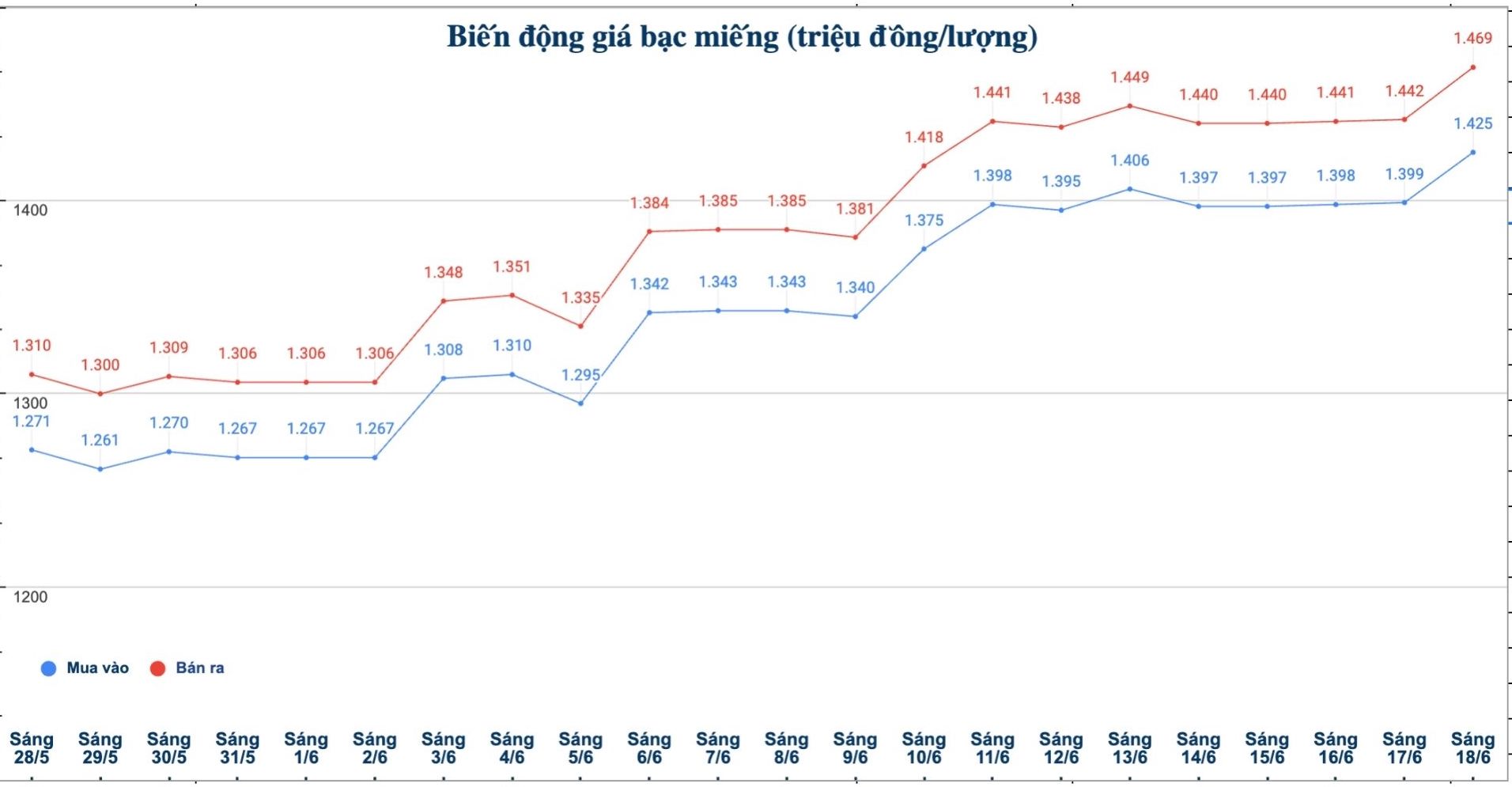

Domestic silver price

As of 9:20 a.m. on June 18, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.425 - 1.469 million VND/tael (buy - sell); an increase of 27,000 VND/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.425 - 1.469 million VND/tael (buy - sell); an increase of 27,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.999 - 39.173 million VND/kg (buy - sell); an increase of 693,000 VND/kg for buying and an increase of 720,000 VND/kg for selling compared to early this morning.

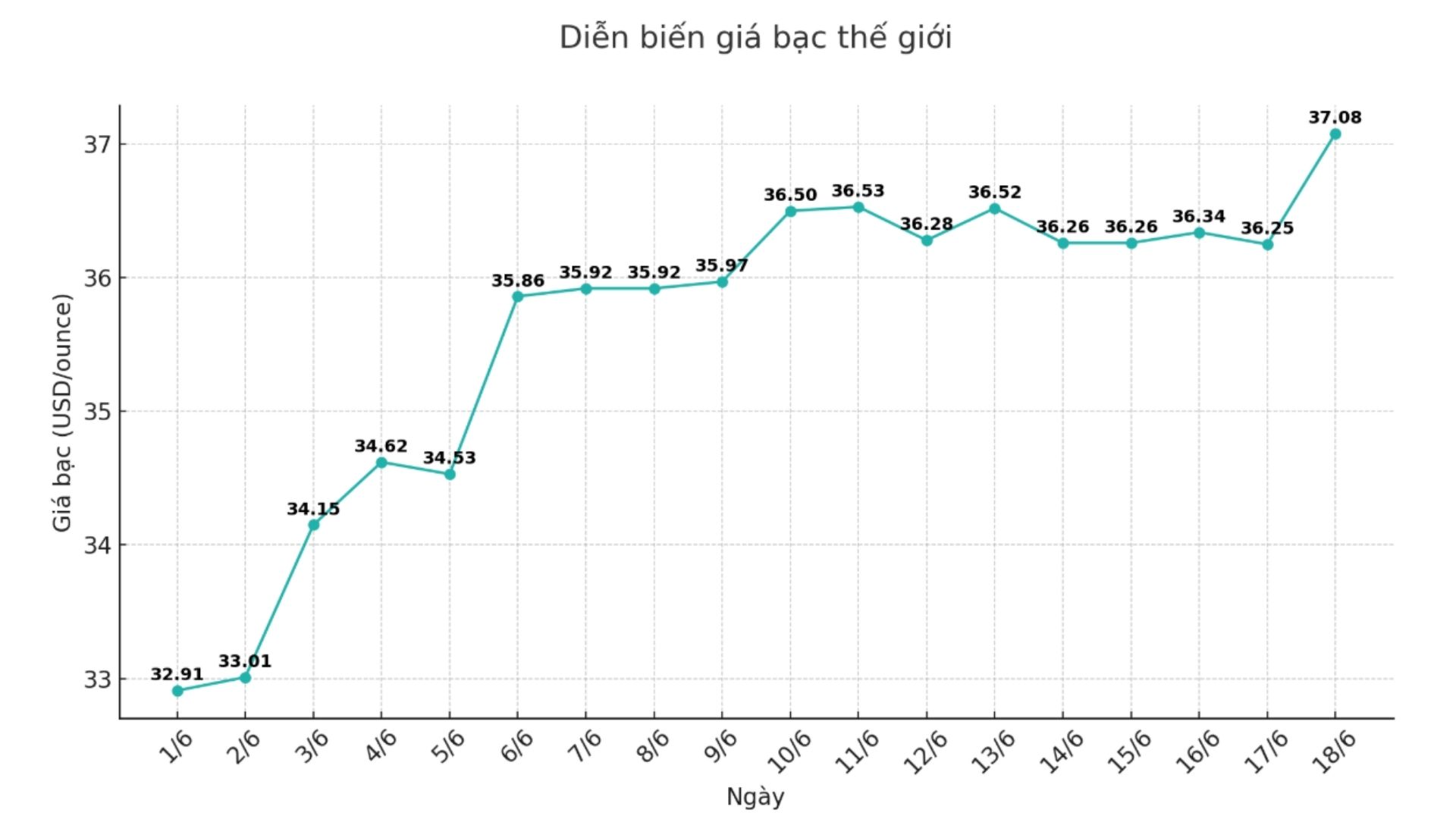

World silver price

On the world market, as of 9:15 a.m. on June 18 (Vietnam time), the world silver price was listed at 37.08 USD/ounce; up 0.83 USD compared to early this morning.

Causes and predictions

Silver prices are attracting attention on exchanges when they overcame the main resistance level at 36.89 USD/ounce, reaching the highest level in many years, with an increase of 23.3% over the same period last year.

"Cillary prices have surpassed $37 an ounce - marking their strongest increase in more than a decade, driven by steady physical demand, industrial sales and supporting technical factors" - James Hyerczyk - market analyst - commented.

Technically, James Hyerczyk said, silver continues to show its strength over all time frames. Traders are now aiming for their next target of $28.34 an ounce, before heading towards the psychological mark of $40.00 an ounce.

"The reason behind the increase in silver prices comes from the imbalance between supply and demand. Industrial manufacturing demand is forecast to increase by 3% by 2025, possibly exceeding 700 million ounces, setting a new record.

In 2024, demand will reach 680.5 million ounces, the highest level in four consecutive years. Although global supply is forecast to increase by 2% and general demand decreases by 1% this year, the supply deficit is still expected to reach 117.6 million ounces, marking the fifth consecutive year of shortages," he said.

The expert added that the gold- silver ratio is falling sharply, suggesting that silver may be in a period of "catching up" with gold. This ratio has recently dropped to a range of 92 - 94, indicating that silver may be entering a period of strong price increase.

"Silver also received support from favorable macro factors. The US Federal Reserve (FED) is expected to cut interest rates this year, further increasing the upward trend of silver prices" - James Hyerczyk assessed.

See more news related to silver prices HERE.