Domestic silver price

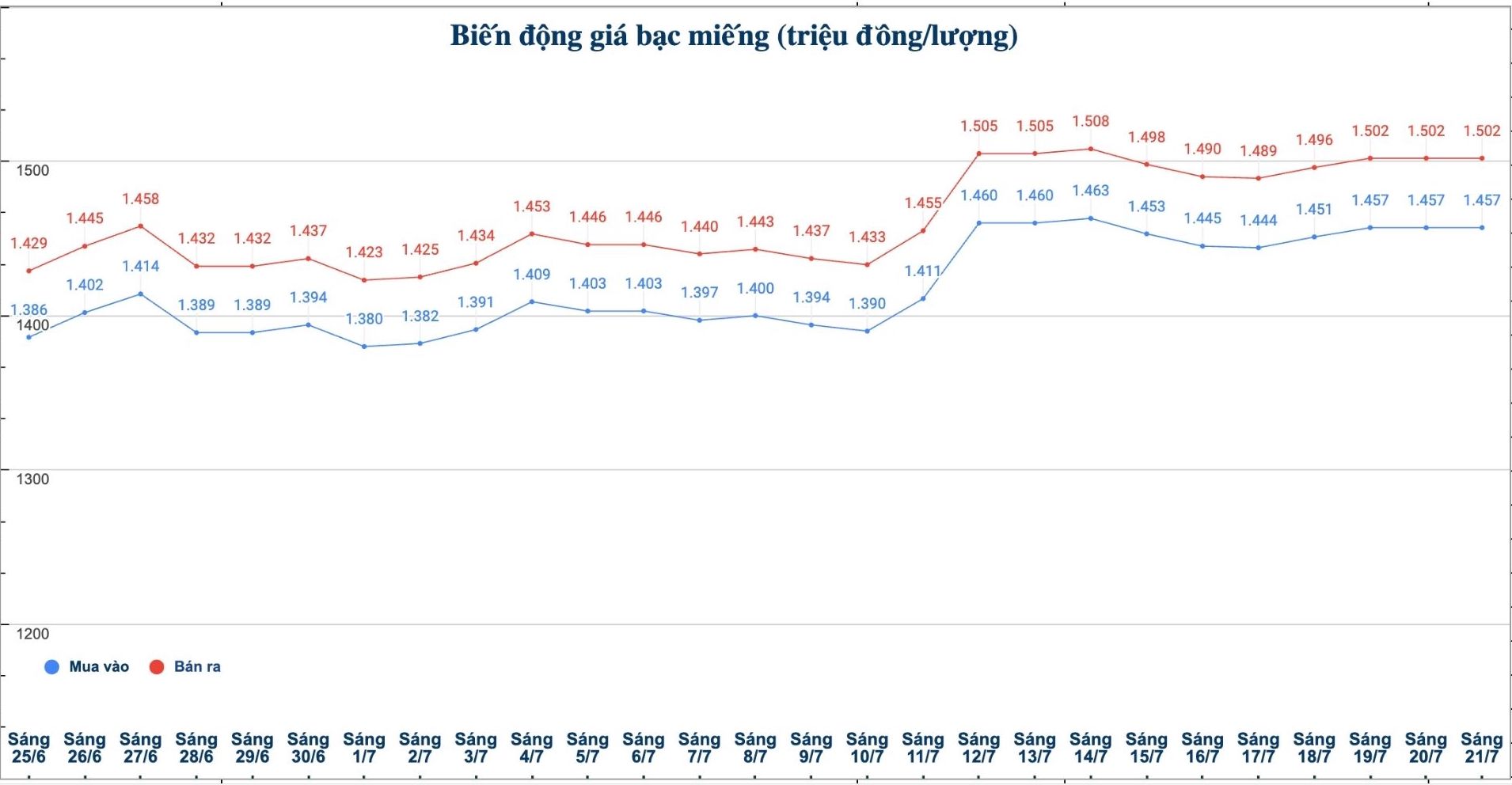

As of 9:40 a.m. on July 21, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.457 - 1.502 million/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.457 - 1.502 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 38.853 - 40.053 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

World silver price

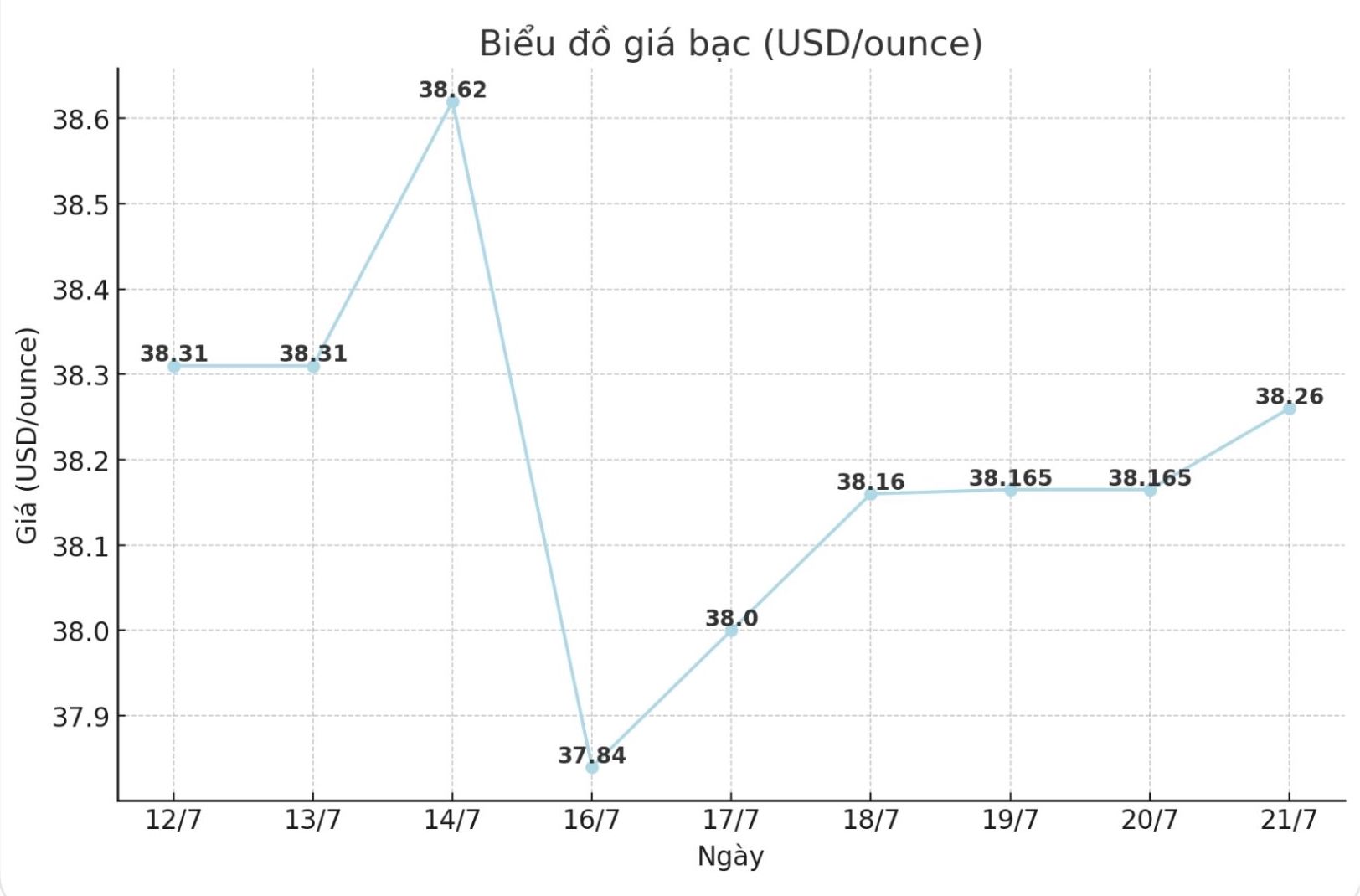

On the world market, as of 9:42 a.m. on July 21 (Vietnam time), the world silver price was listed at 38.165 USD/ounce; an increase of 0.095 USD compared to yesterday morning.

Causes and predictions

Despite profit-taking pressure, market analyst James Hyerczyk believes that silver still shows superior strength over gold - reflecting stable demand in the context of geopolitical instability and expectations of falling interest rates.

"Previously, the peak of 39.13 USD/ounce - the highest level since 2011 - showed that silver is being viewed as an important safe haven and industrial input asset.

Market sentiment remains strong amid mixed signals from the US Federal Reserve (FED) and global policy fluctuations," said James Hyerczyk.

The expert added that stable consumer and production prices have removed the main obstacle to the Fed cutting interest rates. Meanwhile, trade tensions with the EU, Russia and negotiations with Japan and Indonesia continue to increase demand for safe-haven assets.

James Hyerczyk commented that the outlook from now until the end of the third quarter is still positive. "Siliver is supported by monetary policy, industrial demand (soluble energy, electronics) and global uncertainty," he said.

Technically, the weekly price model shows signs of a short-term correction. The key support level is 37.20 USD/ounce - if it persists, prices could continue to fall. Conversely, if it breaks above 39.13 USD/ounce, the uptrend will be consolidated.

"If prices fall below 35.28 USD, the market can adjust deeply to the 31.98 USD area - which can attract long-term buying pressure" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...