Domestic silver price

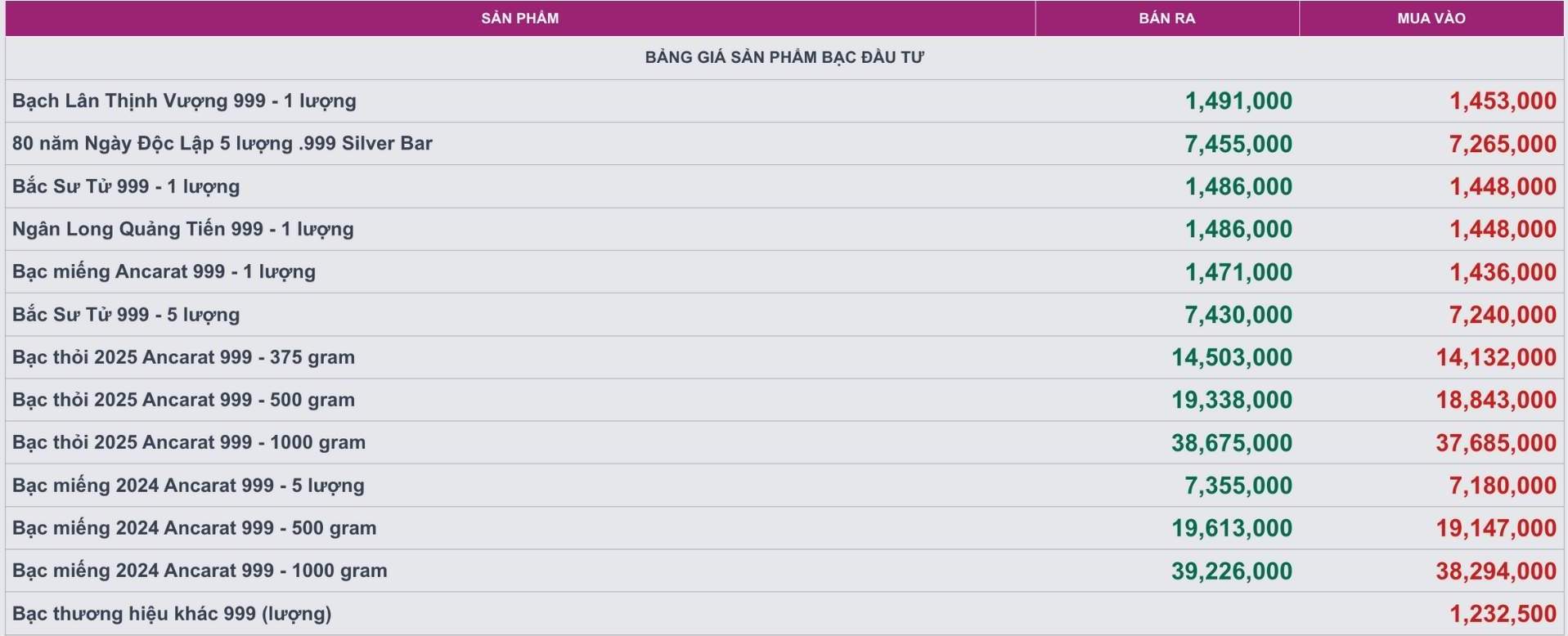

As of 9:40 a.m. on August 12, the price of 999 silver bars at Ancarat Metallurgy Company was listed at 1.436 - 1.471 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 37.685 - 38.675 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at VND19,147 - 19.613 million/kg (buy - sell).

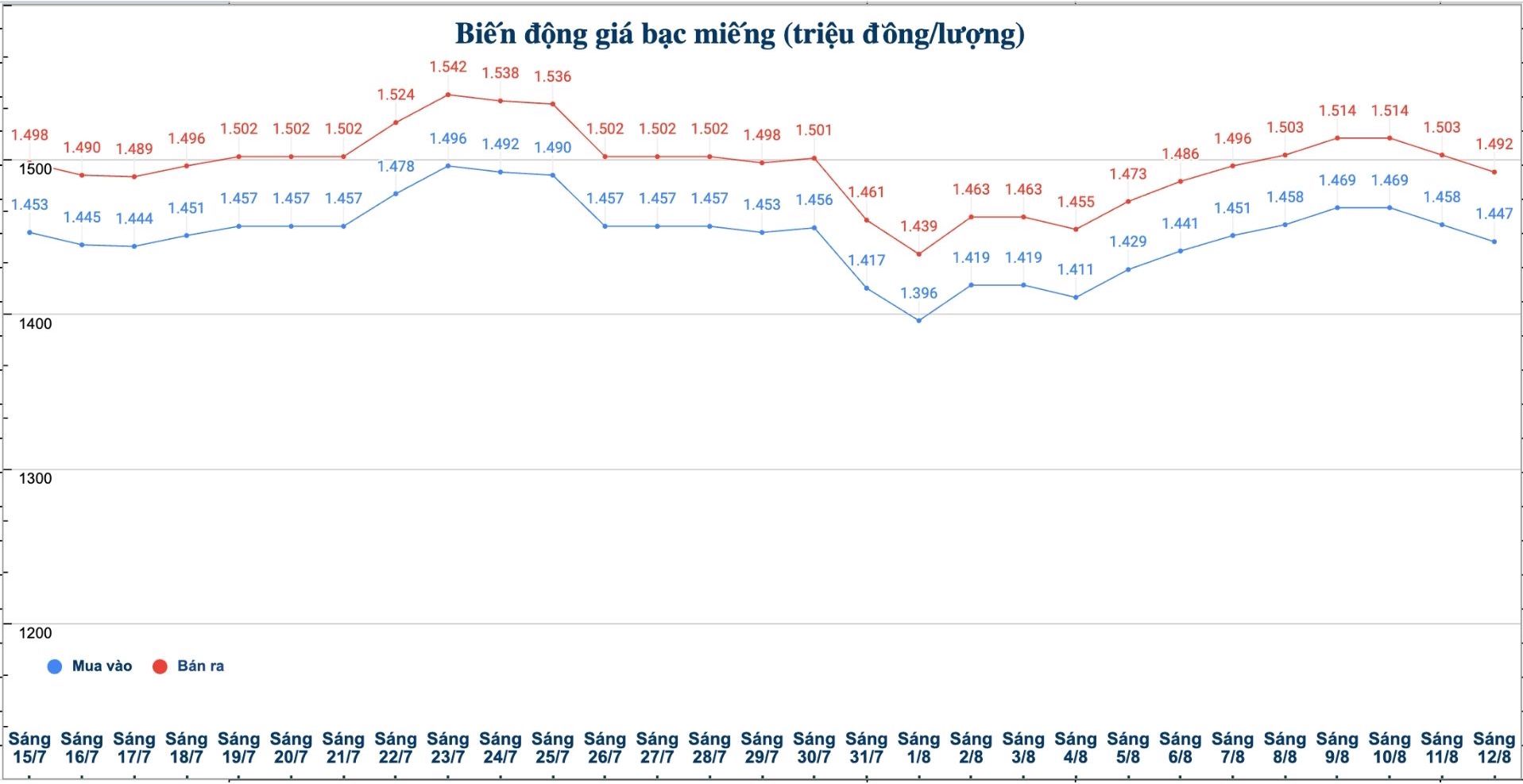

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.447 - 1.492 million VND/tael (buy - sell); down 11,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.447 - 1.492 million VND/tael (buy - sell); down 11,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38,586 - 39,786 million VND/kg (buy - sell); down 293,000 VND/kg in both directions of buying and selling compared to yesterday morning.

World silver price

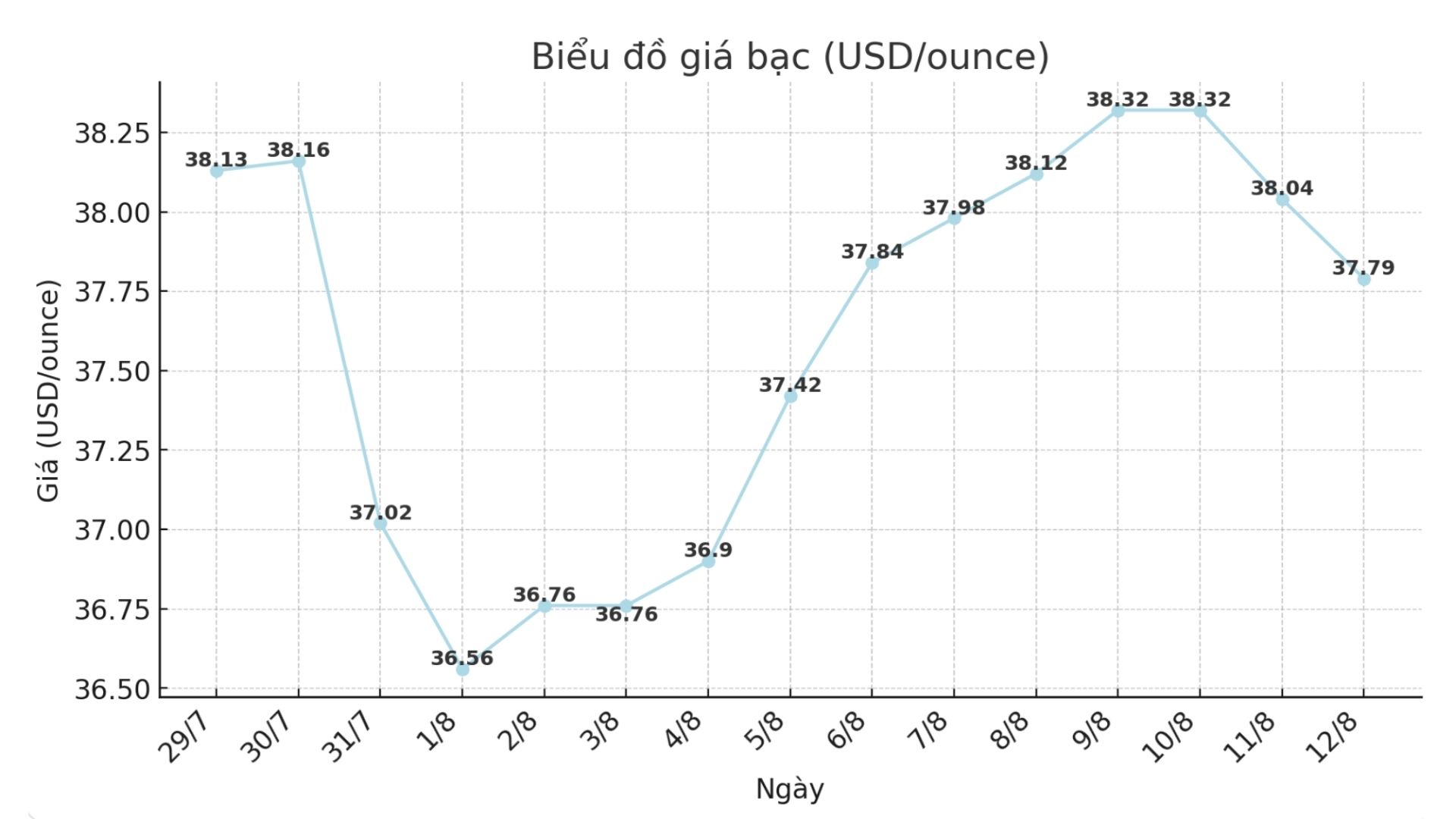

On the world market, as of 9:45 a.m. on August 12 (Vietnam time), the world silver price was listed at 37.79 USD/ounce; down 0.53 USD compared to yesterday morning.

Causes and predictions

Silver prices fell sharply as the US dollar (USD) strengthened, putting pressure on the precious metal market.

However, according to senior analyst Christopher Lewis, the current picture is not simply a story about exchange rates. "This is the time when the market is waiting and observing the US Federal Reserve's (FED) moves, because the decision to cut or keep interest rates unchanged will have a direct impact on the psychology and price trend of silver" - he said.

Christopher Lewis said many investors expect the Fed to cut interest rates, but based on recent economic data and the latest press conference message, this possibility may not be as strong as expected.

In the short term, the expert said that the silver market may face several months of unpredictable fluctuations.

"US$37.50 an ounce is now seen as a key support level. If prices penetrate, the 36.95 USD/ounce zone could be the next held point, but if it falls further, the trend will become quite risky and easily unbalanced.

Conversely, if buying power appears and prices bounce, the first target could be $39/ounce, then towards $40/ounce," said Christopher Lewis.

In the long term, he said, many fundamental factors are still supporting silver, but in the coming weeks, the market may move sideways with strong fluctuations, causing investors to be cautious before making a decision.

"This could be a period of accumulation, preparing for a new breakout if macro factors are favorable," Christopher Lewis said.

See more news related to silver prices HERE...