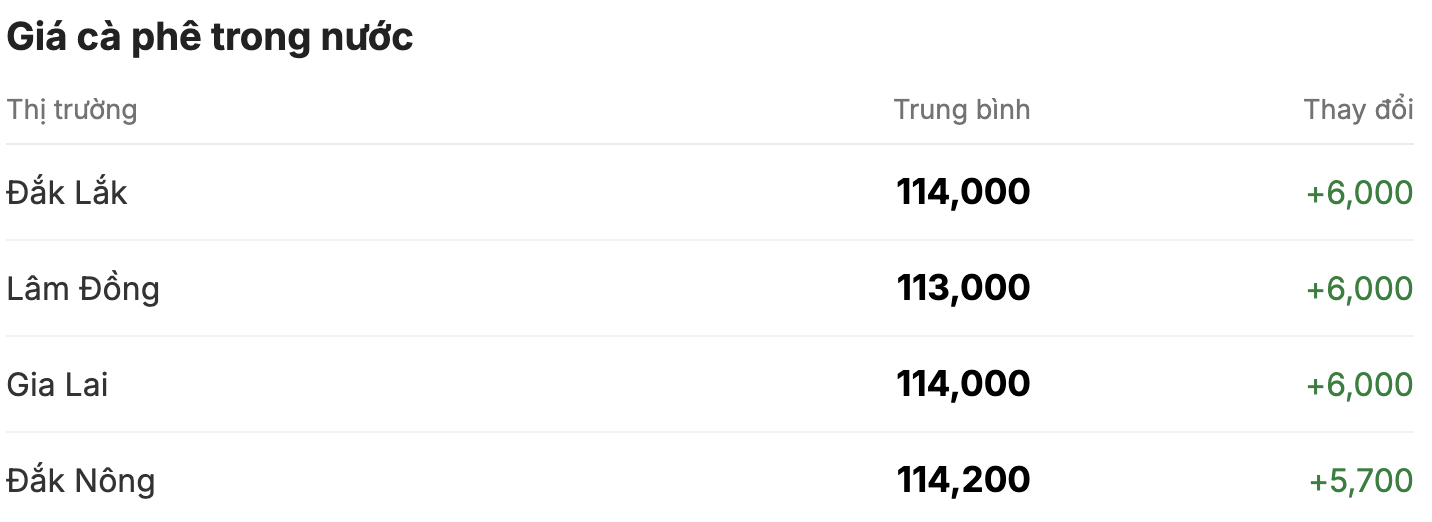

As of 11:30 a.m. today (December 5), the domestic coffee market has turned around and made a breakthrough, with an average increase of VND5,900/kg, causing prices to fluctuate between VND113,000 - VND114,200/kg. The average coffee purchase price in the Central Highlands provinces is VND114,100/kg.

Lam Dong is still the province with the lowest coffee purchasing price in the Central Highlands. Compared to the closing price yesterday (December 4), coffee prices in this region increased by 6,000 VND/kg, currently standing at 113,000 VND/kg.

In the same direction, coffee purchasing prices in Gia Lai and Dak Lak provinces today ranked second on the chart with a dizzying increase of 6,000 VND, listed at 114,000 VND/kg.

Notably, Dak Nong maintained its leading position as the province and city with the highest coffee purchasing price in the country, setting the mark of 114,200 VND/kg. However, this is the locality with the lowest increase, an increase of 5,700 VND/kg.

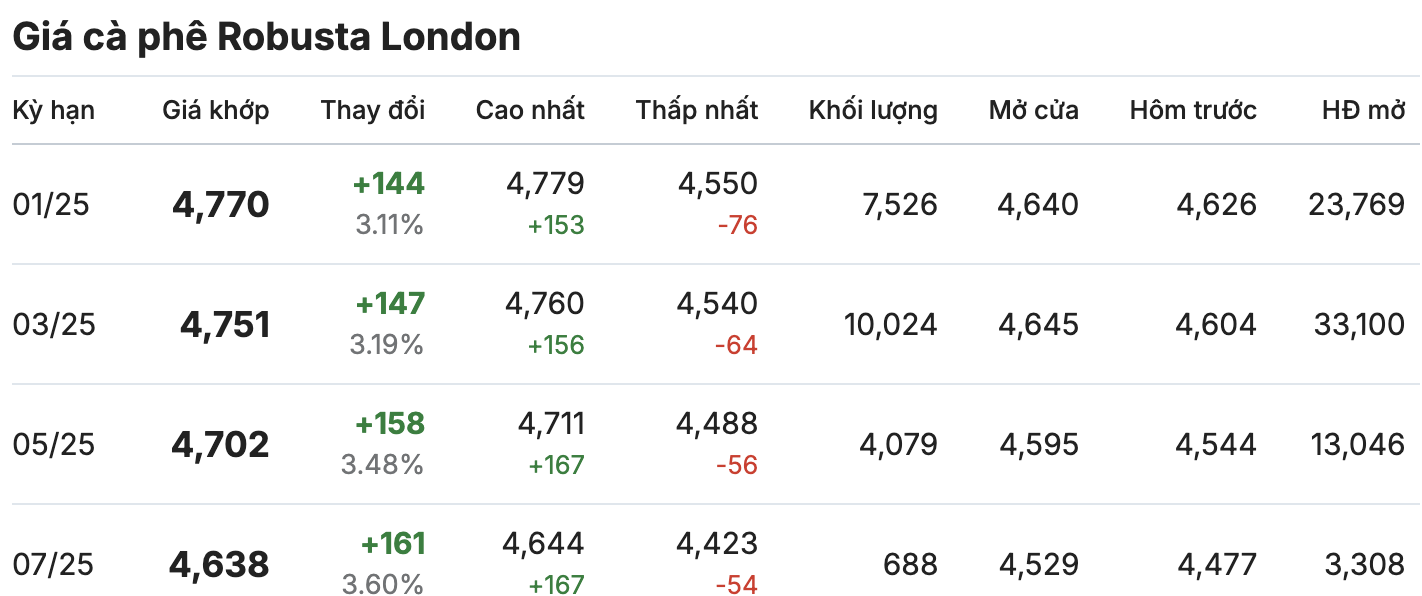

On the London and New York exchanges, the coffee market "turned around" and increased rapidly in all terms. The contract for delivery in January 2025 increased by 3.11% (equivalent to 144 USD/ton), standing at 4,770 USD/ton. The contract for delivery in March 2025 increased by more than 0.08%, remaining at 4,751 USD/ton.

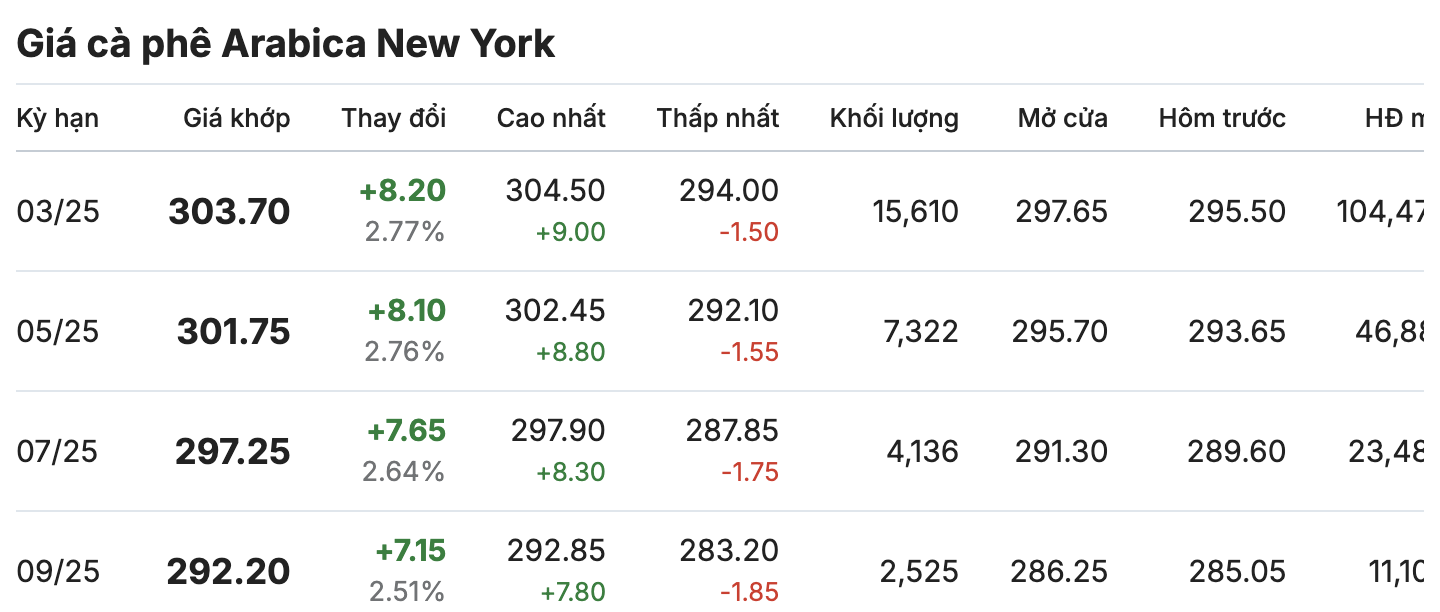

Similarly, the developments in the New York Arabica coffee market for delivery terms in December 2024 and March 2025 simultaneously skyrocketed around 303.70 - 301.75 cents/lb (up nearly 2.80%).

After three previous sessions of decline, coffee on the exchanges regained momentum due to supply concerns in major producing countries such as Brazil and Vietnam.

Below-average rainfall in Brazil’s growing regions since April has continued to weigh on the market over coffee production. In the Global Market Report, Brazil’s 2025-2026 coffee production forecast hovers around 65.2 million bags. Arabica coffee production alone is expected to reach 42.6 million 60kg bags, down slightly by 1.4% from the previous crop.

Recently, European Union (EU) negotiators rejected a proposal to relax the EUDR, only agreeing to keep the plan to postpone the implementation period for another year.

The decision goes against a proposal by EU lawmakers last month to create an additional “zero risk” category for some countries, which would significantly reduce testing requirements.

In Vietnam, weather conditions in the Central Highlands region not only affect harvesting activities but also cause problems in the logistics chain, leading to the possibility that the supply of new crop coffee from Vietnam to the international market will be lower and slower than in previous years.