Silver attracts strong cash flow in the first half of 2025

According to the latest report from the silver Institute (SI), the cash flow into silver has increased sharply in the first half of 2025, amid geopolitical and economic instability, pushing the price of this metal to its highest level in the past 13 years.

The average price of silver in the first 6 months of the year increased by 25%, just slightly lower than the 26% increase in gold in the same period - the report stated.

Experts at SI say that the high gold- silwer price ratio in April and May makes silver seem to be undervaluable in the long term. At the same time, a more positive sentiment in the industrial metals group thanks to the resumption of trade negotiations between the US and China also contributed to supporting silver prices.

With a strong price increase in the first half of the year, silver has quickly become the focus of the precious metal market, attracting significant attention and cash flow from investors.

In the first 6 months of the year alone, silver ETP investment funds recorded net capital flows of up to 95 million ounces, exceeding the total investment of the whole year 2024. This shows that bullish expectations are getting stronger, the experts wrote in the report.

As of June 30, total global silver holdings in ETP funds reached 1.13 billion ounces - just 7% lower than the historical peak of 1.21 billion ounces in February 2021.

Thanks to the sharp increase in silver prices, the total value of these investments also set a series of new records in June, surpassing the 40 billion USD mark for the first time, experts said.

The futures market also showed a strong attraction for silver, as investment funds have continuously increased their purchases this year.

As of June 24, net buying positions have increased by 163% compared to the end of 2024. Notably, institutional investors continue to view silver as a safe haven for value throughout the first half of 2025, with the highest average net purchase since early 2021 the report pointed out.

Mixed retail investment between regions

In contrast to organizations, the retail market recorded an uneven trend.

In Europe, the recovery momentum from the end of 2024 continues to be maintained this year, despite starting from a low base. The investment amount is still significantly lower than the peak period of 2020 - 2022.

In India, retail investment demand remains strong with a 7% increase in the first half of 2025, reflecting confidence that silver prices will continue to increase.

In contrast, in the US, retail investor sales remain high. This, combined with weak purchases, has reduced sales of new gold bars and silver coins, the report said.

SI added that some investors have taken advantage of high prices for years to make a profit, while the lack of large volatility such as the Silicon Valley Bank crisis in 2023 has led to reduced demand for shelter. It is estimated that the total retail demand for silver in the US has decreased by at least 30% since the beginning of the year.

Silver and coins will soon be bustling

In the coming time, experts at SI believe that the trading of gold bars and coins will become more vibrant. However, they also note that demand for newly cast silver products may remain weak.

They also warned: "If silver prices surpass $40 an ounce, the market could react unpredictably. At that time, some investors may choose to take profits, while others rush to buy in the expectation that prices will continue to increase."

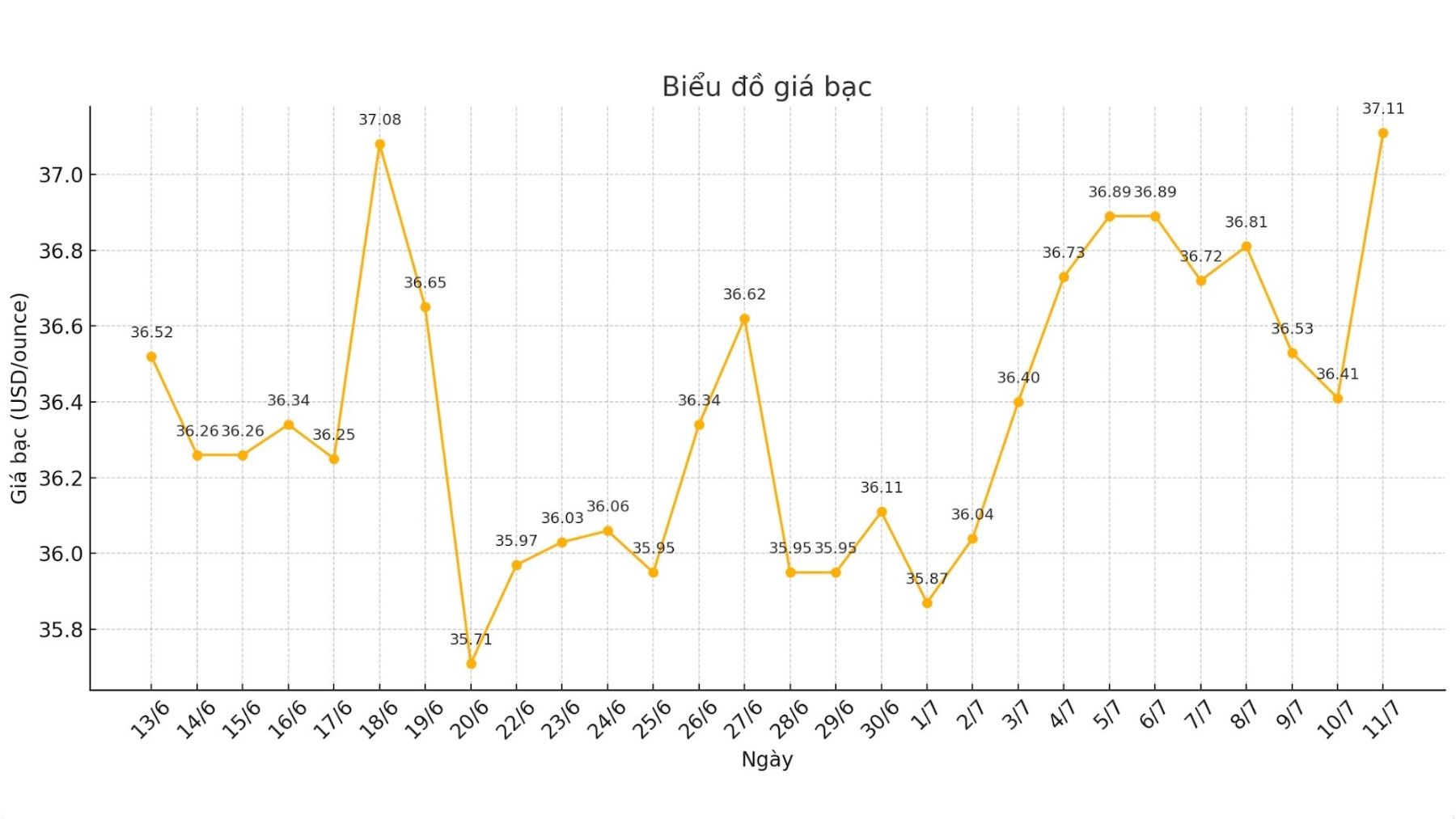

As of 12:15 on July 11 (Vietnam time), the world silver price was listed at 37.37 USD/ounce.

See more news related to silver prices HERE...