Domestic silver price

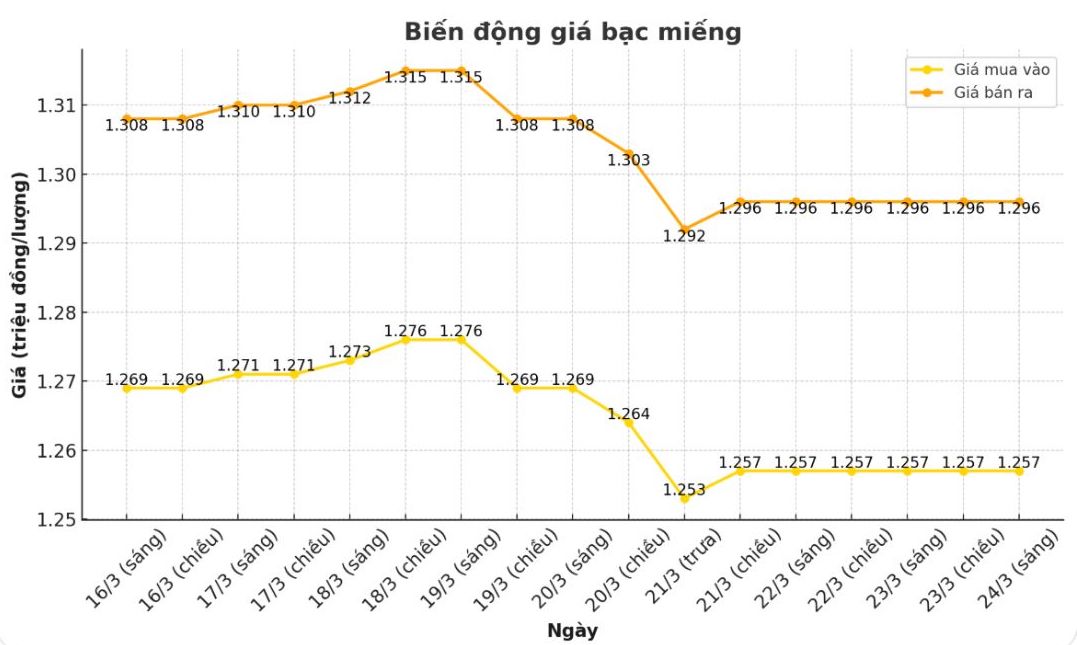

As of 9:50 a.m. on March 24, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1,257 - 1,296 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1,257 - 1,296 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

World silver price

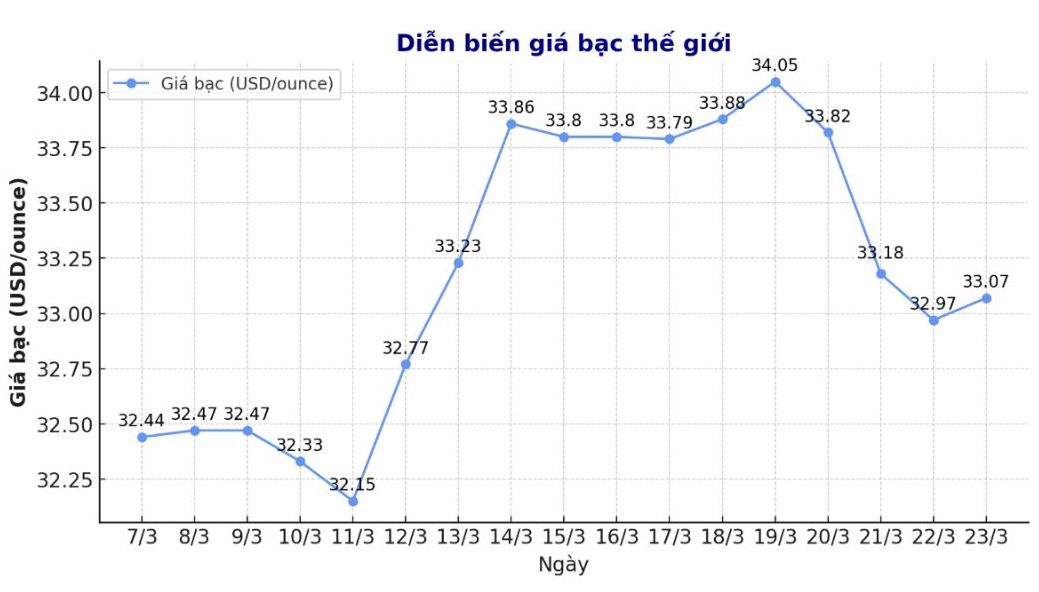

On the world market, as of 10:00 a.m. on March 24 (Vietnam time), the world silver price listed on Goldprice.org was at 32.09 USD/ounce; up 0.28% compared to the previous trading session.

Causes and predictions

Silver prices have increased slightly in the recent trading session. However, according to FXStreet, uncertainty about demand from China could reduce the likelihood of silver price increases. China is the largest consumer of industrial silver, but weak consumption and ineffective stimulus policies are putting pressure on the short-term outlook.

In addition, geopolitical tensions and US tariff issues have also raised concerns about material demand. Although the general trend still exists, short-term factors may cause silver prices to decrease if the US Federal Reserve (FED) maintains a cautious policy and the USD continues to increase.

Conversely, if China changes policy or demand increases sharply, silver prices may stabilize. However, during this time, silver may face sell-off due to macro factors, with traders closely monitoring the Fed's comments, inflation data and signals on physical demand.

Economic data to watch this week:

Monday: US manufacturing and services PMI (S&P Global).

Tuesday: American consumer confidence, new home sales in the US.

Wednesday: Orders for durable US goods.

Thursday: Waiting for home sales, US Q4 GDP.

Friday: US core PCE, US personal income and expenses.

See more news related to silver prices HERE...