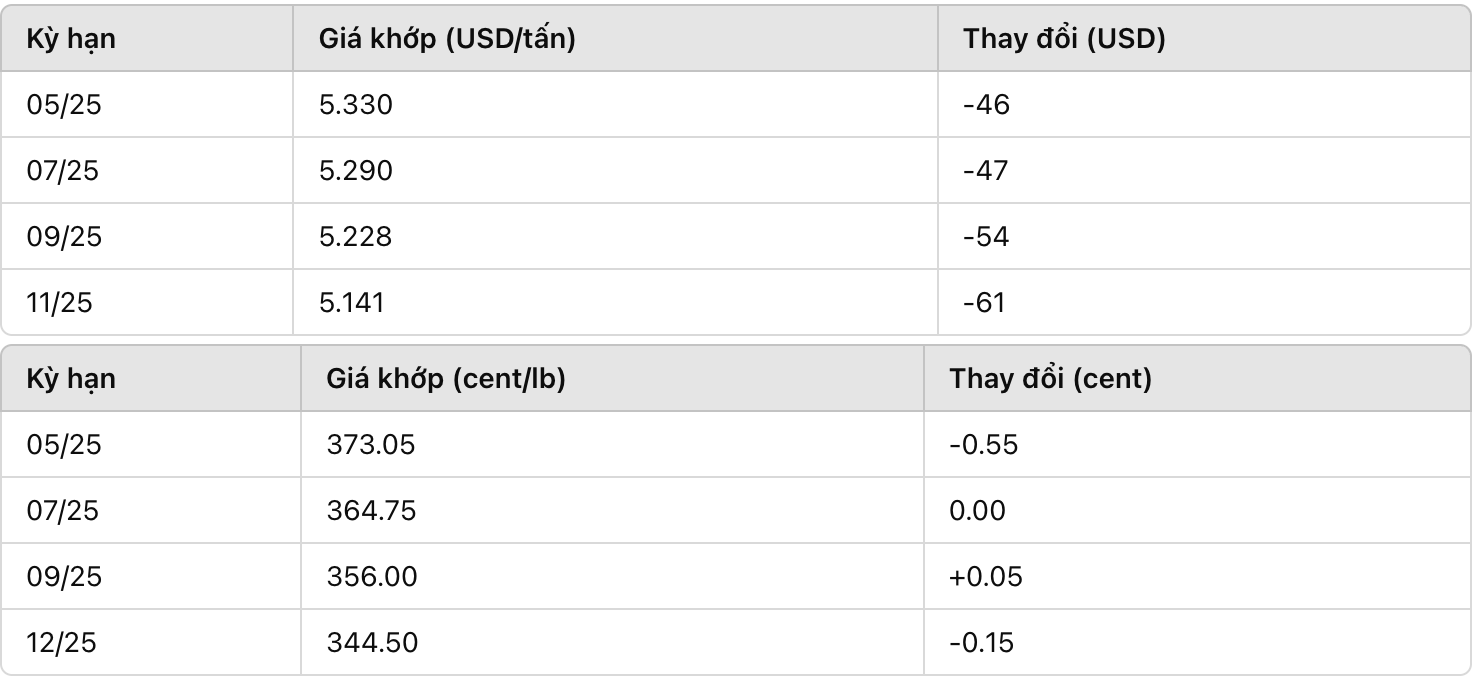

On the London Stock Exchange, Robusta coffee prices continued to weaken. The May contract decreased by 46 USD/ton, falling to 5,330 USD/ton, equivalent to a decrease of 0.86%.

Similarly, on the New York Stock Exchange, Arabica prices decreased slightly. The May contract fell 0.55 cents/lb, trading around 373.05 cents/lb.

The market has not shown any signs of recovery

Coffee prices are still in a downward trend due to many factors. Notably, the Brazilian Real continued to depreciate, causing farmers in this country to sell strongly to preserve profits, increasing pressure on Arabica coffee prices.

Meanwhile, Robusta inventories on ICE have fallen to a two-month low, but still not enough to support prices. Export volumes from Brazil and Vietnam continue to be abundant, causing increased supply pressure.

In addition, consumer demand shows signs of slowing down. Investment funds have also limited purchases due to concerns about global economic risks, causing the trading market to stagnate.

A noteworthy point is that data from Safras & Mercado shows that Brazil has sold 88% of its 2024/25 crop output, but the 2025/26 crop has only sold 13%, much lower than the 4-year average (22%). This reflects that Brazilian farmers still expect prices to increase in the long term.

Coffee price forecast

Short-term: Coffee prices may continue to decrease slightly due to pressure from large supply and weak consumption demand. Robusta can fluctuate around 5,200 - 5,300 USD/ton, while Arabica is still in the 370 - 375 cents/lb range.

Mid-term: The market could recover in April as Brazil enters a new harvest. This is often the time when coffee prices adjust to increase slightly due to roasters stepping up purchases.

debt: Coffee prices may rebound if inventories continue to decline and actual output does not meet expectations. However, global economic risks are still a factor that needs to be closely monitored.