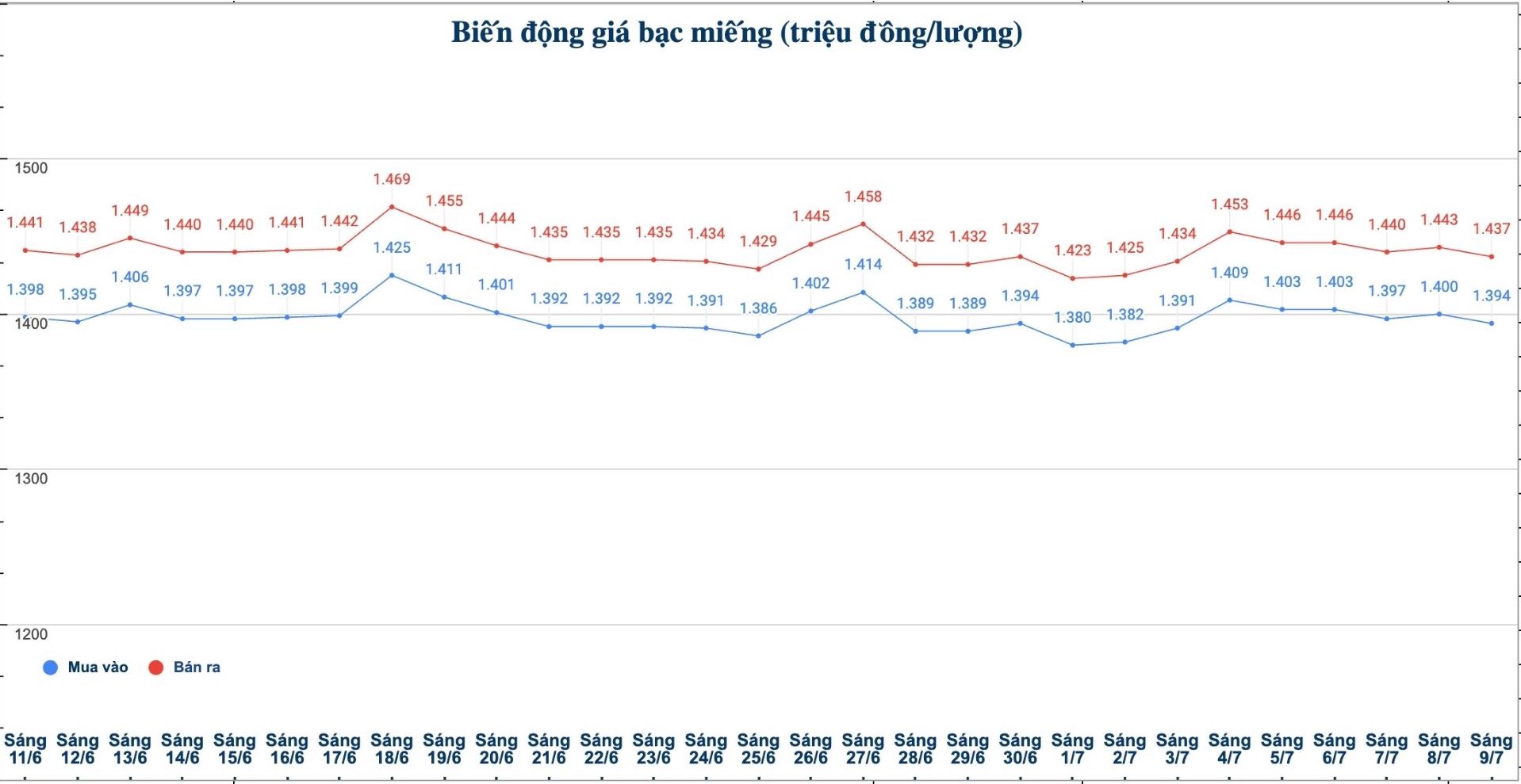

Domestic silver price

As of 10:10 on July 9, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.394 - 1.432 million VND/tael (buy - sell); down 6,000 VND/tael for buying and down 11,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.394 - 1.432 million VND/tael (buy - sell); down 6,000 VND/tael for buying and down 11,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.039 - 38.186 million VND/kg (buy - sell); down 294,000 VND/kg for buying and down 293,000 VND/kg for selling compared to early this morning.

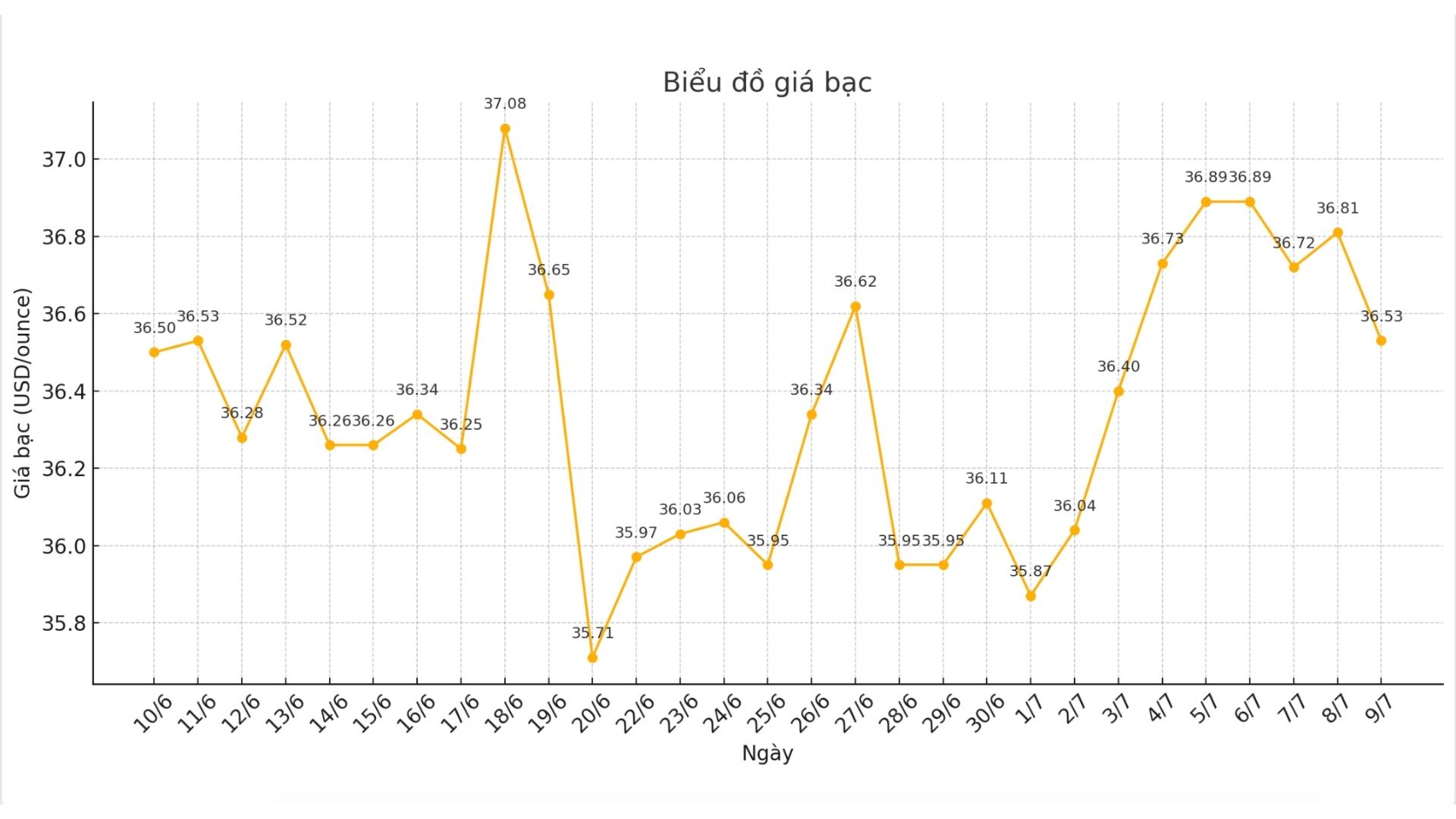

World silver price

On the world market, as of 10:12 on July 9 (Vietnam time), the world silver price was listed at 36.53 USD/ounce; down 0.28 USD compared to yesterday morning.

Causes and predictions

Silver prices reversed and decreased, due to the impact of gold's weakness and cautious sentiment before the minutes of the June meeting of the US Federal Reserve (FED) were released on Wednesday. At the same time, the market is also being affected by information about new US tariffs.

"Currently, silver prices have fallen below the resistance zone of 37.32 USD/ounce, heading towards the short-term support zone of 36.30 USD/ounce. If it cannot hold this mark, silver could retreat deep to the 35.40 - 34.87 USD/ounce range. Meanwhile, the 34.60 USD/ounce level acts as an important defense for the uptrend.

On the other hand, the expert said that if silver surpasses 37.32 USD/ounce and the FED signals a dovish position, prices could rebound.

US bond yields are rising, especially after the US announced the imposition of new tariffs of 25% to 40% on goods from 14 countries, including Japan and South Korea. James Hyerczyk said this increases the cost of holding non-yielding assets such as silver, putting downward pressure on prices.

"However, if tariffs increase inflation expectations, silver could still be supported in the long term as a protective asset. For now, the market is in a tug-of-war situation, waiting for the Fed's move and investors' next reaction to tariff policies" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...