According to Kitco, gold prices continue to climb to unprecedented levels, surpassing the threshold of 3,000 USD/ounce, attracting the attention of investors. However, silver is also having an interesting development as it approaches the important resistance level, while a major bank has just raised its silver price forecast at the end of the year.

In the latest report on the precious metals market, Carsten Fritsch - commodity analyst at Commerzbank - said he raised his year-end silver price forecast to $35/ounce, higher than the previous $33/ounce.

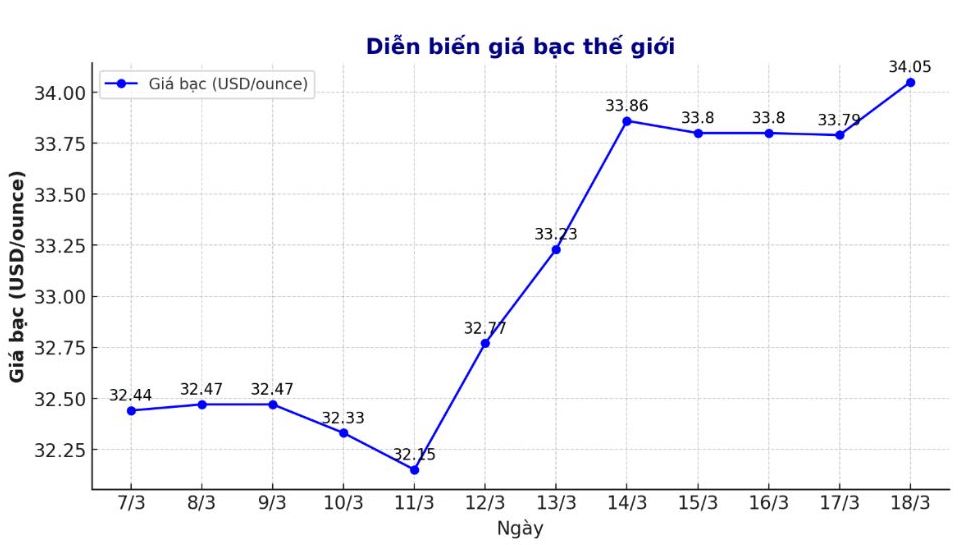

This positive outlook comes as silver prices have just reached a four-month high, surpassing the resistance level of $34/ounce. Despite a slight profit-taking after breaking above $34 an ounce, Carsten Fritsch believes that silver prices will soon remain stable above this threshold.

This price is only about $1 lower than the 12-year high set nearly a year ago. With gold's upward momentum, silver could soon hit that level again," he said.

Not only benefiting from the increase in gold, silver is also strongly supported by industrial demand. Fritsch stressed that the silver market has been plagued by supply shortages for the past four years as industrial demand has continuously hit record highs. He cited a report by the Silver Institute showing that this market is likely to continue to face serious supply shortages this year.

For gold, although gold prices are in a strong uptrend, Fritsch warned that the increase may be taking place too quickly. He pointed out that gold took less than five years to increase by $1,000 an ounce and hit a new peak. While it took up to 12 years to break above $2,000 an ounce before that, after hitting $1,000 an ounce in March 2008.

We expect gold prices to correct this year. This forecast is based on the assumption that the FED may cut interest rates less than what the market is expecting.

In addition, record high gold prices could cause a decline in physical demand, as reflected in data from China and India," said Carsten Fritsch, commodity analyst.

However, Fritsch said there is still a risk that gold prices could continue to rise in the short term, especially as ETFs and speculators return to the market. If the Fed decides to cut interest rates more aggressively, despite the risk of increasing inflation, gold prices may continue to rise, he added.

As of 10:30 a.m. on March 19 (Vietnam time), the world silver price listed on Goldprice.org was at 34.05 USD/ounce.

See more news related to silver prices HERE...