Domestic silver price

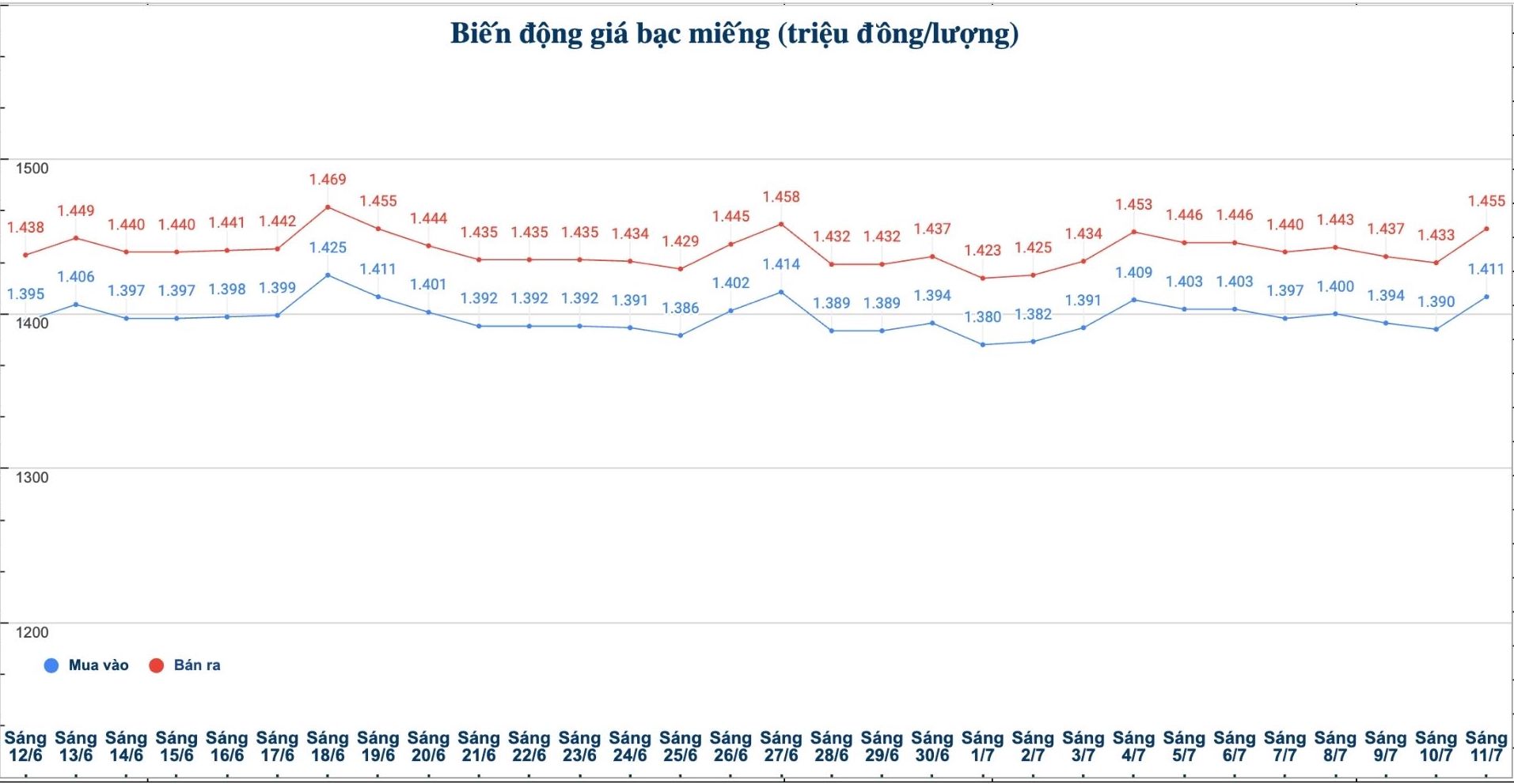

As of 9:10 a.m. on July 11, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.411 - 1.455 million VND/tael (buy - sell); an increase of 21,000 VND/tael for buying and an increase of 22,000 VND/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.411 - 1.455 million VND/tael (buy - sell); increased by 21,000 VND/tael for buying and increased by 22,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37,626 - 38,799 million VND/kg (buy - sell); an increase of 560,000 VND/kg for buying and an increase of 586,000 VND/kg for selling compared to early this morning.

World silver price

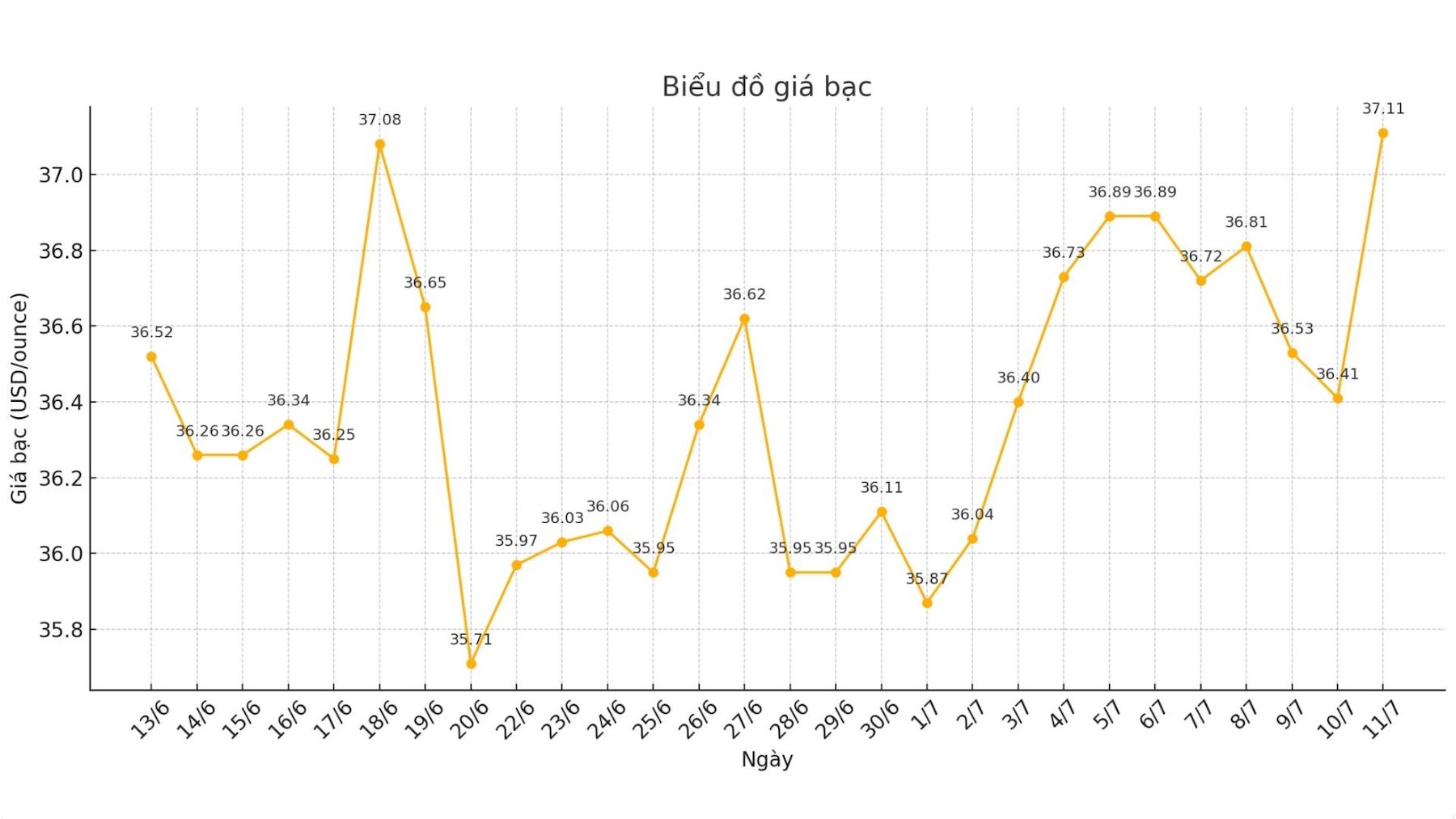

On the world market, as of 9:11 a.m. on July 11 (Vietnam time), the world silver price was listed at 37.11 USD/ounce; up 0.7 USD compared to yesterday morning.

Causes and predictions

Silver prices broke out as the US dollar weakened and expectations increased that the US Federal Reserve (FED) would cut interest rates by the end of the year. In addition, silver also benefits from gold's recovery.

The minutes of the Feds June meeting showed that the majority of officials approved a rate cut this year, although rates remain unchanged, said market analyst James Hyerczyk. This has caused US government bond yields to fall sharply, leading to a decrease in the cost of holding non-yielding assets such as silver."

On the other hand, US President Donald Trump's new tax decisions, especially the 50% tax on imports and goods from Brazil, have raised new concerns about inflation.

"If energy prices return, the risk of inflation will increase, thereby boosting demand for safe-haven assets such as silver," said James Hyerczyk.

In addition, the weakening US dollar makes silver more attractive to buyers using other currencies.

However, James Hyerczyk believes that silver prices are fluctuating in a narrow range and still need a new factor strong enough to create a clear increase.

"If it breaks through the resistance level of 37.32 USD/ounce, the uptrend could be consolidated. Conversely, if it breaks through the support level of 36.30 USD/ounce, silver prices could retreat to the range of 35.40 - 34.87 USD/ounce" - he said.

James Hyerczyk added that the silver market is still in the waiting period for new signals from the Fed and inflationary developments related to tariffs.

See more news related to silver prices HERE...