On January 15, 2025, within the framework of the 6th National Forum on Developing Vietnamese Digital Technology Enterprises, the Ministry of Information and Communications (MIC) awarded the Make in Vietnam 2024 Digital Technology Product Award. The announcement and award ceremony was attended by General Secretary To Lam, Minister of MIC Nguyen Manh Hung and representatives of leaders of ministries, branches, 63 localities and enterprises.

The “Make in Vietnam Digital Technology Product” award honors outstanding technology products and solutions from Vietnamese enterprises that solve domestic and international problems. Excellently surpassing hundreds of nominations and many rigorous rounds of evaluation, the MISA Lending business loan connection platform won the Make in Vietnam Gold Award, category of Outstanding Digital Technology Product in the field of finance, banking, trade, and services. This title affirms MISA’s efforts in the information technology industry, promoting the creation of valuable solutions for the Finance - Banking sector.

According to the World Bank's Vietnam SME 2023 report, 65% of small and medium-sized enterprises (SMEs) lack capital, while the proportion of outstanding loans to SMEs is only 18.24% (State Bank) and the financial gap is up to 21.7 billion USD (IFC). The main reasons come from lack of collateral, limited credit history, lack of financial transparency and high risk.

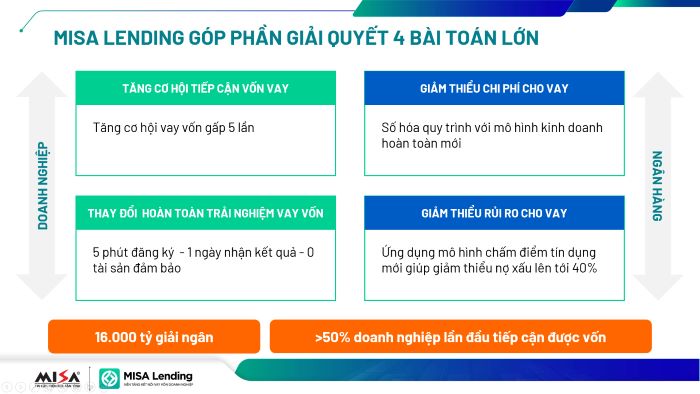

MISA Lending is the first unsecured loan connection platform in Vietnam, created to help SMEs easily access credit at reasonable costs, while reducing risks for financial institutions. In particular, businesses using MISA's accounting and electronic invoice software can borrow 100% online through MISA Lending without collateral, with a success rate 5 times higher than traditional methods.

Explaining this outstanding loan rate, MISA representative said that firstly, it comes from the fact that businesses using MISA software are quality businesses, using digital technology with management thinking, highly appreciated by banks. Second, financial solutions on the platform are also tailored to each customer using MISA software. Finally, with the customer's consent, MISA supports the preparation of standard loan documents based on available data from the software to increase the possibility of successful loans.

With its outstanding features, MISA Lending has actively contributed to the development of the digital economy in three aspects. Firstly, the platform helps to clear capital flows for SMEs, with 35% of customers approved for loans, while promoting digital transformation and process optimization for banks. Secondly, MISA Lending contributes to building a transparent economy through reliable financial data from MISA software, helping banks feel confident in granting credit. Finally, the platform supports SME development by providing an effective capital access channel, promoting business expansion, money circulation and comprehensive economic growth.

After only 2 years of launching, MISA Lending has achieved impressive numbers: total cumulative disbursement value up to 16,000 billion VND, in 2024 alone reaching 11,000 billion VND, successful unsecured loan rate of 33%, 5 times higher than the market average, and effectively processed 20,000 loan applications. These achievements affirm MISA's pioneering role in applying digital technology to support Vietnamese businesses to access financial resources quickly, promoting sustainable development. The platform is currently connected with leading banks in Vietnam such as Techcombank, MB Bank, BIDV, MSB and Standard Chartered, ... affirming its pioneering position in the digital financial ecosystem in Vietnam.

The Make in Vietnam 2024 Award is a testament to the efforts of more than 3,000 MISA employees in solving the problem of digital transformation in general and access to loans in particular for Vietnamese businesses. MISA is committed to promoting cooperation with reputable banks and financial institutions, expanding the digital financial ecosystem, and accompanying businesses to take advantage of opportunities for breakthrough development in the era of technology and global integration.