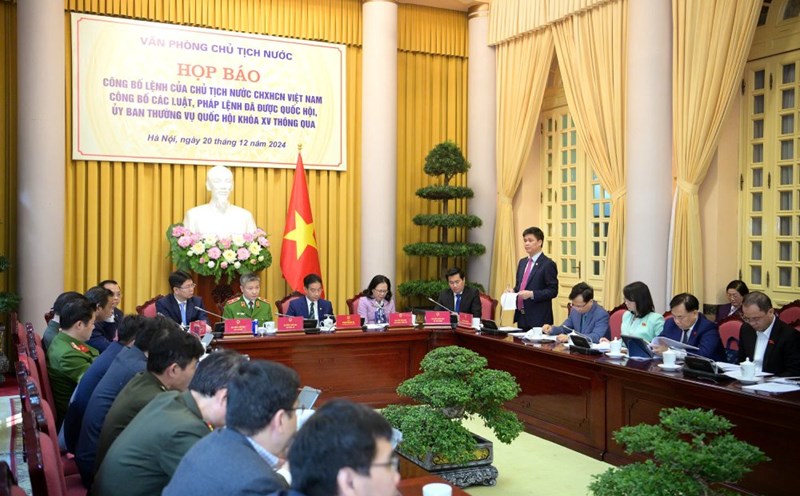

On the morning of December 20, the Office of the President held a press conference to announce the President's Order promulgating laws passed by the National Assembly.

Regarding the Law on Value Added Tax (amended), Mr. Le Tan Can - Deputy Minister of Finance said that the Law consists of 4 chapters, 18 articles and will take effect from July 1, 2025.

According to the Deputy Minister of Finance, the law is aimed at perfecting regulations on VAT policies to cover all revenue sources, expand the revenue base; ensure transparency, ease of understanding, and ease of implementation of the law to contribute to improving the capacity and effectiveness of tax management activities in preventing and combating tax evasion, tax losses and tax debts; and ensure correct and sufficient collection to the State budget.

The law also amends regulations to conform with international tax reform trends.

Regarding regulations on taxpayers, the law supplements regulations on e-commerce business activities and business on digital platforms.

For those not subject to VAT, the law raises the annual tax-free revenue of households and individuals doing business from 100 million VND to 200 million VND.

Regarding the 5% tax rate, the following subjects are subject to the following tax rates: fertilizers, fishing vessels in coastal areas; specialized machinery and equipment serving agricultural production according to Government regulations; traditional and folk performing arts activities.

At the press conference, reporters asked about the fact that at the 8th session of the National Assembly, the Government was requested to urgently issue a Decree on customs management of exported and imported goods traded via e-commerce channels, ensuring that import tax exemptions for small-value goods are not allowed.

In particular, immediately terminate the validity of Decision 78/2010 of the Prime Minister, creating a basis for tax authorities to have a legal basis and sanctions to manage tax collection for foreign e-commerce platforms selling goods to Vietnam.

"I request the leaders of the Ministry of Finance to inform us about the steps being taken and when the termination of Decision 78 will take place," the reporter asked.

Responding to this content, Mr. Luu Duc Huy - Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision (Ministry of Finance) said that the Government's Resolution assigned the Ministry of Finance to submit for consideration the abolition of Decision 78/2020.

The Ministry of Finance has sent an official dispatch to request opinions from relevant ministries, branches and localities in accordance with the provisions of the Law on Promulgation of Legal Documents. Along with that, on December 4, 2024, the Ministry of Finance also sent an official dispatch to request opinions from the Ministry of Justice on the repeal of the decision.

On December 12, the Ministry of Justice organized a review council to review the decision's cancellation at the request of the Ministry of Finance.

"Currently, the Ministry of Finance is waiting for the appraisal opinion of the Ministry of Justice to complete the procedures in accordance with the order and procedures for promulgation of the Law on Promulgation of Legal Documents. From there, it will submit to the Prime Minister to cancel this decision," said Mr. Huy.