Domestic silver price

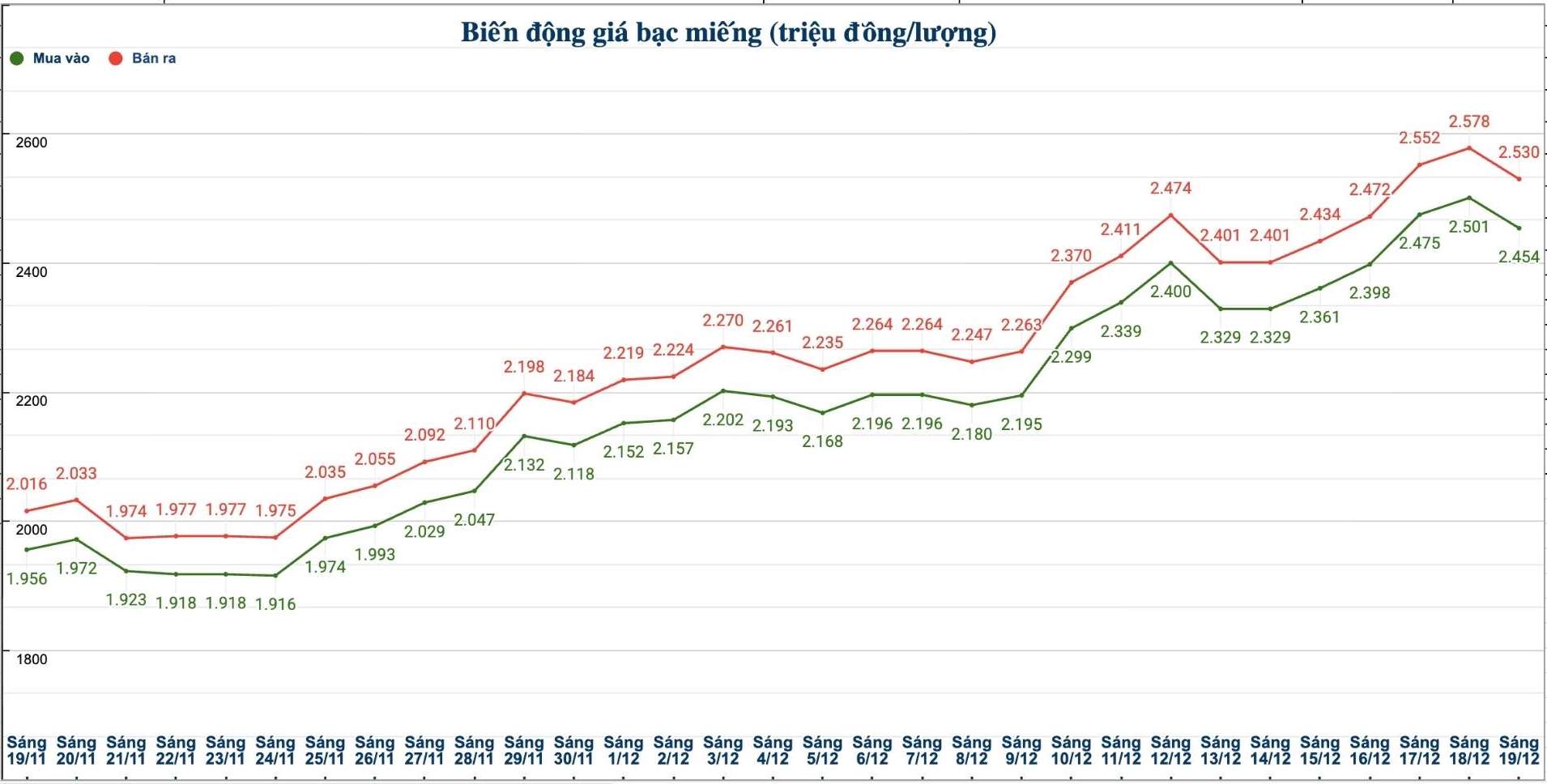

As of 10:40 a.m. on December 19, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND2.447 - VND2.507 million/tael (buy - sell); down VND48,000/tael for buying and down VND49,000/tael for selling compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 84.394 - 66.354 million VND/kg (buy - sell); down 1.266 million VND/kg for buying and down 1.306 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of the Golden Rooster Bank of Vietnam (Sacombank-SBJ) is listed at VND2.463 - 2.523 million/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.454 - 2.530 million/tael (buy - sell); down VND 47,000/tael for buying and down VND 48,000/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 65.439 - 67.466 million VND/kg (buy - sell); down 1.254 million VND/kg for buying and down 1.28 million VND/kg for selling compared to yesterday morning.

World silver price

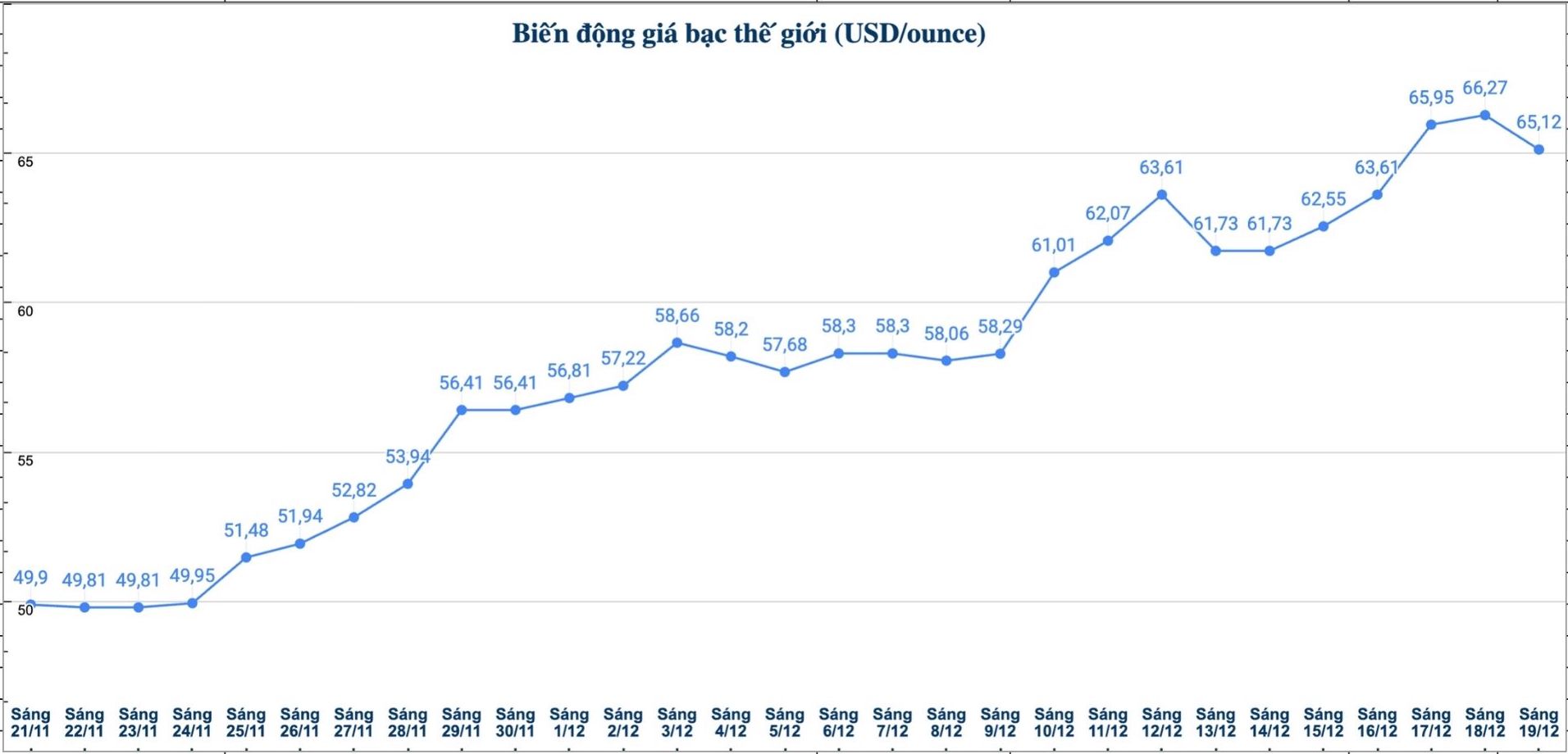

On the world market, as of 10:40 a.m. on December 19 (Vietnam time), the world silver price was listed at 65.12 USD/ounce; down 1.15 USD compared to yesterday morning.

Causes and predictions

Silver prices fell in the trading session on Friday morning. According to Kitco analyst Jim Wyckoff, the decline has been driven largely by profit-taking by investors trading in short-term futures contracts, after silver prices have risen sharply recently.

In the futures market, the price of silver delivered in March decreased by 0.641 USD, down to 66.25 USD/ounce.

In addition, the US Department of Labor announced that the consumer price index (CPI) in November increased by 2.7% compared to the same period last year, significantly lower than the forecast of 3.1%.

This cooling inflation data has initially put pressure on the precious metals market, as investors adjusted their expectations about the monetary policy orientation of the US Federal Reserve (Fed) in the coming time.

Technically, Jim Wyckoff said that the next bullish target for the March silver contract is to bring the closing price above the strong resistance level of 70.00 USD/ounce. On the contrary, the sellers are aiming to pull prices below the important support zone of 60.00 USD/ounce.

"The most recent resistance levels were determined at a record peak of 67.18 USD/ounce and then 67.50 USD/ounce. Meanwhile, the support levels are at the bottom of the day at 66.825 USD/ounce and lower at 66.00 USD/ounce," said Jim Wyckoff.

See more news related to silver prices HERE...