Update SJC gold price

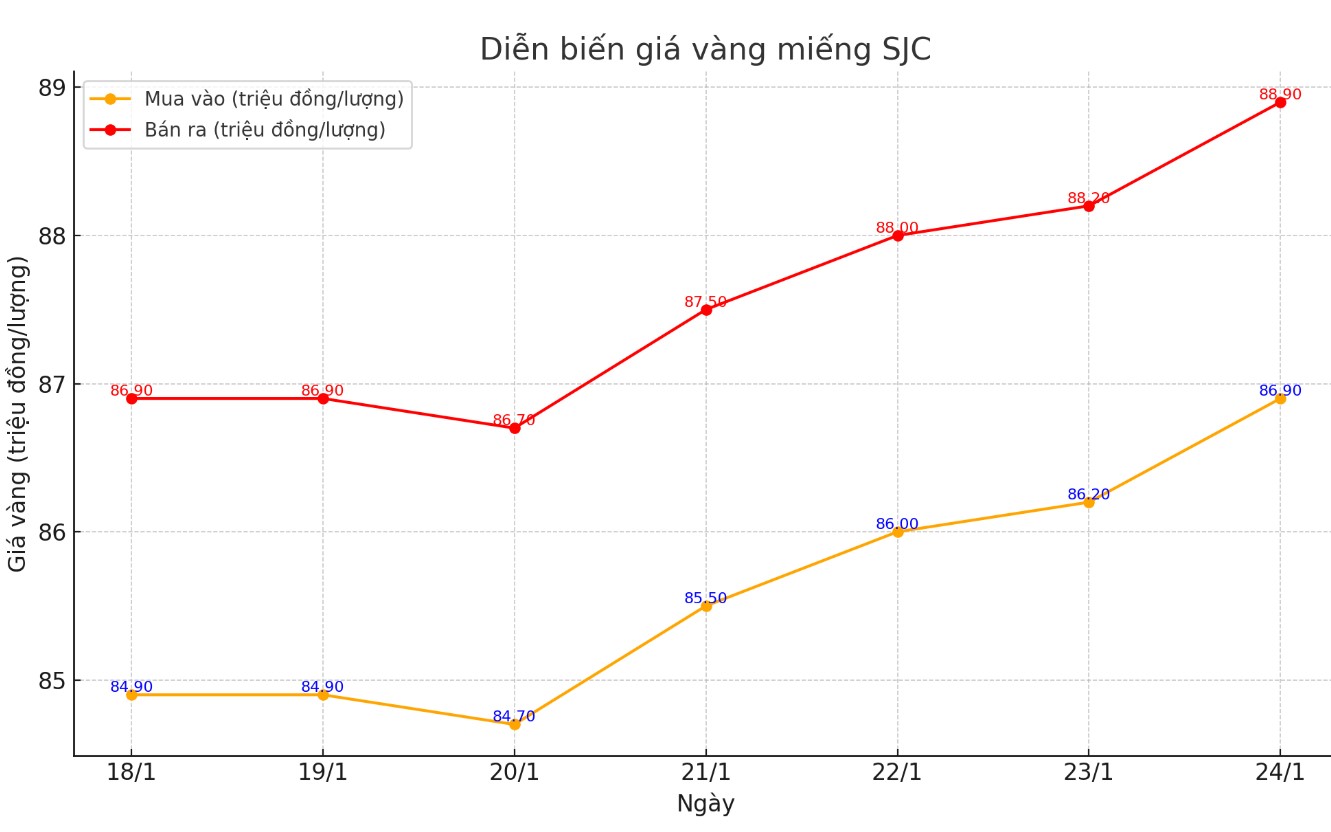

As of 6:20 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); an increase of VND700,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); an increase of 800,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.8-88.8 million VND/tael (buy - sell); increased 700,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

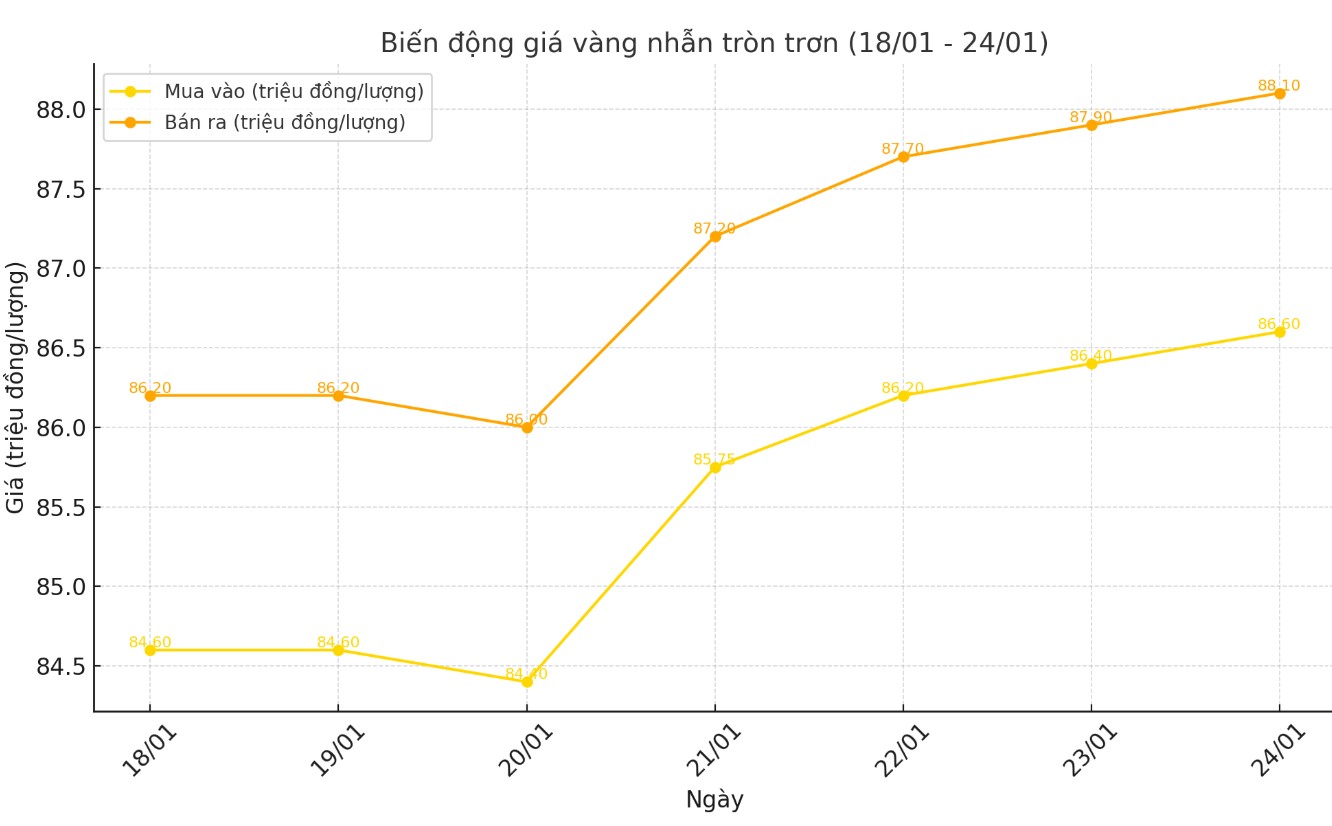

As of 6:20 p.m. today, the price of round gold rings listed by DOJI Group is at 86.6-88.1 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to the closing price of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 750,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

As of 6:30 p.m., the world gold price listed on Kitco was at 2,778.2 USD/ounce, up 31 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased amid a decrease in the USD index. Recorded at 6:35 p.m. on January 24, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.180 points (down 0.43%).

Asian gold prices hit a near three-month peak on January 24 and are on track for a fourth consecutive weekly gain due to uncertainties over US President Donald Trump’s tariff plans and calls for...

The dollar fell after Donald Trump's remarks went against market expectations, said senior analyst Jigar Trivedi of Reliance Securities.

Mr Trump has called for immediate interest rate cuts and has offered no clarity on tariffs. The lack of clarity on his future policies has sent investors flocking to safe-haven assets like gold to hedge against volatility.

Meanwhile, the Bank of Japan raised interest rates to their highest level since the 2008 global financial crisis. Interest rate decisions from the US Federal Reserve (FED) and the European Central Bank are expected next week.

Traders see little chance of a Fed rate cut next week, according to CME Group's FedWatch tool. There is a 99.5% chance the Fed will leave rates unchanged at its January 28-29 meeting. Higher interest rates reduce the appeal of non-yielding bullion.

The trend for gold remains bullish, which means the market is still on track to hit the $3,000 an ounce mark by 2025, said Capital.com financial markets analyst Kyle Rodda.

“The fall in the dollar has pushed gold higher,” said Daniel Pavilonis, senior market strategist at RJO Futures. “Today’s moves reflect sensitivity to the direction from the White House. I think part of the move is because the market is waiting for those messages.”

See more news related to gold prices HERE...