Domestic silver price

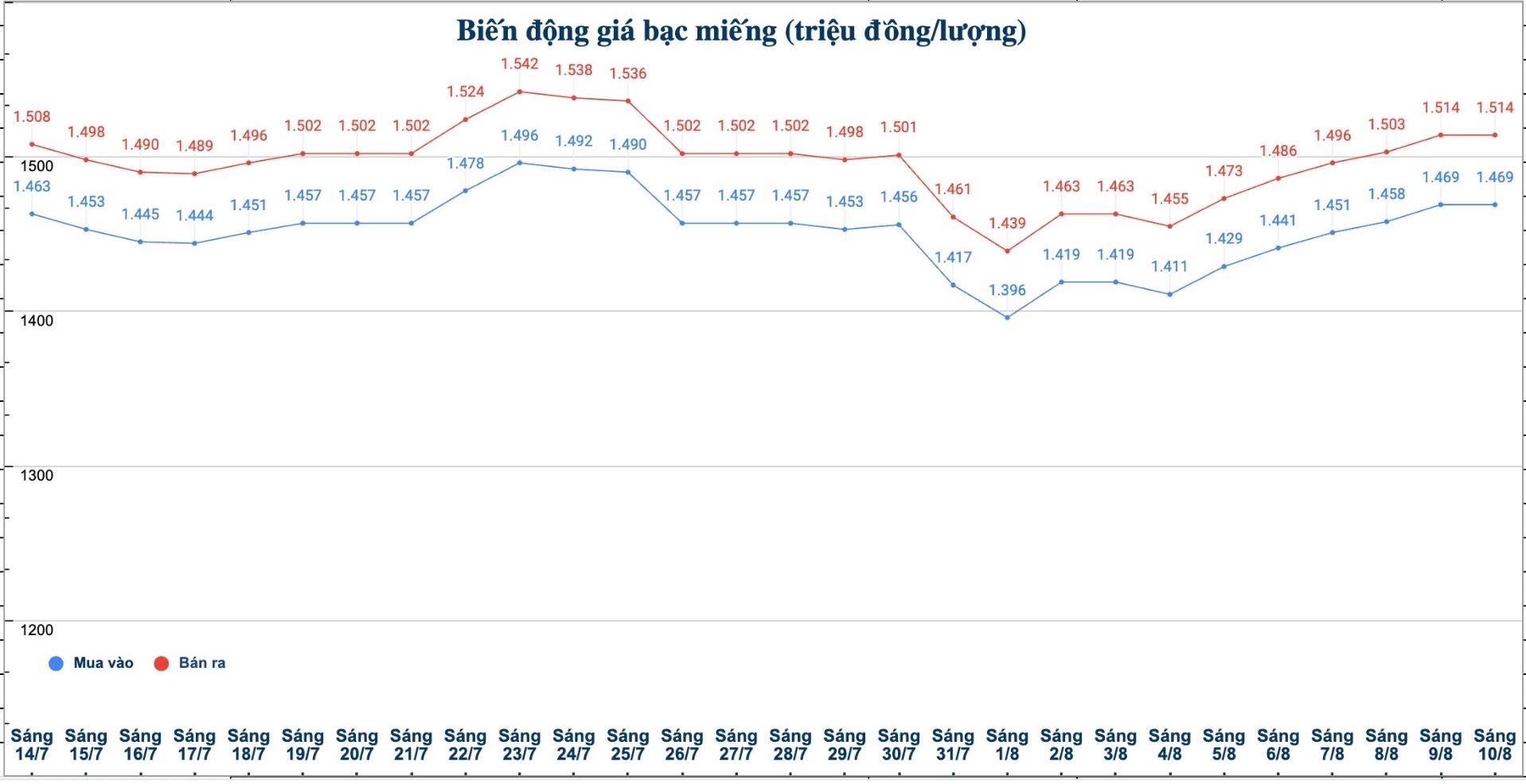

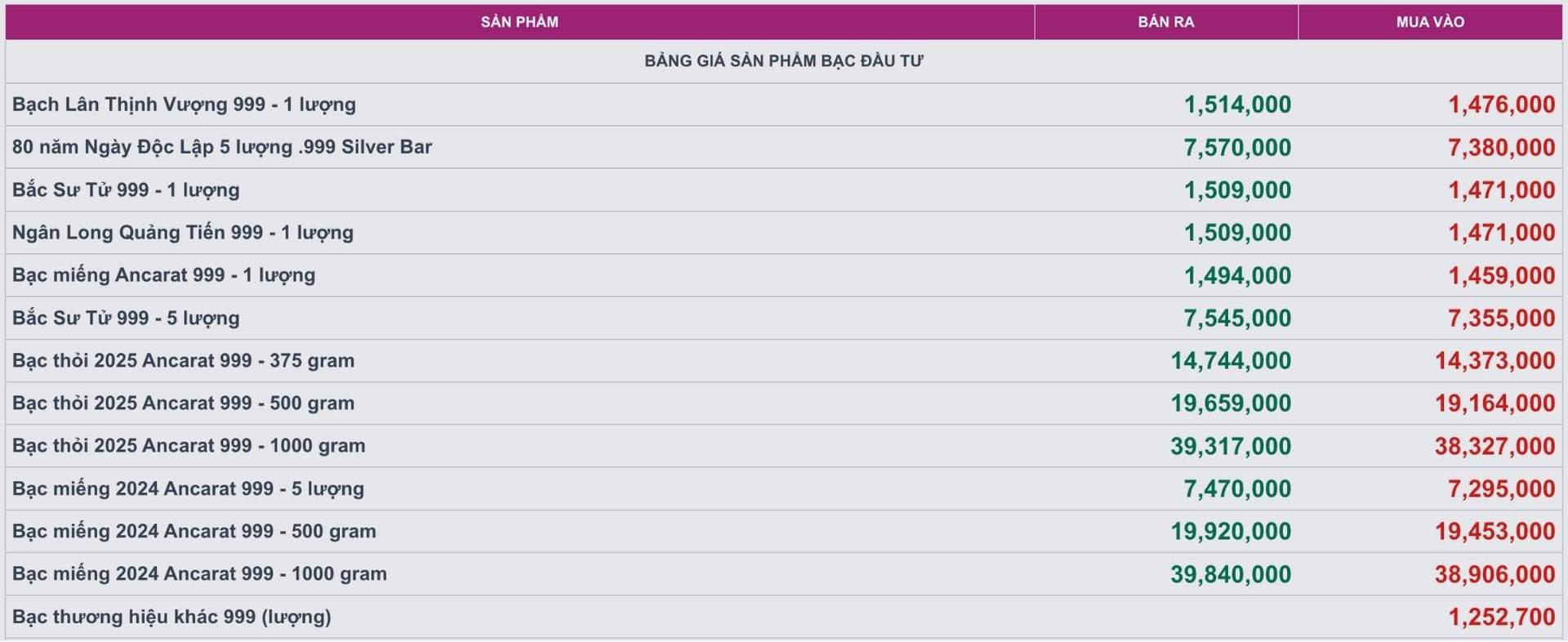

As of 10:05 on August 10, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.469 - 1.514 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.469 - 1.514 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 gold bars (1kg) at Phu Quy Jewelry Group was listed at 39.173 - 40.373 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 silver bars at Ancarat Mineral and kimical Company was listed at 1.459 - 1.494 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) Ancarat Metallurgy Company listed at 38.327 - 39.317 million VND/kg (buy - sell).

World silver price

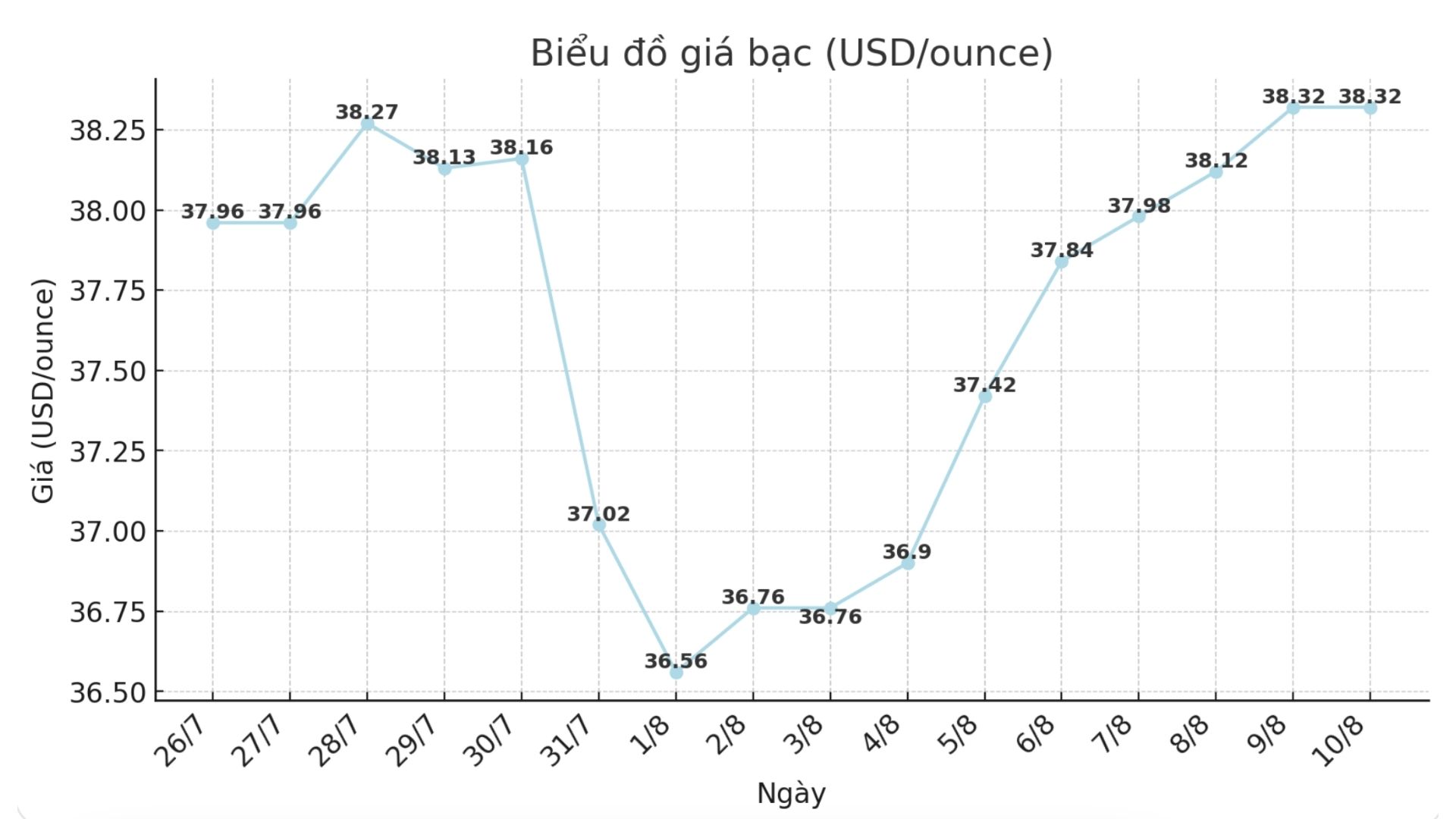

On the world market, as of 10:06 on August 10 (Vietnam time), the world silver price was listed at 38.32 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Silver prices increased sharply in the context of investors increasing their search for safe havens, while betting on the possibility that the US Federal Reserve (FED) will soon cut interest rates.

According to technical analyst Christian Borjon Valencia, a large-scale weakening of the US dollar and expectations that the Fed could cut interest rates right at the September meeting have created a significant push for this precious metal.

However, he believes that buying power needs to surpass the 39.00 USD/ounce mark to test the peak since the beginning of the year at 39.52 USD/ounce, before moving towards the challenge of the 40.00 USD/ounce threshold.

On the contrary, although the increase has been consolidated through price movements, the market has not been able to clearly establish a reversal signal - Christian Borjon Valencia commented.

Meanwhile, market expert James Hyerczyk assessed that although gold still dominates, silver has also emerged thanks to the impact of macroeconomic factors and possesses "two roles" - both a risk-off tool and an important raw material in production.

"This combination makes silver an attractive choice at a time when the psychology of avoiding the risk of spreading" - he said.

James Hyerczyk commented that the high price of gold is contributing to stimulating buying pressure to spread to the silver market, especially when investors are looking for assets with relatively higher value. He said that in case interest rates fall, production activities can recover, thereby maintaining demand for silver in the industrial sector.

See more news related to silver prices HERE...