Domestic silver price

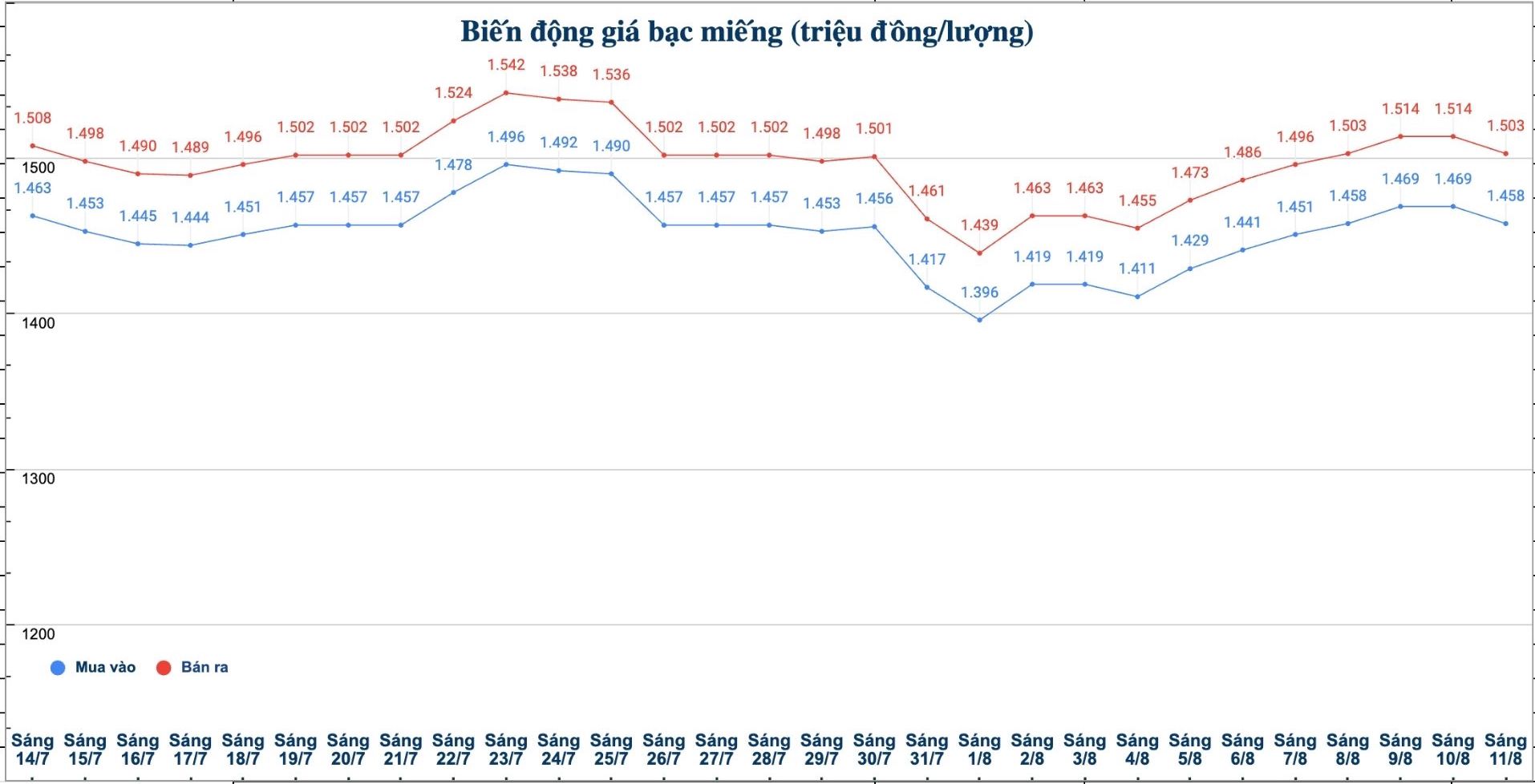

As of 9:25 a.m. on August 11, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.458 - VND1.503 million/tael (buy - sell); down VND11,000/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.458 - 1.503 million VND/tael (buy - sell); down 11,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.879 - 40.079 million VND/kg (buy - sell); down 294,000 VND/kg in both directions of buying and selling compared to yesterday morning.

World silver price

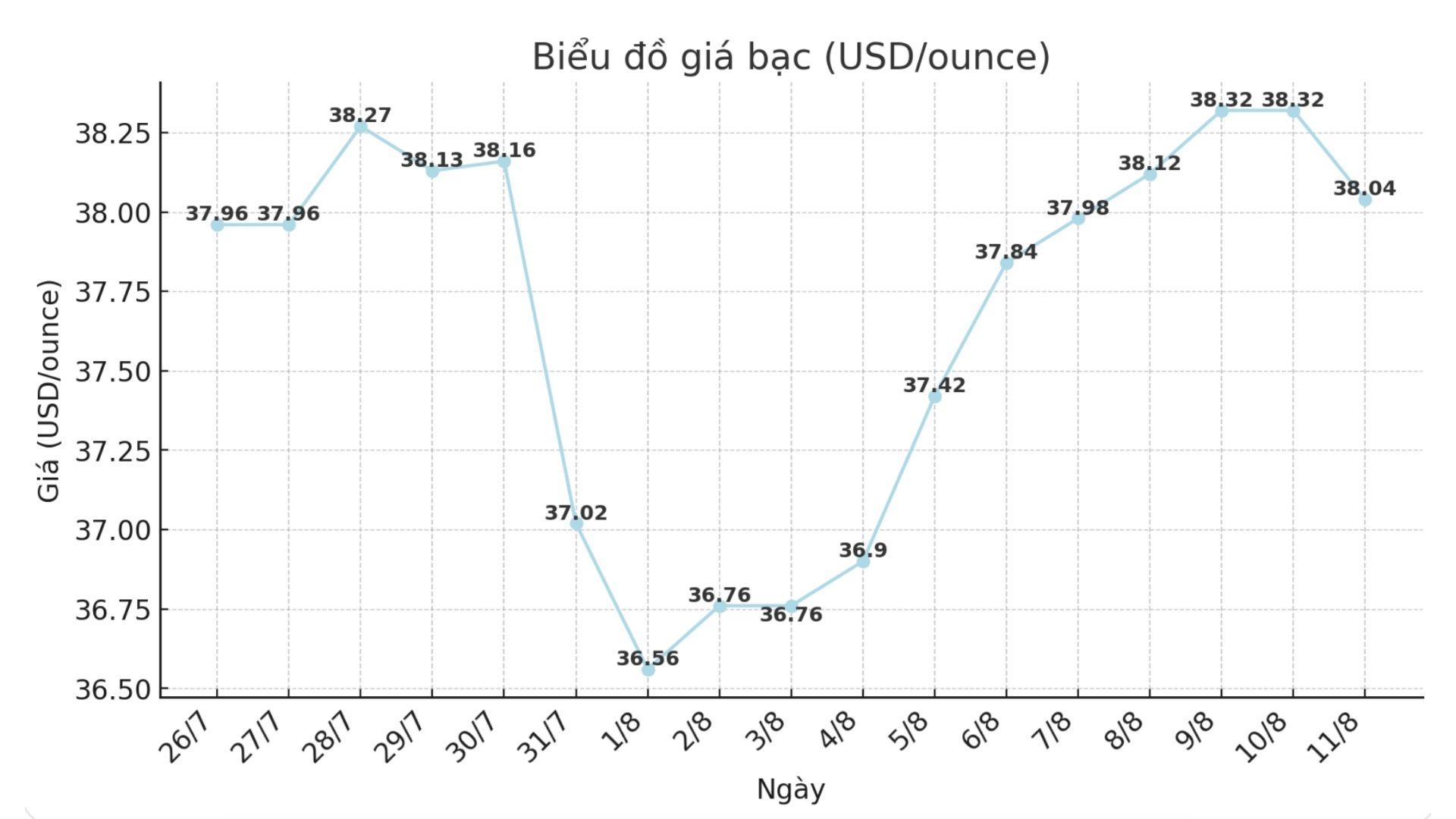

On the world market, as of 9:30 a.m. on August 11 (Vietnam time), the world silver price was listed at 38.32 USD/ounce; down 0.28 USD compared to yesterday morning.

Causes and predictions

Despite a slight reversal, silver prices remained firmly above the important support level, as market sentiment was strongly boosted by expectations of the Fed cutting interest rates in September.

According to market expert James Hyerczyk, this momentum comes from the Non-farm Employment Report released on August 1, showing that only 73,000 new jobs were created in July - a significantly low level - along with a sharp adjustment to reduce the June employment data.

"Unsatisfactory employment data has led to a possibility of the Fed cutting interest rates above 90%, dragging the US dollar and US bond yields down, thereby supporting silver prices," he said.

In contrast, China's stagnant production - reflected in the sluggish PMI - is still a major obstacle, showing the "double-sided" characteristics of silver: both playing the role of a safe-haven asset and being strongly affected by industrial demand.

This week, the focus is on the CPI report.

"Colding inflation will pave the way for the Fed to cut interest rates, creating strong buying momentum to push silver prices towards a 14-month peak of 39.53 USD/ounce. Conversely, a high CPI could cause the Fed to temporarily hold, the US dollar to rise and the silver to retreat to the $36/ounce zone before attracting new buying momentum, said James Hyerczyk.

Technically, James Hyerczyk said that the outlook for silver prices is still leaning towards an uptrend as the market looks towards the time of announcing the CPI.

See more news related to silver prices HERE...