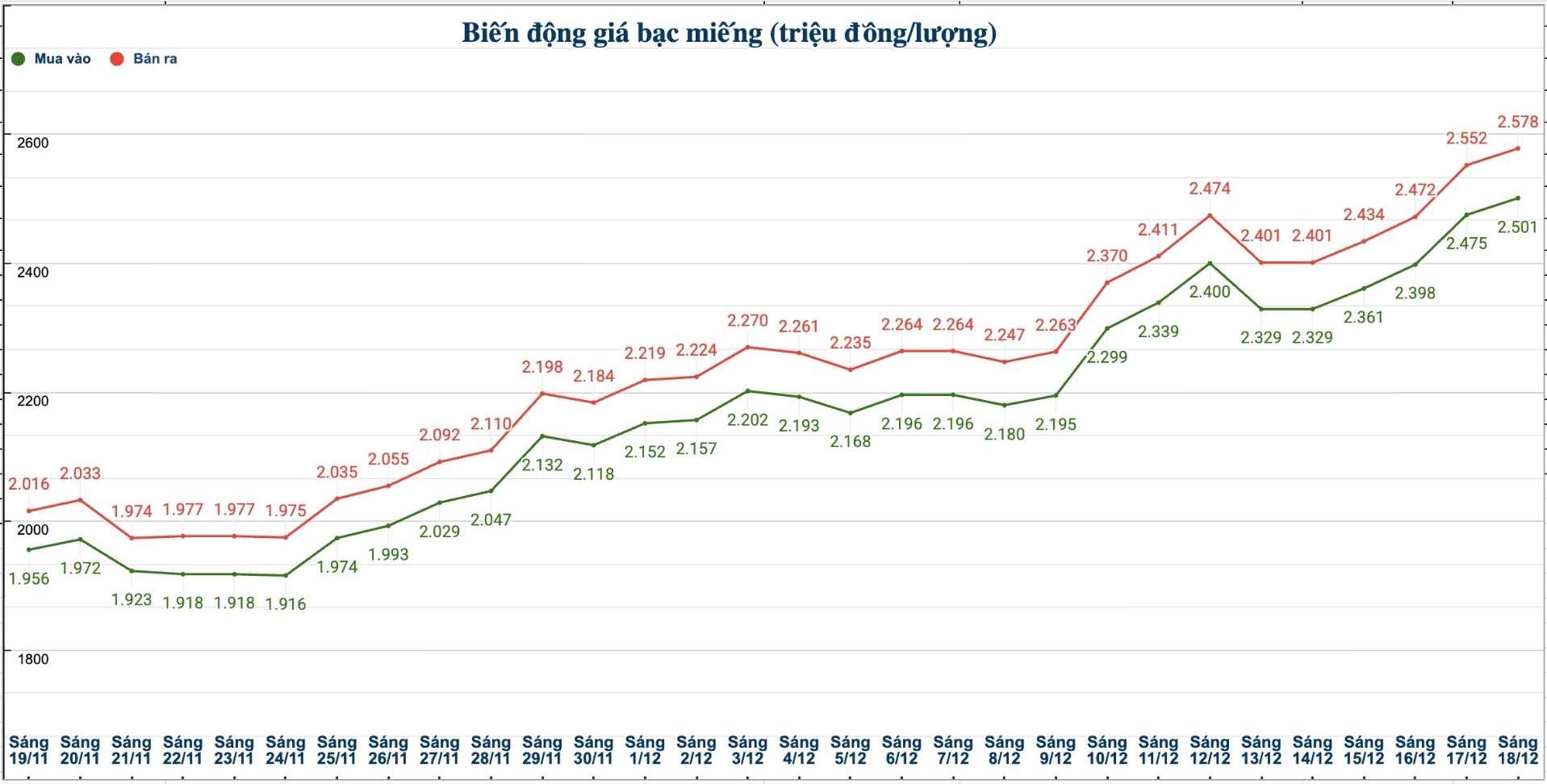

Domestic silver price

As of 10:40 a.m. on December 18, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.495 - 2.556 million VND/tael (buy - sell); an increase of 23,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Petrochemical Company was listed at 65.660 - 67.660 million VND/kg (buy - sell); an increase of 594,000 VND/kg for buying and an increase of 614,000 VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone One Member Co., Ltd. (Sacombank-SBJ) was listed at VND2.484 - 2.544 million/tael (buy - sell); an increase of VND15,000/tael for buying and VND18,000/tael for selling compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.501 - 2.578 million/tael (buy - sell); an increase of VND26,000/tael in both directions compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 66.693 - 68.746 million VND/kg (buy - sell); an increase of 694,000 VND/kg for buying and an increase of 693,000 VND/kg for selling compared to yesterday morning.

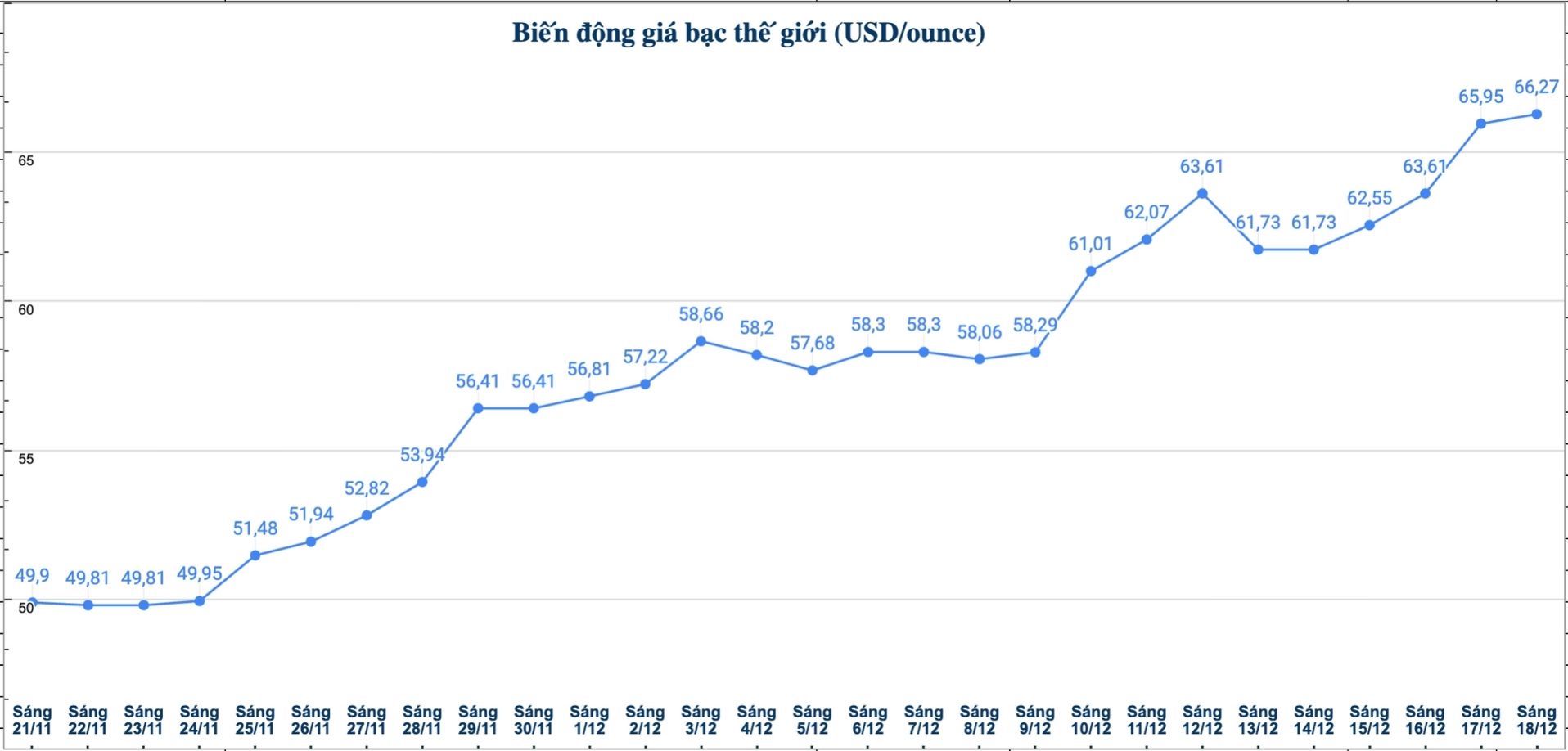

World silver price

On the world market, as of 10:40 a.m. on December 18 (Vietnam time), the world silver price was listed at 66.27 USD/ounce; up 0.32 USD compared to yesterday morning.

Causes and predictions

According to precious metals analyst Christopher Lewis at FX Empire, silver prices continued to increase strongly and remain above the 66 USD/ounce mark, despite concerns that the current price level is quite high compared to traditional standards.

"In the context of no clear fundamental factors that could cause a sharp reversal in prices, the downward corrections are being seen by investors as a buying opportunity, as the market moves towards higher psychological milestones," said Christopher Lewis.

The expert said that since February 2024, silver prices have skyrocketed from the low, reflecting a long and clear uptrend.

According to him, at this time, most investors are relying on market expectations and growth momentum, because there are no technical signals or fundamental factors showing that the uptrend is about to end.

He added that in the short term, slight corrections could still open up new buying opportunities, while the $70/ounce mark is considered the next important psychological threshold. On the other hand, if silver prices fall below $62.50/ounce, the market could retreat to $60/ounce.

"However, silver is still a growing investment channel and this trend is likely to continue until there are clear signs of slowing down," Christopher Lewis said.

See more news related to silver prices HERE...