The voting council highly appreciated the deal based on 4 criteria: Deal size, Deal nature, Deal significance and Deal effectiveness.

GELEX was voted for its M&A deal in the renewable energy sector with Sembcorp, a leading corporation from Singapore.

The transaction took place in 2023, when GELEX signed an investment cooperation agreement with Sembcorp Industries. By 2024, the two sides had realized the relationship by Sembcorp Industries acquiring shares or capital contributions in operating energy projects belonging to GELEX Group. To date, 3/4 of the projects have been completed for transfer.

Sembcorp Industries, part of Sembcorp, a leading integrated urban and energy solutions provider headquartered in Singapore. Sembcorp, 49% owned by Temasek Holding (Singapore Government's investment fund), has invested in many countries around the world. The company is listed on the Singapore Stock Exchange and is a member of the Straits Times Index (STI) - the top 30 largest listed companies on the Singapore Stock Exchange.

GELEX representative said: “This is not just a simple financial transaction. At this time, GELEX is only divesting part of its investment portfolio to find and select partners to accompany us in the next projects. We really want to accompany capable investors. Cooperating with Sembcorp will help GELEX maximize its potential, support each other to develop more strongly in the Vietnamese and international markets, opening up new opportunities in the future.”

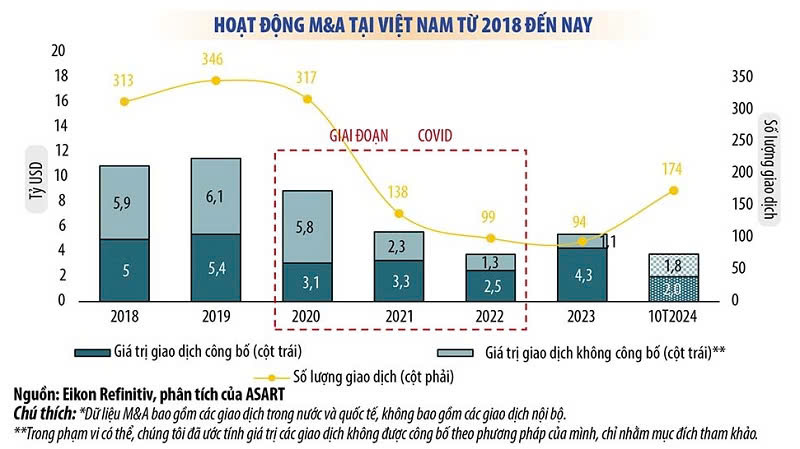

The deal took place in the context of the global and Vietnamese economies gradually recovering and the M&A market is expected to become active again after a period of stagnation.

According to KPMG Vietnam, as of October, there were 174 transactions recorded, with a total announced value of approximately 2 billion USD. Although the number of transactions increased by about 21% compared to the same period last year, the total value decreased by 54%, showing a significant decline. The main reasons were the difficulties of the global economy, the high USD interest rate environment and investor hesitation in the face of prolonged instability. However, investors still maintained their activities, but prioritized strategic transactions, focusing on value, instead of speculative transactions.

The M&A market in Vietnam is becoming an attractive destination not only for international investors but also for domestic investors. Large enterprises are taking advantage of the opportunity to expand their networks and seek strategic partners.

According to KPMG, the proportion of M&A deals involving domestic enterprises in 2024 will reach 40%, significantly higher than in previous years. This clearly reflects the maturity in strategic thinking of Vietnamese enterprises. M&A has become an important tool to help enterprises innovate technology, expand scale, develop products and increase competitiveness in the international market.

It is forecasted that in 2025, when the economy recovers, foreign investment flows accelerate into Vietnam, combined with the growth of domestic enterprises, M&A activities will also be more strongly activated.