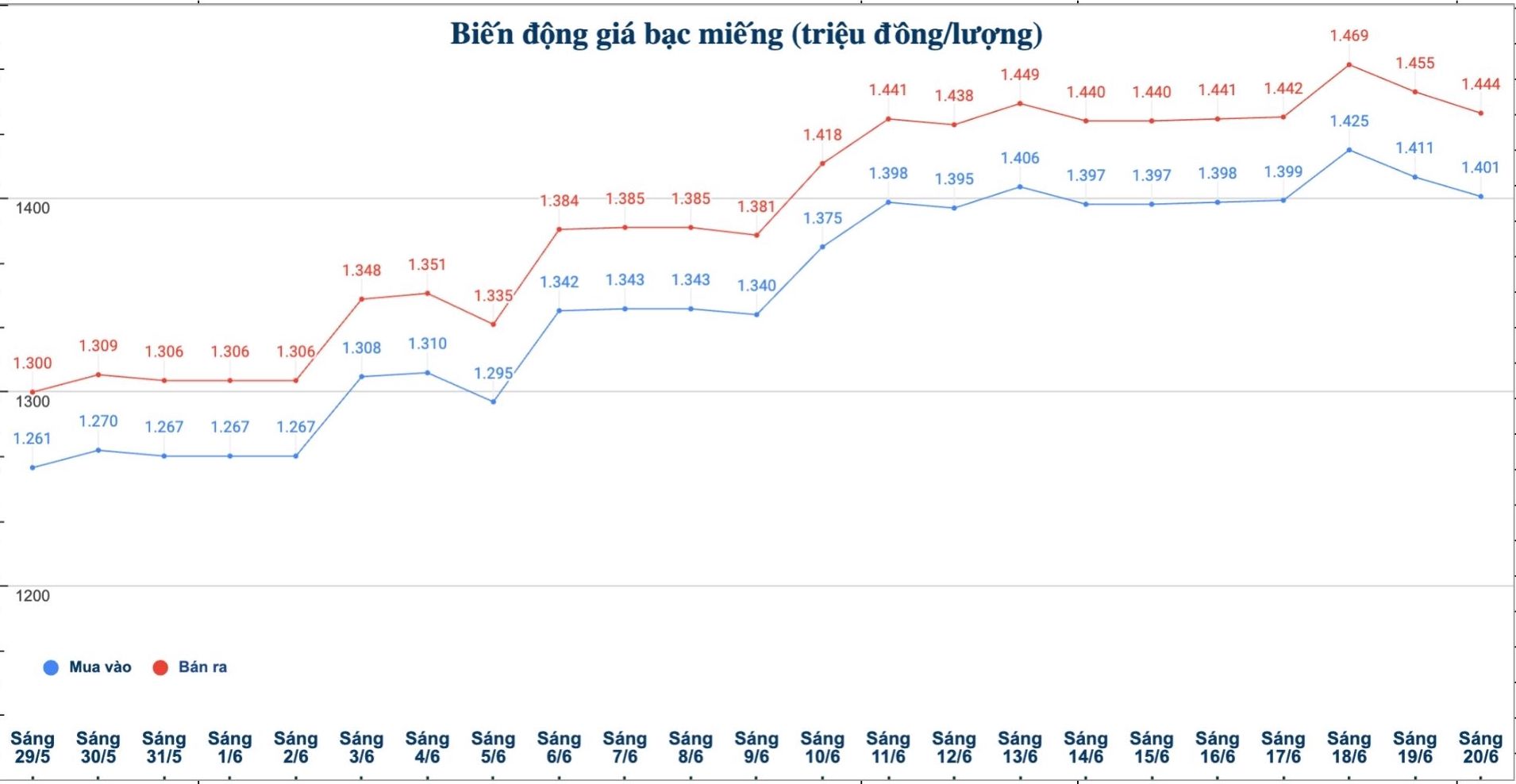

Domestic silver price

As of 9:40 a.m. on June 20, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.401 - 1.444 million/tael (buy - sell); down VND10,000/tael for buying and down VND11,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.401 - 1.444 million VND/tael (buy - sell); down 10,000 VND/tael for buying and down 11,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.359 - 38.506 million VND/kg (buy - sell); down 267,000 VND/kg for buying and down 293,000 VND/kg for selling compared to early this morning.

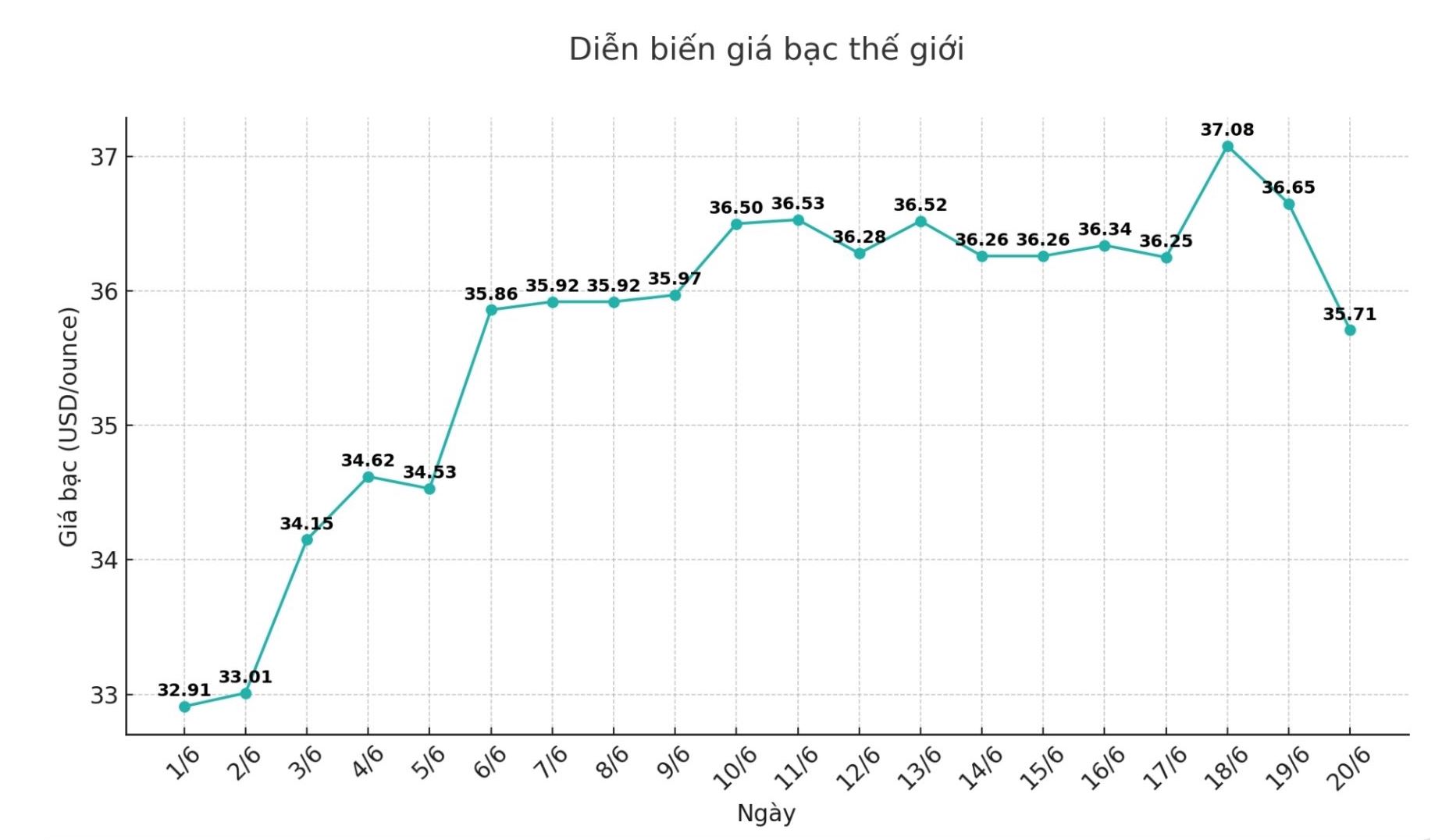

World silver price

On the world market, as of 9:45 a.m. on June 20 (Vietnam time), the world silver price was listed at 35.71 USD/ounce; down 0.94 USD compared to early this morning.

Causes and predictions

The silver market is under new pressure, falling sharply from its recent high as traders reacted to the latest policy stance of the US Federal Reserve (FED).

While both gold and silver have fallen following the Feds comments, silver is facing a stronger decline, said James Hyerczyk, a market analyst. The dual role of the metal as a monetary and industrial asset makes it particularly vulnerable to economic growth concerns.

James Hyerczyk said that about 60% of silver demand comes from industrial applications - making silver vulnerable as the Fed strengthens its anti-inflation stance with tight monetary conditions.

"Unlike gold, which attracts safe-haven cash flow during times of policy uncertainty, silver also shares the fear of increasing bond yields.

The latest recession appears to be due to profit-taking. As traders benefit from the recent rally in silver prices to an 11-year high begin taking profits amid a more hawkish macro economy, added James Hyerczyk.

Short-term pressure on silver could continue if the Fed keeps interest rates unchanged and economic data stable. However, if there are signs of decline, silver can recover quickly thanks to its volatility.

"Currently, traders should focus on key support levels and maintain flexibility - controlling the scale of positions and regulating transactions will be very important. Although the current Fed policy limits short-term gains, the long-term outlook for silver remains, especially in the context of continued monetary instability," said James Hyerczyk.

See more news related to silver prices HERE.