Domestic silver prices

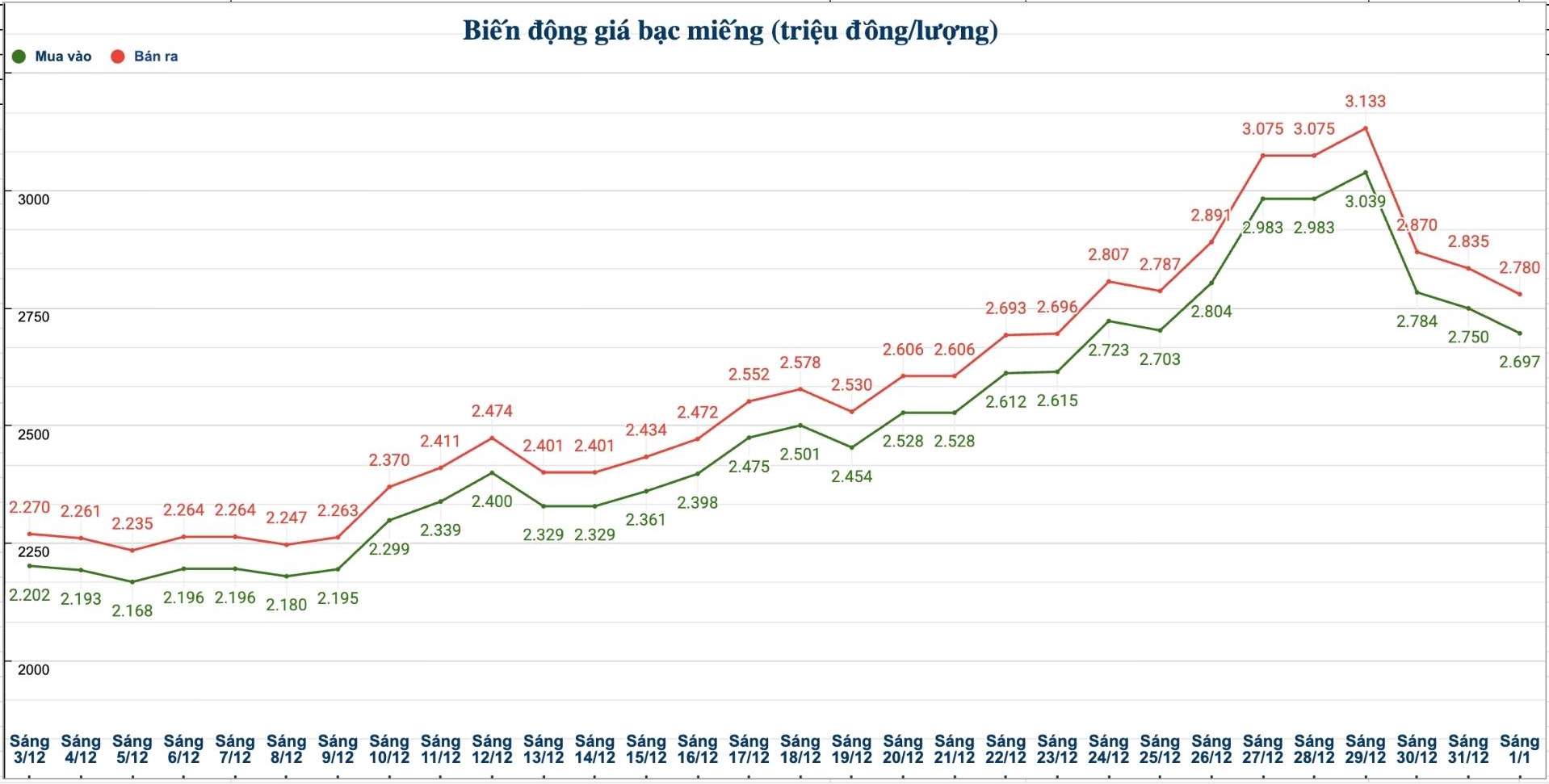

As of 10:45 am on January 1st, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 2.753 - 2.821 million VND/tael (buying - selling); down 4,000 VND/tael in both directions compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 72.526 - 74.726 million VND/kg (buying - selling); down 98,000 VND/kg on the buying side and down 108,000 VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Jewelry Company Limited (Sacombank-SBJ) is listed at the threshold of 2.793 - 2.868 million VND/tael (buying - selling); down 69,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.697 - 2.780 million VND/tael (buying - selling); down 53,000 VND/tael on the buying side and down 55,000 VND/tael on the selling side compared to yesterday morning.

It's a bit of a bit of a bit of a bit of a bit of a bit.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 71.919 - 74.133 million VND/kg (buying - selling); down 1.414 million VND/kg on the buying side and down 1.466 VND/kg on the selling side compared to yesterday morning.

World silver prices

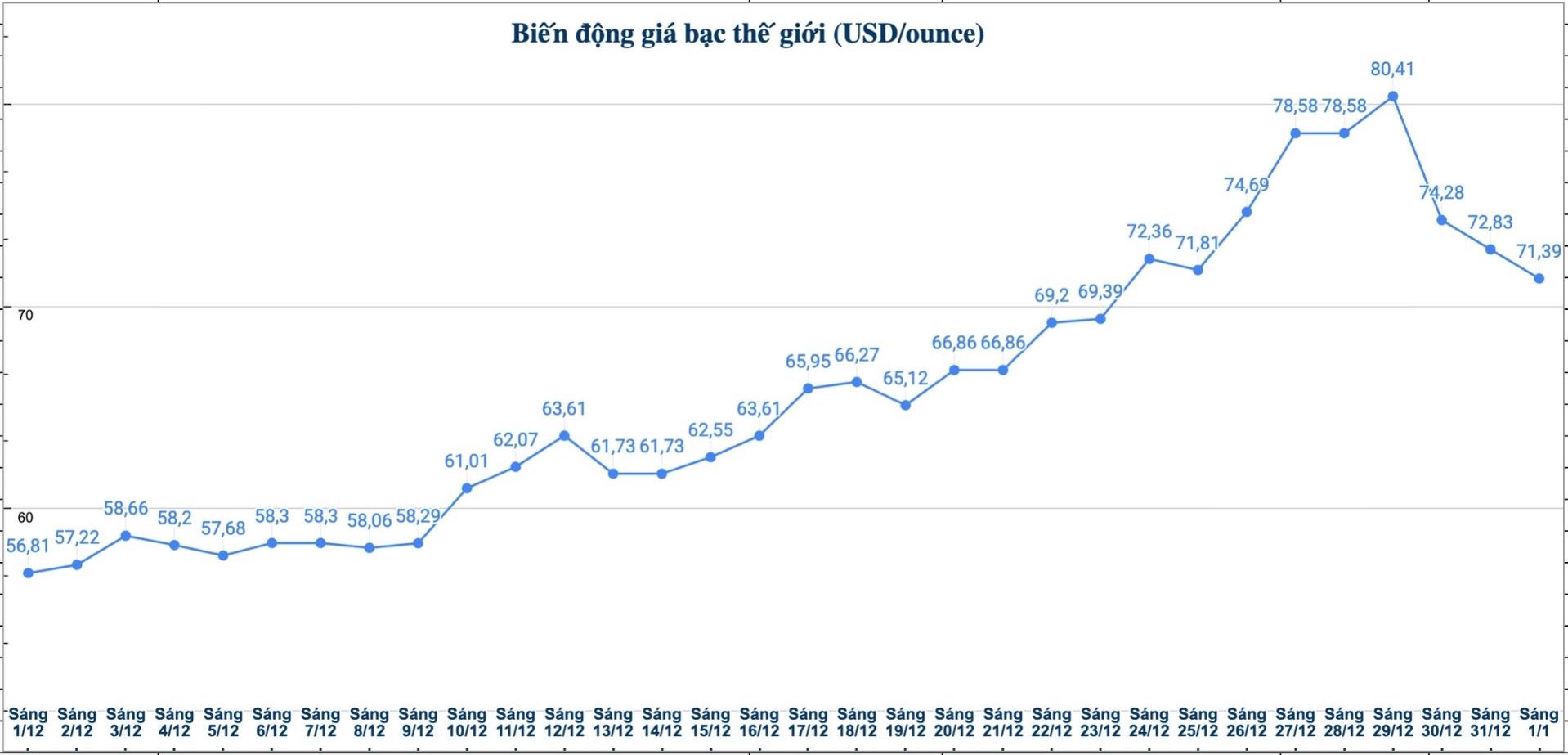

On the world market, as of 10:45 am on January 1 (Vietnam time), the world silver price was listed at 71.39 USD/ounce; down 1.44 USD compared to yesterday morning.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Causes and forecasts

Silver prices continued to fall in Thursday morning's trading session, showing that the market is entering a correction phase after a period of hot increases. According to precious metals analyst Christopher Lewis at FX Empire, although the possibility of forming a stable trading zone is possible, the short-term prospects of silver still contain many risks.

He said that silver prices are unlikely to fall deeply to low levels such as 20 USD/ounce or even 18 USD/ounce - levels that appeared a few years ago. Instead, the market may establish a higher support zone than the previous period.

However, Christopher Lewis believes that, at the current price level, the market is showing signs of increasing correction pressure. "Repeated strong fluctuations reflect the increasing instability and caution of investors. The question is whether silver prices will move sideways for a long time to cool down, or continue to show sudden increases and decreases" - he said.

According to Mr. Lewis, the most positive scenario is for the market to move sideways to stabilize again. Conversely, if silver prices suddenly surge back from the current level, it could become a bad signal, because excessive fluctuations in silver risk spreading to other financial markets.

However, this expert also does not recommend that investors sell virtual silver at the present time. He believes that markets with high volatility tend to gradually weaken, because large risks make many investors no longer interested in participating.

This is a market that has increased very quickly in a short time, so a correction is inevitable" - Mr. Lewis commented.

According to him, for investors holding silver, taking a partial profit and reducing the scale of position is a reasonable choice. "The trading strategy needs to be adjusted to suit the level of volatility that is increasing sharply, far from the relatively stable market conditions in July" - Christopher Lewis gave his opinion.

See more news related to silver prices HERE...