Domestic silver price

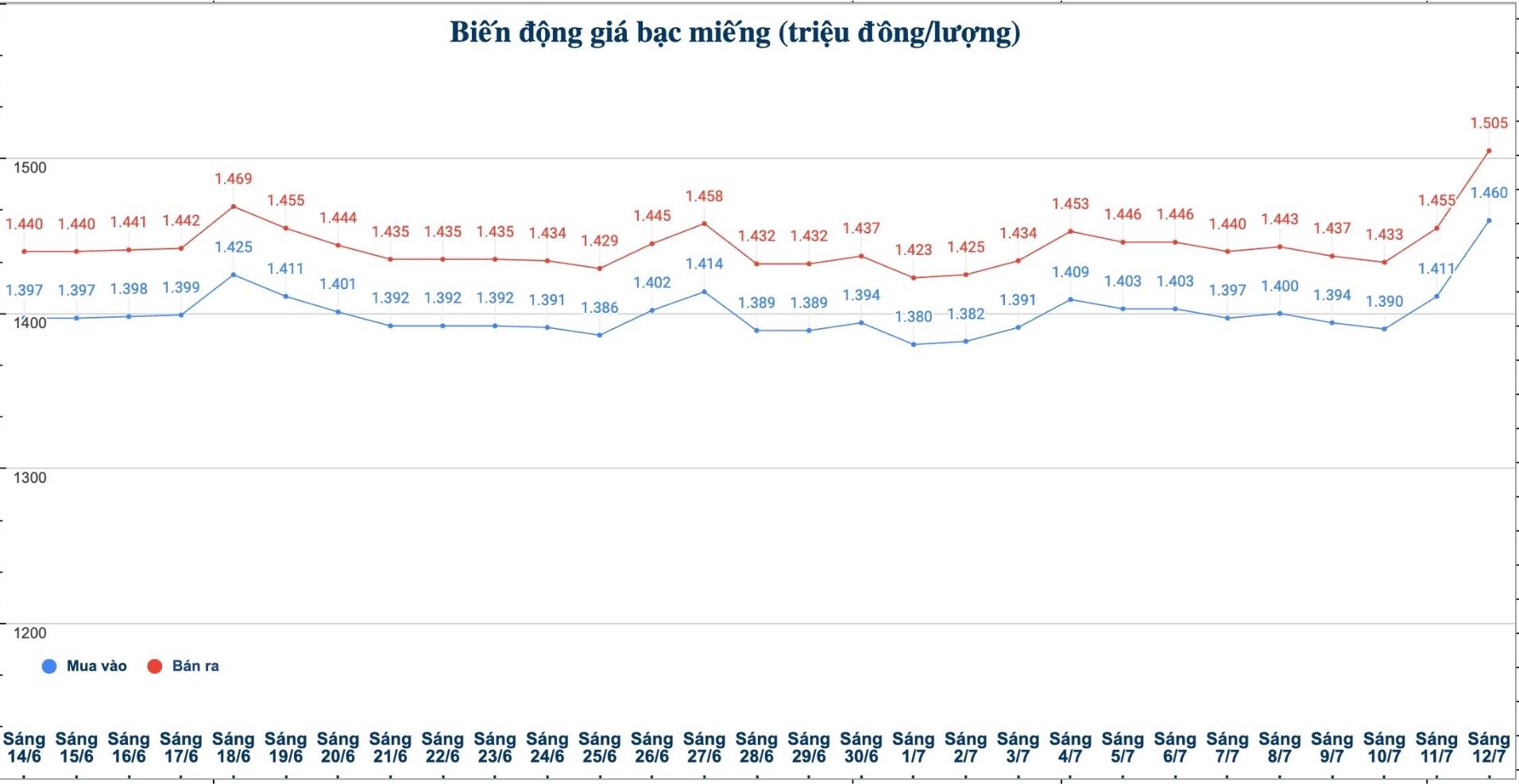

As of 9:30 a.m. on July 12, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1,460 - 1,505 million VND/tael (buy - sell); an increase of 49,000 VND/tael for buying and an increase of 50,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1,460 - 1.505 million VND/tael (buy - sell); increased by 49,000 VND/tael for buying and increased by 50,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38,933 - 40,133 million VND/kg (buy - sell); an increase of 1.307 million VND/kg for buying and an increase of 1.334 VND/kg for selling compared to early this morning.

World silver price

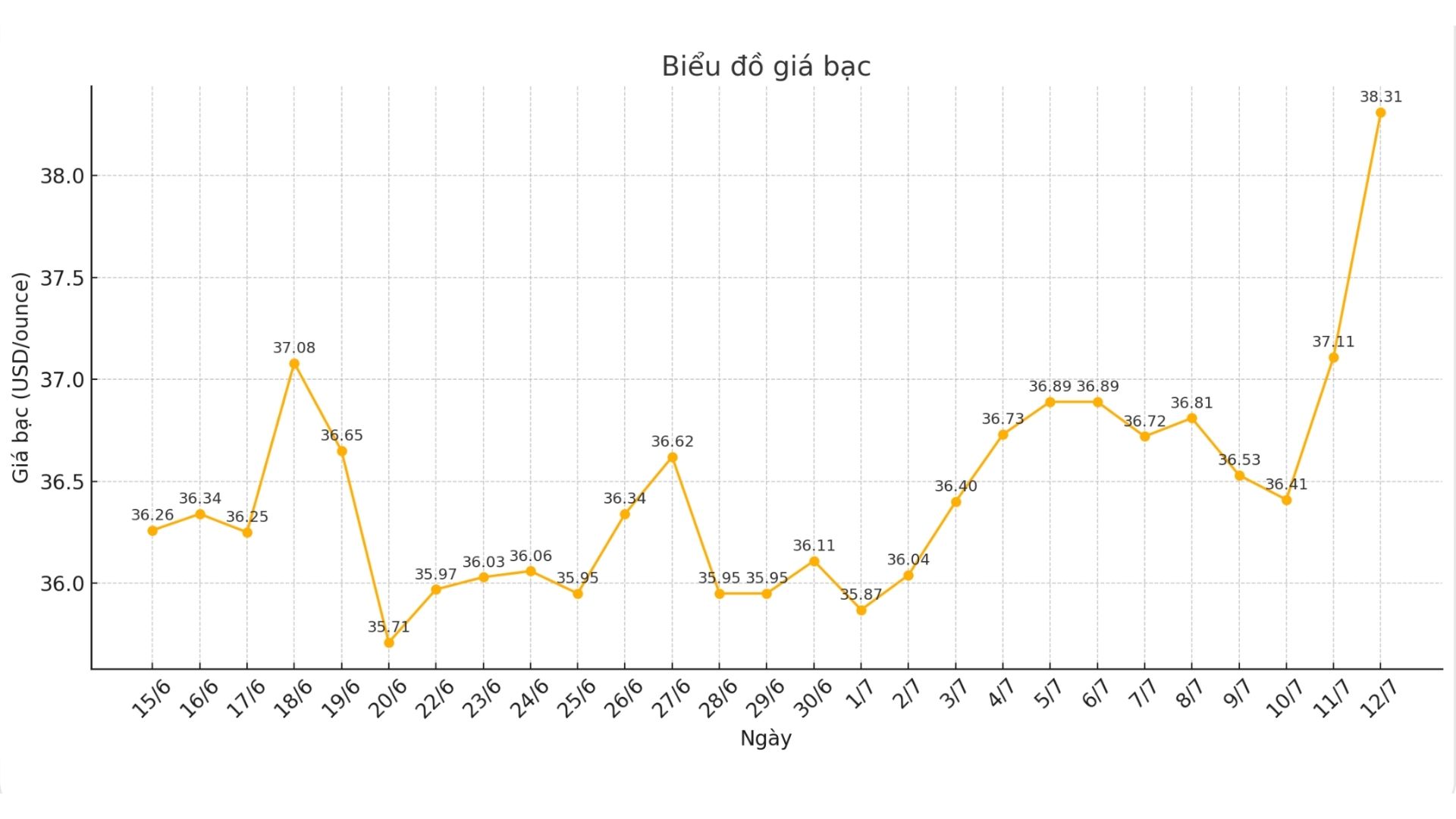

On the world market, as of 9:31 a.m. on July 12 (Vietnam time), the world silver price was listed at 38.31 USD/ounce; an increase of 1.2 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to increase strongly in this morning's trading session, showing that the increase is very steady.

"The US imposition of a 50% tax on copper has caused many fluctuations in the market, but the long-term impact on silver supply still needs to be carefully considered," said Przemysław Radomski, CEO of Sunshine Profits.

He said that about 70-80% of the world's silver is a by-product of the exploitation of other metals, in which copper mining plays an important role, accounting for about 20-25% of the global silver supply. "Therefore, any change in the mining sector could affect the silver market," Przemysław Radomski said.

Senior market analyst Christopher Lewis believes that if the uptrend continues, silver could reach $40/ounce, as the market is accumulating and this is a familiar model in technical analysis.

"Current price fluctuations also show that the possibility of reaching this level is very high, and there is no clear sign of stopping that," Christopher Lewis assessed.

He also supports buying silver, especially as short-term corrections could be a good opportunity.

"US$37.50 an ounce could help strengthen the uptrend. However, investors need to stay positive but cautious, not to use too much leverage, because the silver market is often volatile and easily affected by unexpected information" - Christopher Lewis added.

According to Christopher Lewis, if silver prices fall below below below 36.50 USD/ounce, the current uptrend could be reversed. "However, the silver market is now showing signs of a strong breakthrough after a long period of stagnation," he emphasized.

See more news related to silver prices HERE...