Domestic silver price

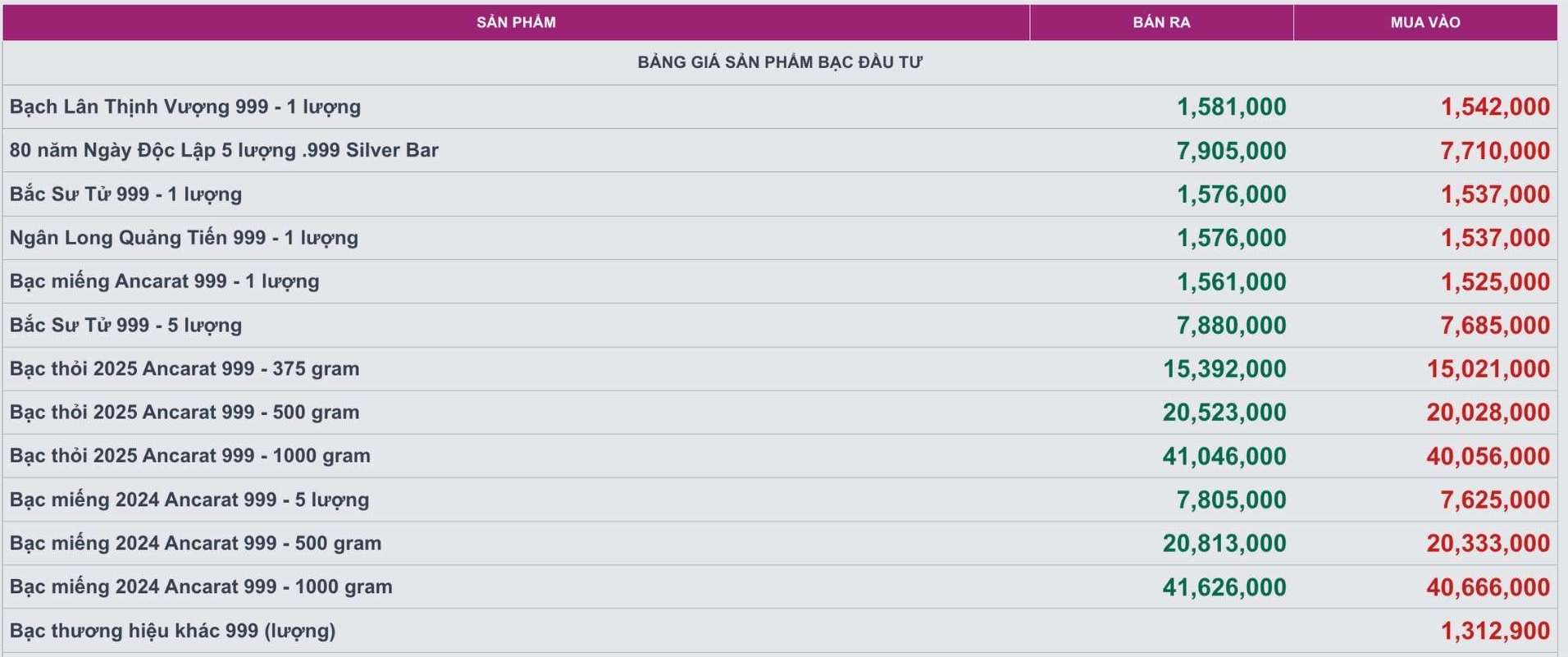

As of 9:35 a.m. on September 1, the price of 999 999 coins (1 tael) at Ancarat Golden Rooster Company was listed at 1.525 - 1.561 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 40.056 - 41.046 million VND/kg (buy - sell).

The price of 2024 Ancarat 999 (1kg) silver bars at Ancarat Metallurgy Company was listed at 40.666 - 41.626 million VND/kg (buy - sell).

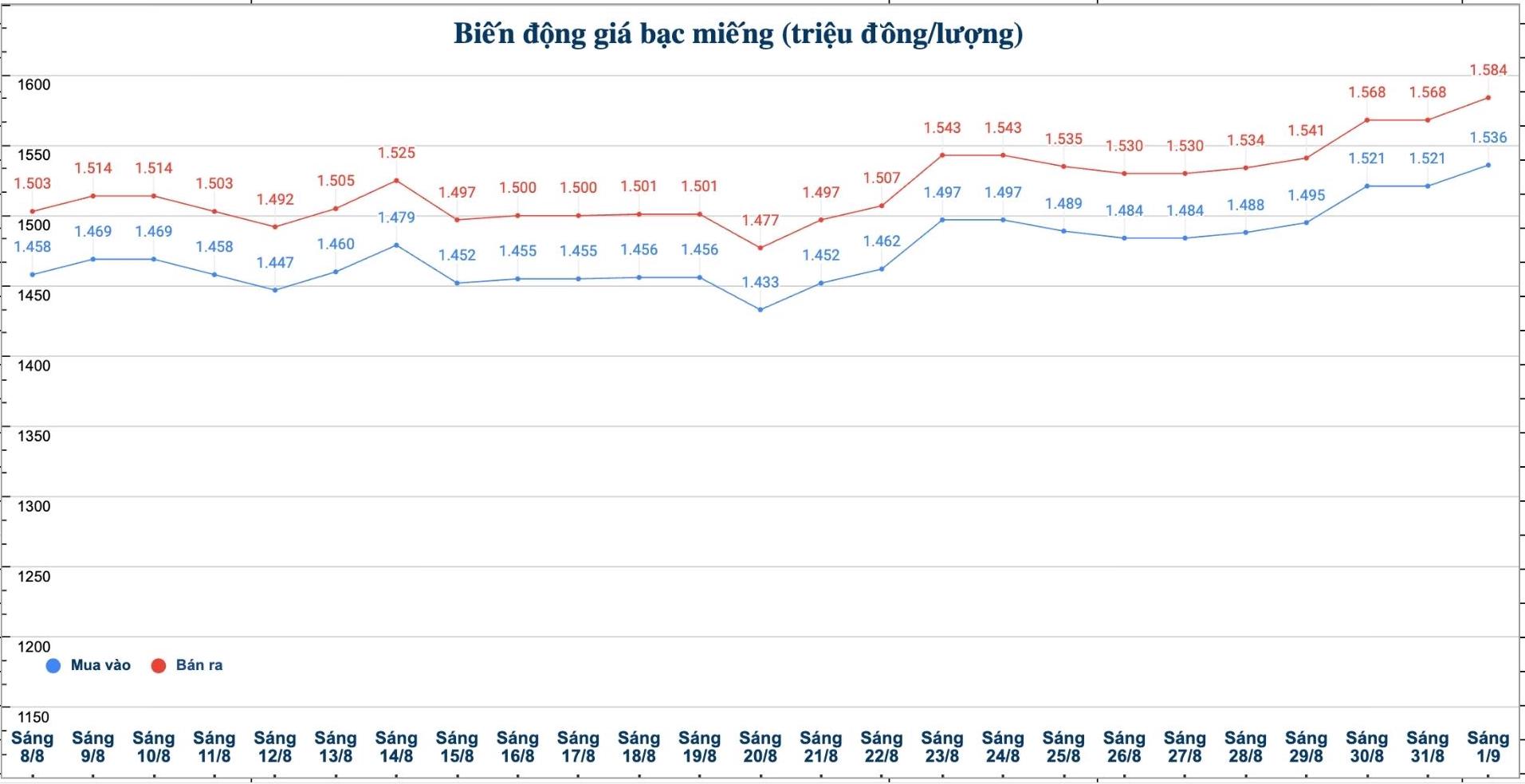

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.536 - 1.584 million VND/tael (buy - sell); an increase of 15,000 VND/tael for buying and an increase of 16,000 VND/tael for selling compared to yesterday morning.

The price of 999 gold bars (1 tael) at Phu Quy Jewelry Group was listed at 1.536 - 1.584 million VND/tael (buy - sell); an increase of 15,000 VND/tael for buying and an increase of 16,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 40.959 - 42.239 million VND/kg (buy - sell); an increase of 400,000 VND/kg for buying and an increase of 426,000 VND/kg for selling compared to yesterday morning.

World silver price

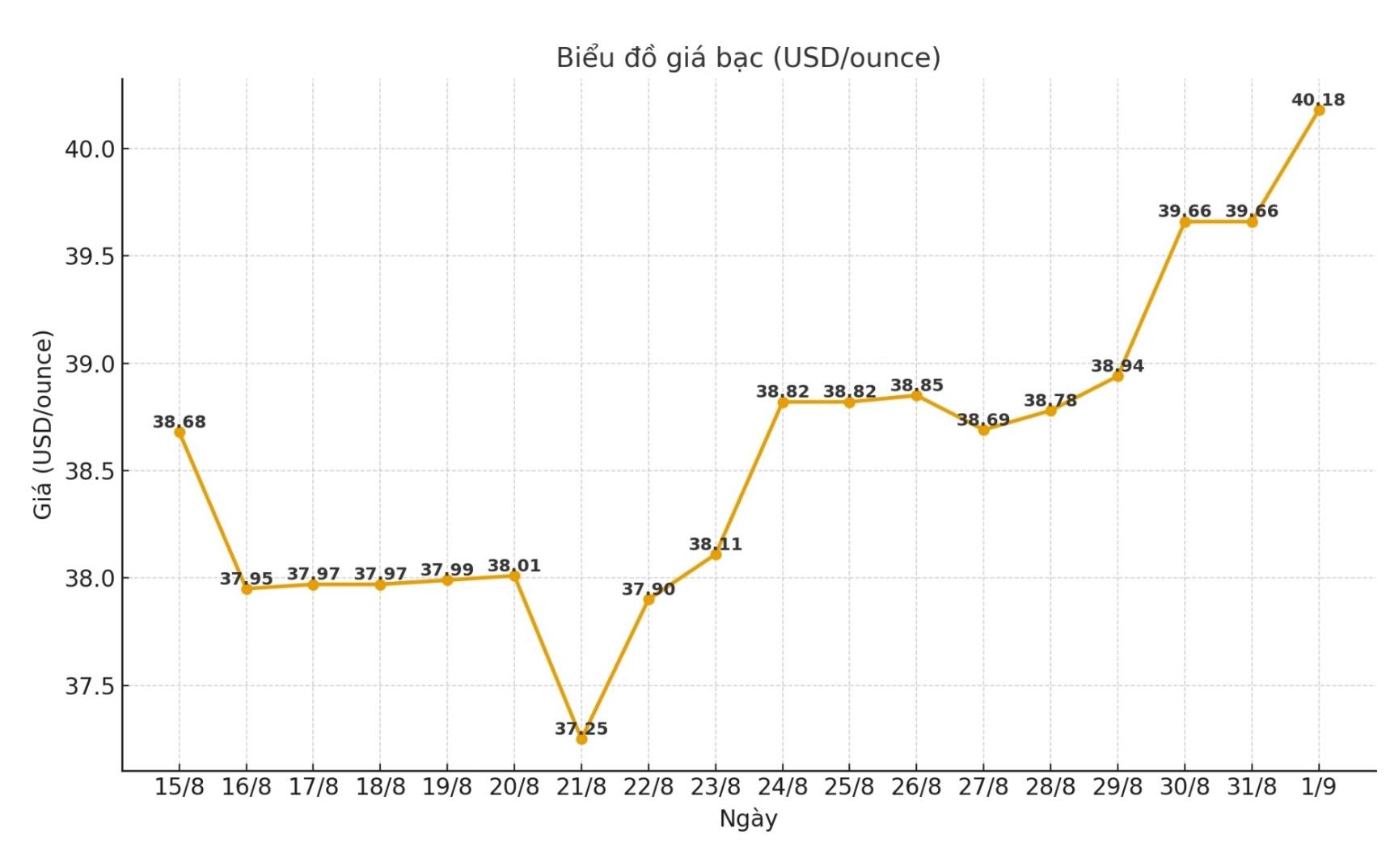

On the world market, as of 9:33 a.m. on September 1 (Vietnam time), the world silver price was listed at 40.18 USD/ounce; up 0.52 USD compared to yesterday morning.

Causes and predictions

Silver has surpassed the important resistance level of 39.53 USD/ounce. According to analyst James Hyerczyk, this is the highest weekly closing price in more than a decade, affirming the breakthrough after a long period of accumulation and opening a clear uptrend for buyers.

"After breaking above the 39.53 USD/ounce mark - the barrier to holding prices since July - silver has a technical space to move towards the 44.22 USD/ounce zone, as long as market conditions continue to be favorable," he said.

James Hyerczyk said the market is placing an 89% chance that the US Federal Reserve (FED) will cut interest rates in September after the PCE core inflation index in July stopped at 2.9%. The Fed's dovish voice, which focuses more on job risks, has reinforced the positive sentiment for the precious metal.

In addition, the USD index fell 2.19% in August, falling below many important thresholds. The weak greenback, combined with the sustained strength of gold, continues to drive the upward momentum of silver" - the expert emphasized.

Assessing the current trend, expert James Hyerczyk said that silver is still leaning towards price increase. As long as prices remain above 39.53 USD/ounce, the possibility of moving to 44.22 USD/ounce is still very clear. However, the August non-farm payrolls (NFP) report will be a key factor, Hyerczyk said.

See more news related to silver prices HERE...