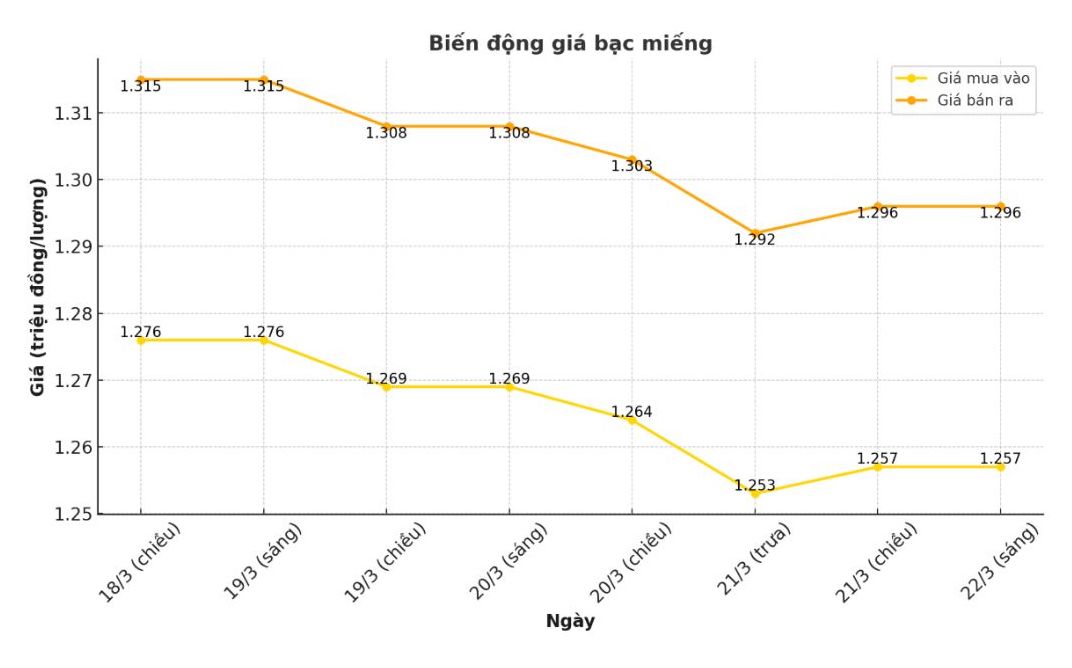

Domestic silver price

As of 8:50 a.m. on March 22, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1,257 - VND1,296 million/tael (buy - sell); an increase of VND4,000/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1,257 - 1,296 million VND/tael (buy - sell); an increase of 4,000 VND/tael for both buying and selling compared to early this morning.

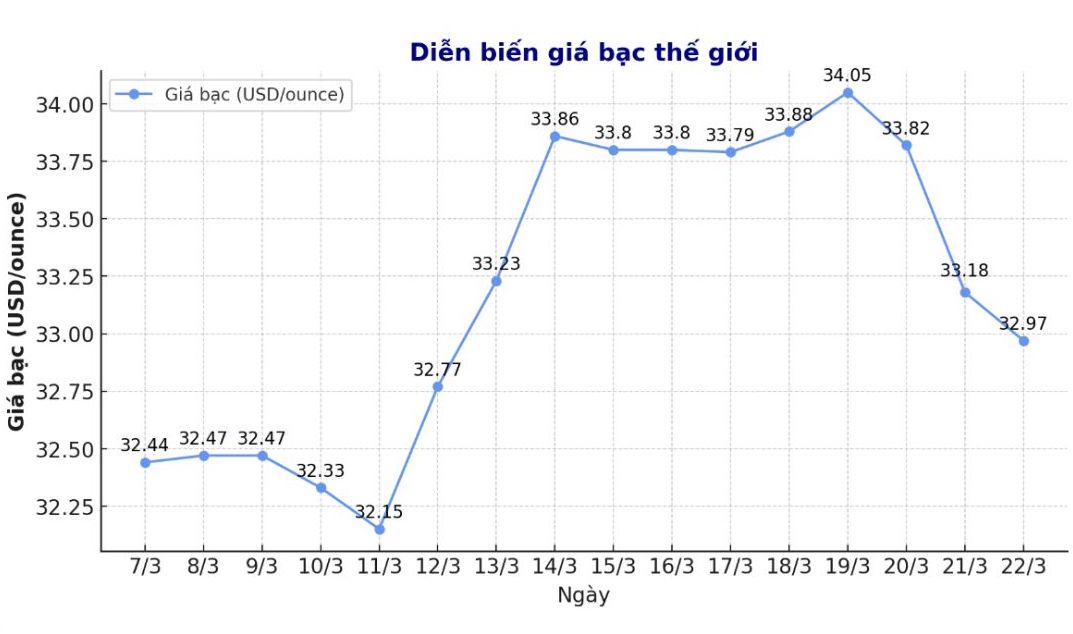

World silver price

On the world market, as of 9:00 a.m. on March 22 (Vietnam time), the world silver price listed on Goldprice.org was at 32.97 USD/ounce; down 1.3% compared to the previous trading session.

Causes and predictions

According to FXStreet, silver prices have fallen to a new low, nearly 33.00 USD/ounce in the last trading session. The price of this precious metal continued to decrease for three consecutive sessions as the USD continued to strengthen. This comes from expectations that the Federal Reserve (FED) will not cut interest rates in the near future.

The US Dollar Index (DXY), which tracks the value of the US dollar against six major currencies, has increased sharply to nearly 104.00 points.

The Fed said interest rates will not fall until it assesses the impact of US President Donald Trump's tariffs on economic growth and inflationary pressures. These signals appear after the central bank maintained loan interest rates in the range of 4.25% - 4.50% for the second consecutive time.

The scenario of the FED keeping interest rates high for a long time will not be favorable for assets such as silver.

However, concerns about US President Donald Trump imposing tariffs in April could curb the decline in silver prices. US President Donald Trump's tariff policies are expected to put pressure on global growth. Historically, increased global uncertainty will increase the attractiveness of safe-haven assets.

See more news related to silver prices HERE...