Domestic silver price

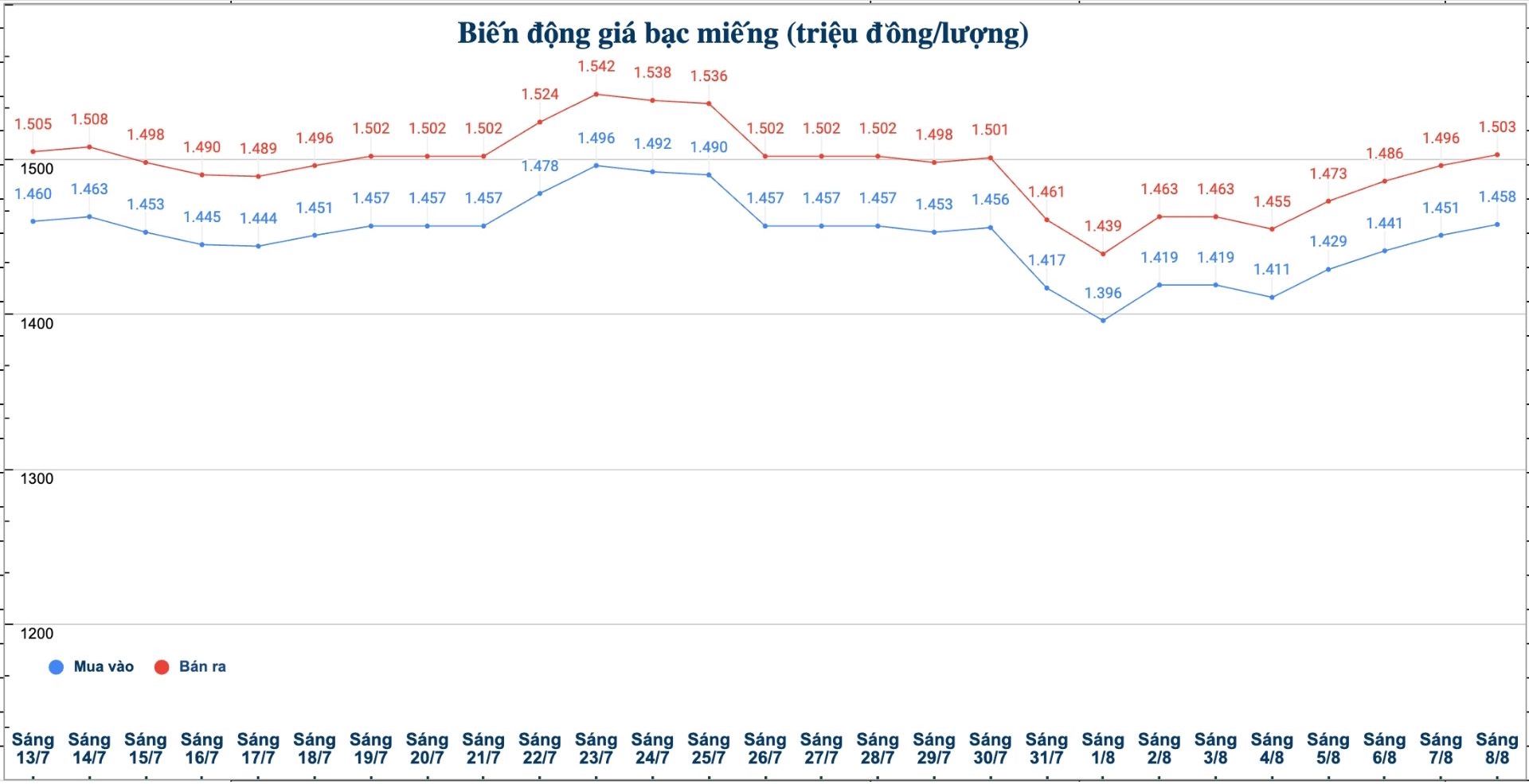

As of 9:20 a.m. on August 8, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.458 - VND1.503 million/tael (buy - sell); an increase of VND7,000/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.458 - 1.503 million VND/tael (buy - sell); an increase of 7,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38,879 - 40,079 million VND/kg (buy - sell); an increase of 186,000 VND/kg in both buying and selling directions compared to yesterday morning.

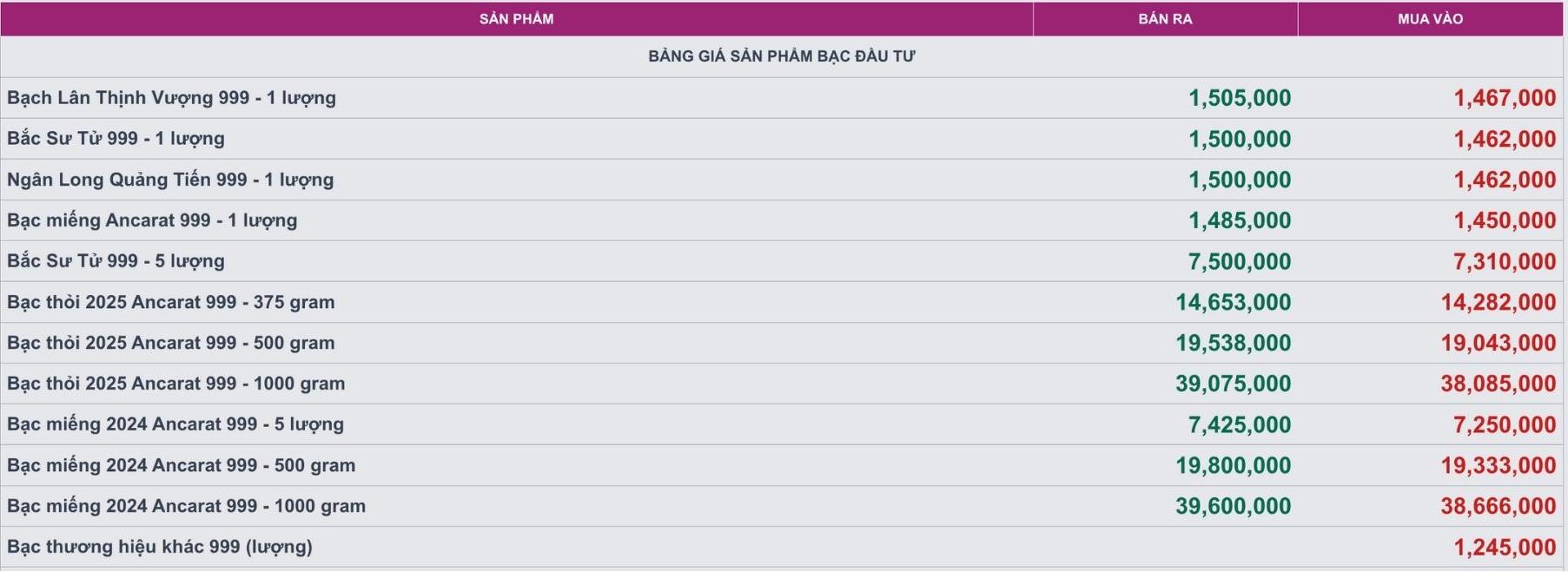

At the same time, the price of 999 silver bars at Ancarat Ngoai Company was listed at 1,450 - 1.485 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) Ancarat Metallurgy Company listed at 38.085 - 39.075 million VND/kg (buy - sell).

World silver price

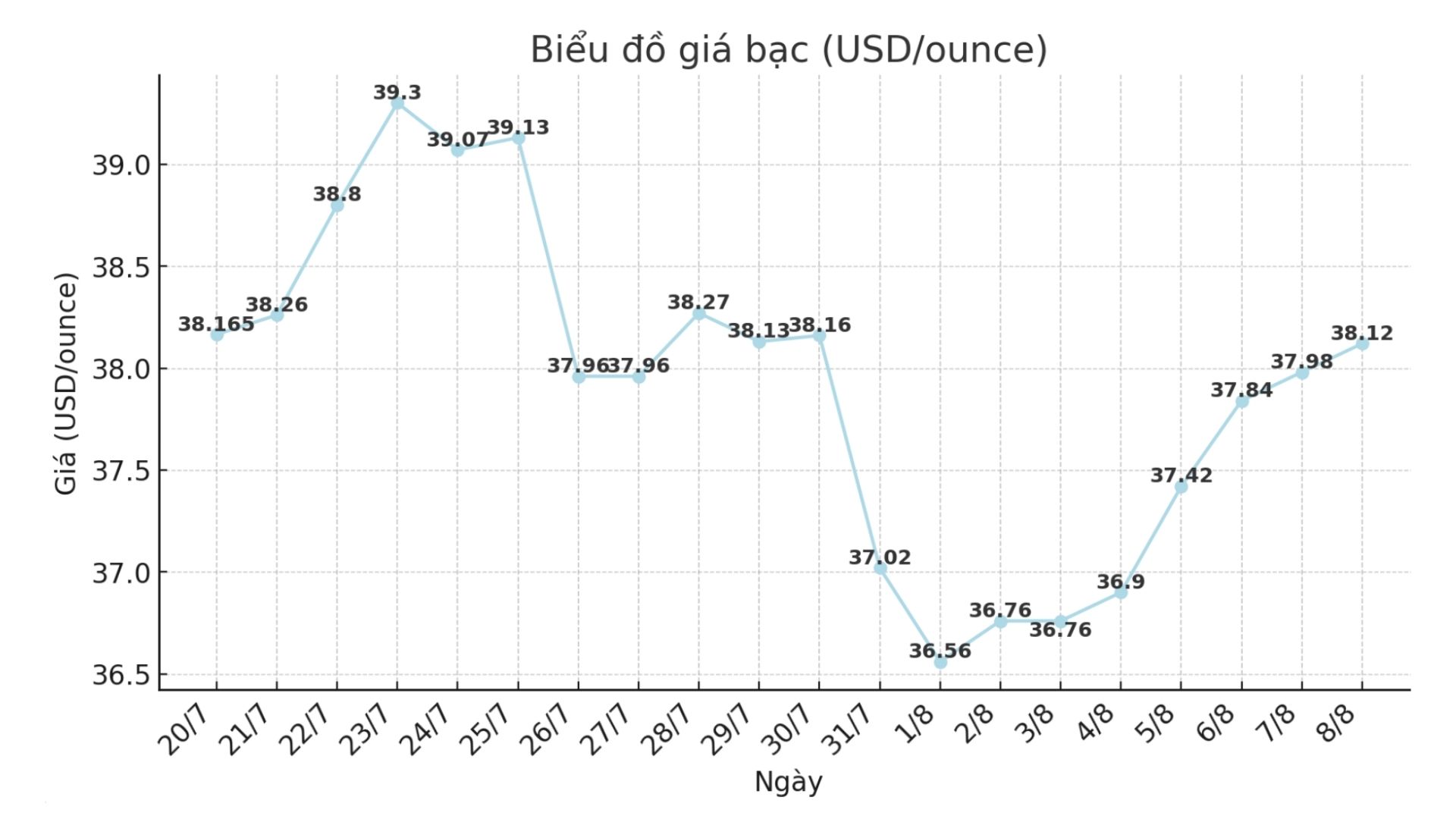

On the world market, as of 9:25 a.m. on August 8 (Vietnam time), the world silver price was listed at 38.12 USD/ounce; up 0.14 USD compared to yesterday morning.

Causes and predictions

Silver prices increased sharply, benefiting from the wave of safe-haven searches, which was triggered by the US's strong trade policy and growing expectations that the US Federal Reserve (FED) would soon cut interest rates.

Although gold is still the main focus, market analyst James Hyerczyk said that silver is also of interest thanks to its link with similar macro factors and dual attraction - both as a risk-off asset and a service for industrial production. This makes silver a worth considering choice in the context of current risk-off psychology.

"A big impact on silver's rally is the market's current valuation of a 93% chance of a Fed rate cut in September, compared to just 48% a week ago, according to CME FedWatch data," said James Hyerczyk.

According to him, the reason comes from the dovish comments of FED officials and signs of weakening the US economy, especially after President Trump announced the large-scale tax. These measures include a tax rate of 10 - 50% for many countries and a tax of 100% for non-domestic semiconductors.

"The strong trade position has put pressure on the USD. Because silver is priced in USD and not profitable, the weak greenback and the decrease in yields make the metal more attractive to international buyers" - James Hyerczyk commented.

James Hyerczyk added that gold's strong recovery also creates more momentum for silver. Gold has just skyrocketed to $3,397.58/ounce thanks to safe-haven demand and expectations of policy easing from central banks.

"When gold prices are high, the spread of buying power also drives silver, especially as investors seek assets with relatively better value. In addition, if interest rates decrease, the manufacturing sector can flourish, thereby maintaining demand for silver in the industrial sector" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...