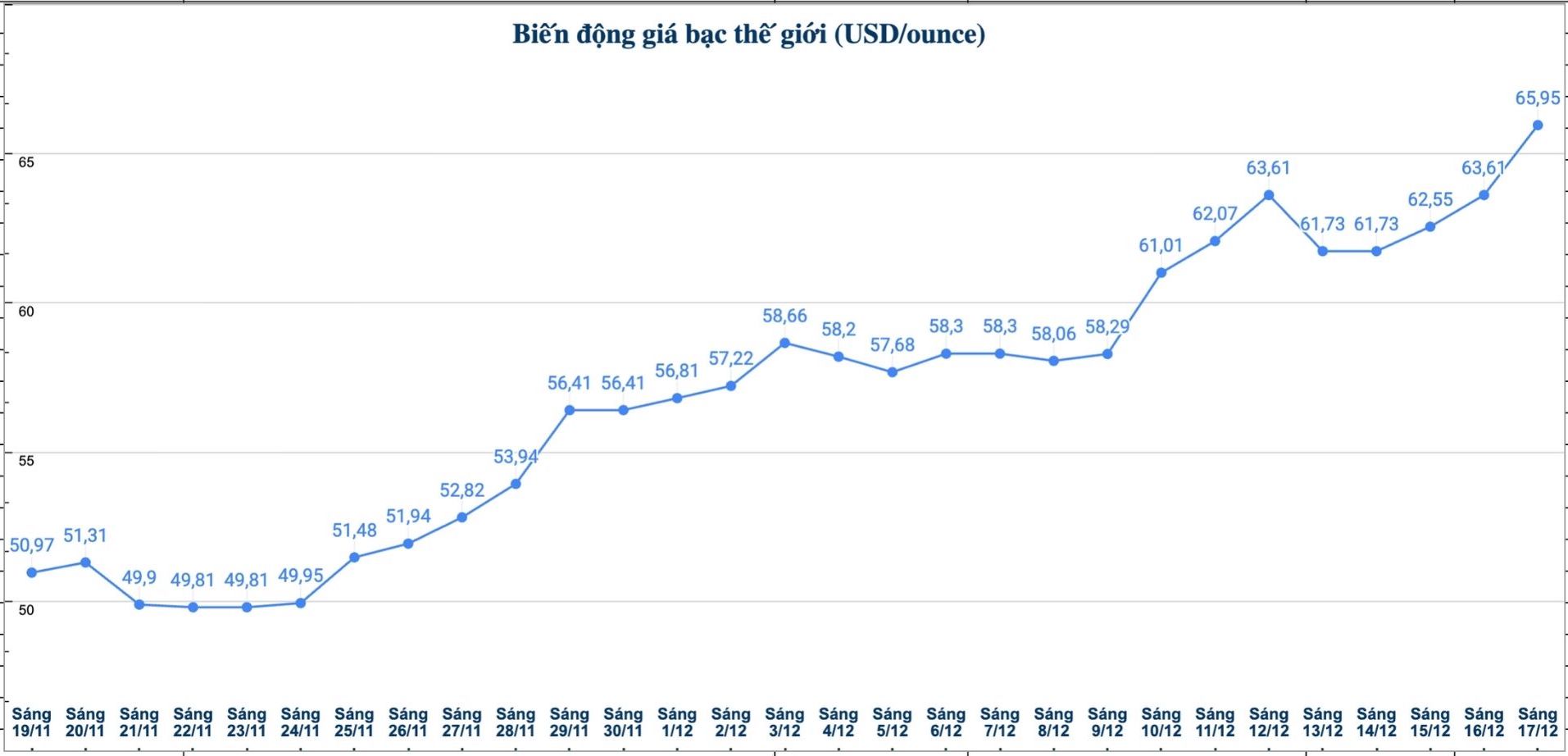

As silver prices are driven by investment cash flow and return to above $63/ounce, a report by The Silver Institute (an international nonprofit association consisting of members who are different participants in the global silver industry) shows that the important long-term support still comes from consumption demand, especially in the industrial sector.

According to the latest report published by Oxford Economics, The Silver Institute has updated its forecast on industrial silver demand. This precious metal is expected to continue to play an important role in the electrification of the global economy, thanks to its outstanding electricity and heat conduction properties.

"Siliver is becoming increasingly essential for rapidly developing technology fields such as solar energy, electric vehicles, charging infrastructure, data centers and artificial intelligence. These industries are expected to boost demand for industrial silver by 2030," the report said.

In particular, solar energy continues to be the largest driver of silver consumption in the industrial segment. The report shows that although the amount of silver used in each fiber optic battery has decreased over time thanks to improved technology, the strong expansion rate of renewable energy is still superior to the material-saving trend.

According to The Silver Institute, in 2014, the solar energy sector accounted for only about 11% of the total global demand for silver. After a decade, this rate has increased to 29%. The electric vehicle market is identified as the second largest source of industrial silver consumption. The report forecasts that global automobile demand will grow by about 3.4% per year in 2025-2031.

A report by The Silver Institute said that electric vehicles use significantly more silver than traditional internal combustion engine vehicles, because silver is widely applied in battery management systems, power electronics, charging infrastructure and electrical connections. On average, each electric vehicle consumes about 25-50 grams of silver, 67-79% higher than vehicles using internal combustion engines.

"In addition, the rapidly growing artificial intelligence economy is expected to become a new growth driver for silver demand. Expanding data centers to meet growing computing needs will lead to demand for hardware, thereby increasing silver consumption," the report said.

The report estimates that the total global IT capacity has increased by about 53 times, from 0.93 gigawatt (GW) in 2000 to nearly 50 gigawatt (GW) in 2025. Accordingly, the link between increased demand for IT energy and demand for silver is clear.

In the long term, analysts at The Silver Institute believe that industrial demand will continue to be an important support factor for the upward trend of silver prices. According to The Silver Institute, except for the solar energy sector, silver currently accounts for a relatively small proportion of the cost of the automobile industry and building a data center, thereby creating room for silver prices to increase higher without significantly affecting the profits of these industries.

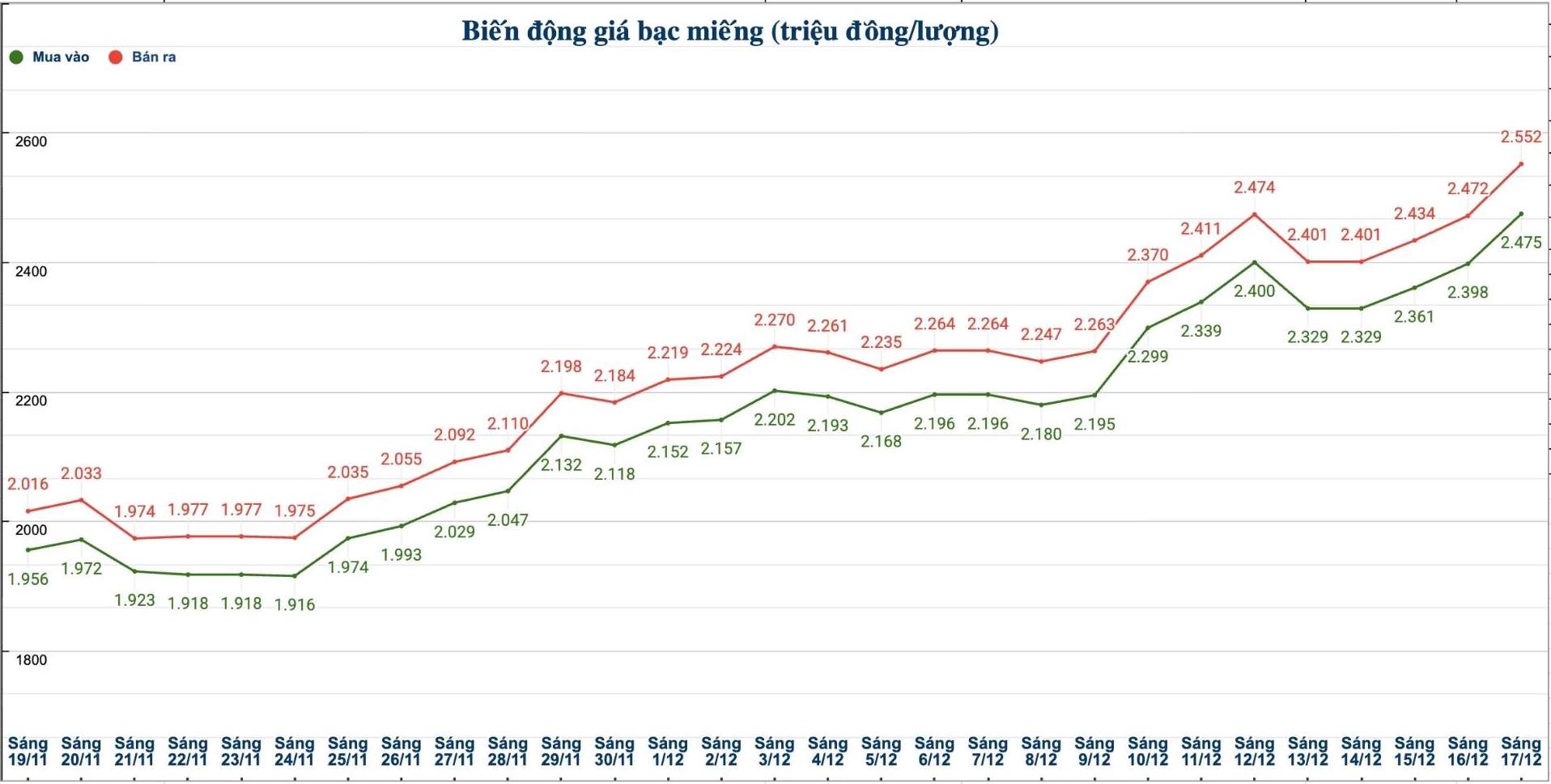

Updated silver price

As of 11:25 on December 17, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.469 - 2.530 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 84.986 - 66.966 million VND/kg (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND2.474 - 2.551 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at VND25.973 - 68.026 million/kg (buy - sell).

See more news related to silver prices HERE...