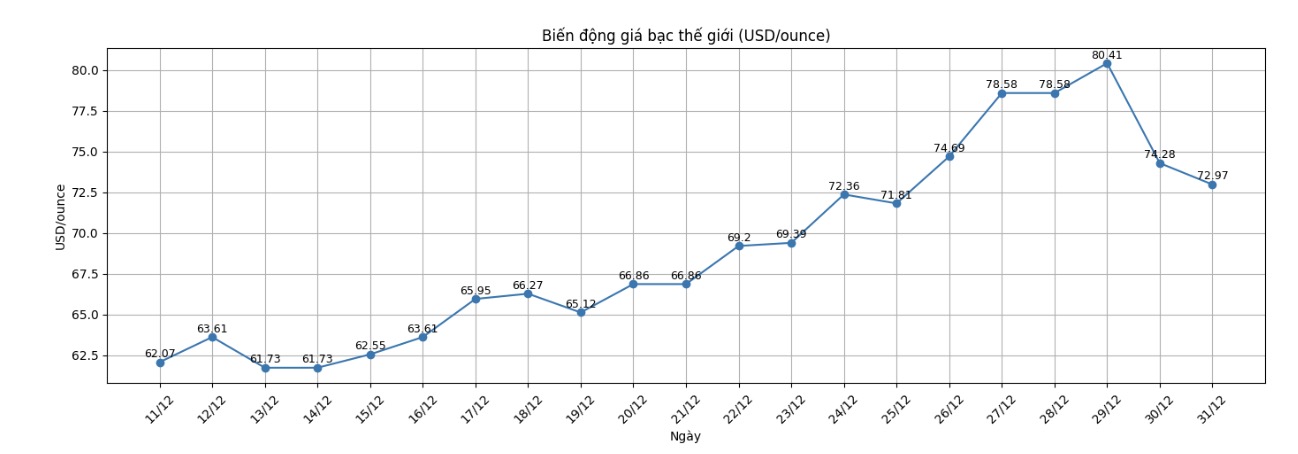

Silver prices increased 2.5 times compared to the beginning of the year - causing many investors to begin to worry about the possibility of downward adjustments. However, according to historical analysis of the gold/silver ratio, there are still many scenarios showing that this "gray" metal may increase even more strongly. "In particular, a tight supply situation in key markets could create a major price shock in 2026, according to Peter Krauth, an expert at SilverStockInvestor.

Mr. Krauth believes that even though silver has reached a historical peak, the price increase market may still be in the early stages.

Gold has surpassed the historic peak of $50 - this is a breakthrough after 45 years. I think $50 will become a new floor level. We are in an unprecedented price range, so the sharp price increase after surpassing this mark is not too surprising," he said.

When silver prices have surpassed historical milestones, Mr. Krauth said that his most important measure at this time is the correlation between silver and gold, through the gold/silver ratio.

Since 1997, this rate has decreased sharply 5 times. If we take the average decrease of 44%, then from the peak of about 105 in April, the rate may decrease to about 59. Currently, the rate is at 67. Assuming cautiously that gold prices remain at 4,000 USD/ounce of silver, then 4,000 divided by 59 gives about 67 USD/ounce of silver – meaning we have reached this threshold," he analyzed.

This is only the lowest scenario, in the event that gold prices adjust to the support zone of 4,000 USD. If gold increases slightly higher, the impact on silver prices will be very significant.

Suppose gold rises to 4,400 USD/ounce for silver and remains there, while the gold/silver ratio falls to about 55 – the long-term average since 1997 – then 4,400 divided by 55 will give silver prices about 80 USD/ounce" - he said. This level coincides with the nearest peak of silver above 82 USD/ounce before the adjustment.

However, according to Mr. Krauth, this is still not the most optimistic scenario. Many major banks forecast that gold prices could approach 5,000 USD by 2026, or even higher. In previous cycles, the gold/silver ratio not only returned to the average level but also decreased deeper.

The scenario of a sharp increase is gold rising to 5,000 USD/ounce of silver and the gold/silver ratio falling to about 45. 5,000 divided by 45 will give the silver price about 111 USD" - he said.

Even, the level of 45 is still not the historical bottom. "In 2011, this rate once decreased to 30," he added. "If we take the average of 4-5 recent decreases, the number of about 40 is completely possible. Then, 5,000 USD of gold divided by 40 would give silver prices about 125 USD/ounce.

Prospects for 2026

In the opposite direction, a more pessimistic scenario is that gold prices adjust to $4,000/ounce, even $3,800/ounce – meaning silver has increased too much compared to the gold/silver ratio.

“After the recent adjustment of the gold/silver ratio, I do not rule out the possibility of a short or medium-term reversal. The ratio may return to the 78–80 zone. If gold is at 4,000 USD/ounce, divided by 80, silver is about 50 USD/ounce. If gold is 3,800 USD/ounce, then silver is about 47.5 USD/ounce. The bottom zone of 40 USD/ounce may be the support level” - Mr. Krauth said.

Looking towards 2026, Mr. Krauth said that many factors supporting silver prices have been reflected by the market, such as the possibility of the Fed cutting interest rates, demand from the solar energy industry or the weakening of the jewelry industry. However, the increasingly tight supply of silver may create unpredictable price shocks.

We can get closer to the "explosion point", when a large industrial enterprise requests the delivery of 20 million ounces of silver under the contract. At the last minute, the exchange may declare "impossible", no silver to deliver and only request cash payment. But the business will say: "I don't need money, I need silver". Then, a big news will break out and the price of silver may skyrocket," Krauth warned further.

I think the FOMO mentality (fear of missing opportunities) will continue. Gold has surpassed $4,000/ounce, even $4,400/oucne. Many people look at it and think that one ounce of gold is too expensive. They will look for other options and silver, although it has increased sharply, still looks much'cheaper' at $60" - he said.

According to him, when investors learn more and realize that the gold/silver ratio is still higher than the historical average, they will conclude that even when gold goes sideways, silver still has room to increase.