Domestic silver price

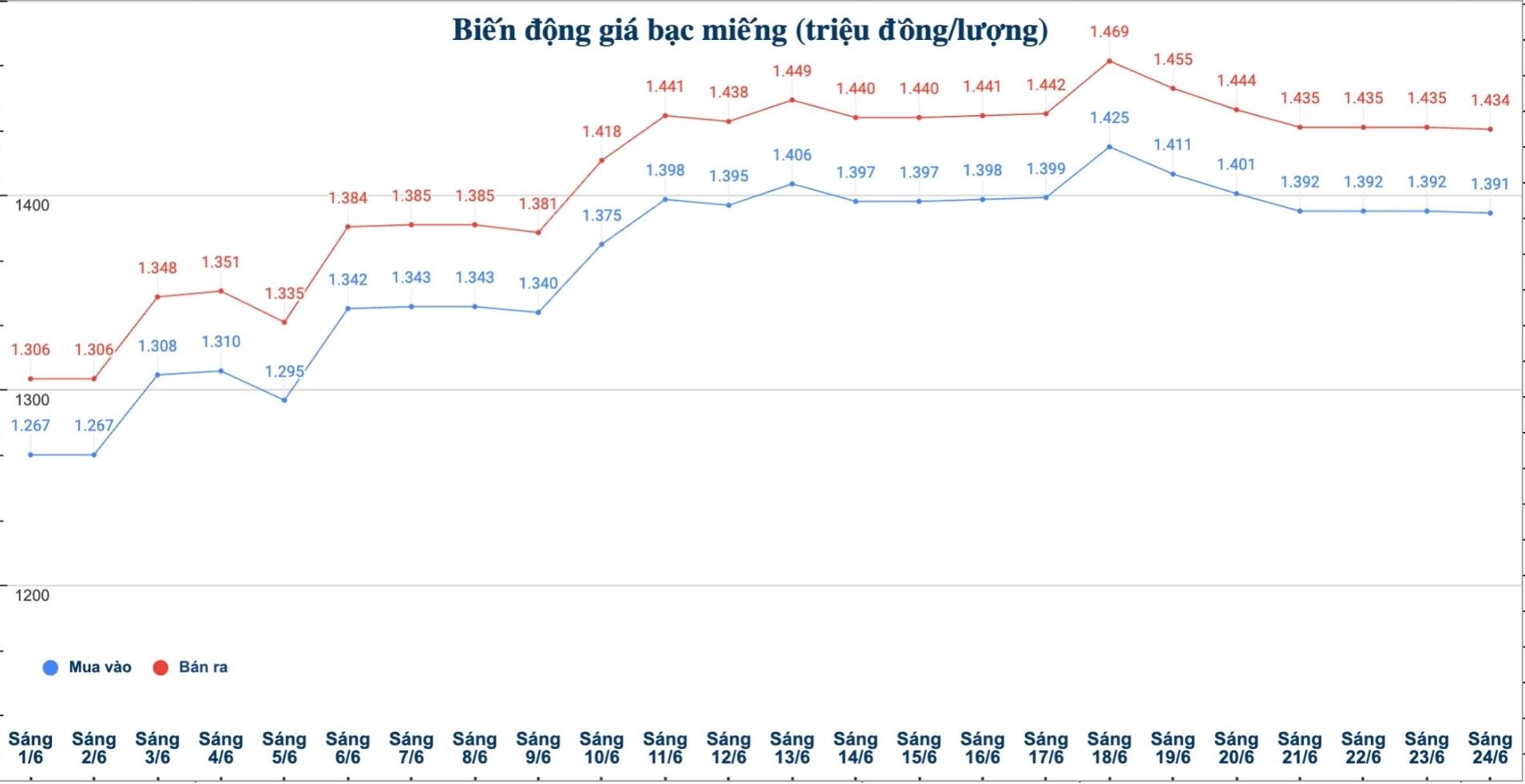

As of 9:45 a.m. on June 24, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.391 - 1.434 million/tael (buy - sell); down VND1,000/tael for both buying and selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.391 - 1.434 million VND/tael (buy - sell); down 1,000 VND/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.093 - 38.239 million VND/kg (buy - sell); down 26,000 VND/kg for buying and down 27,000 VND/kg for selling compared to early this morning.

World silver price

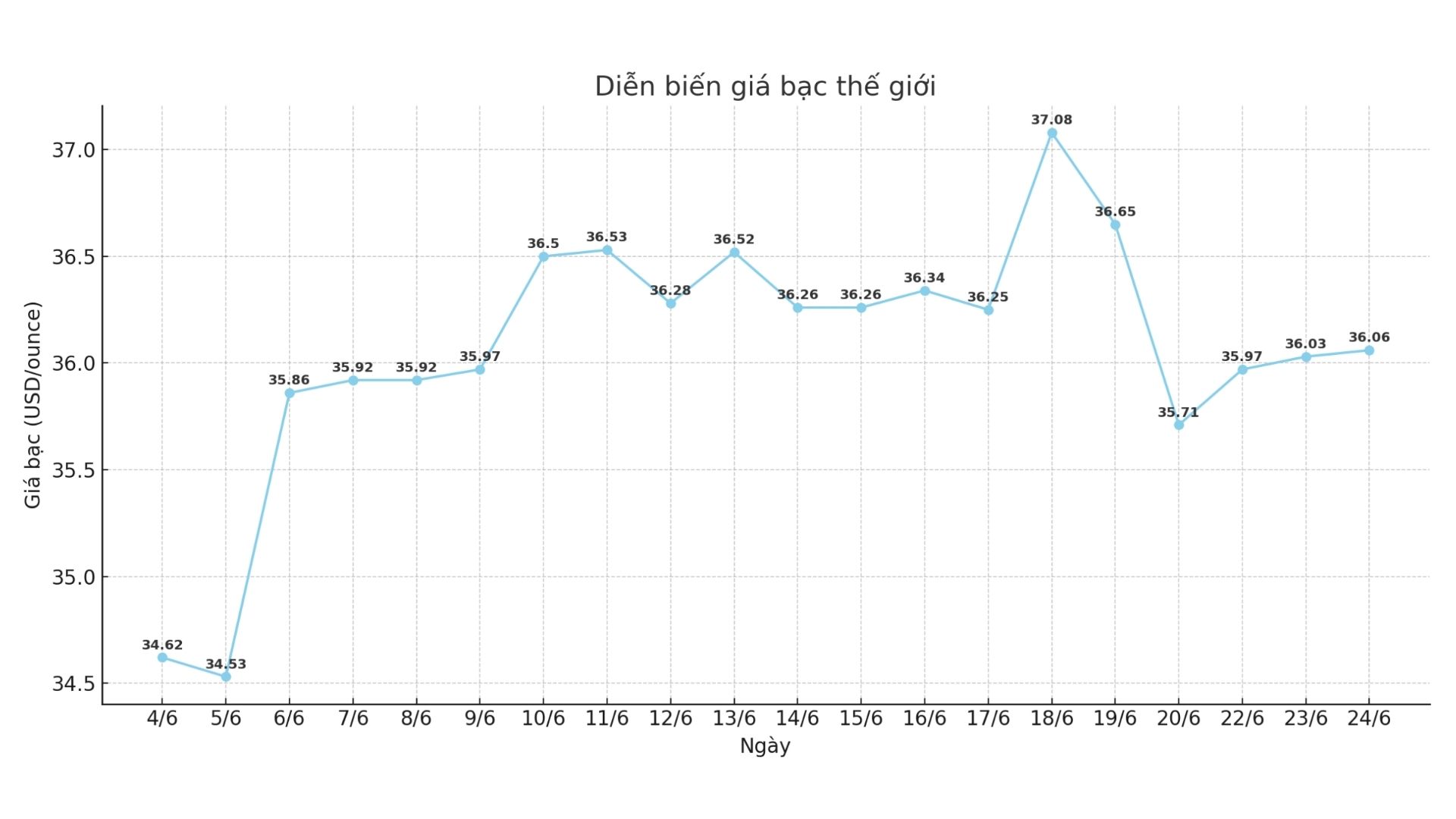

On the world market, as of 9:45 a.m. on June 24 (Vietnam time), the world silver price was listed at 36.06 USD/ounce; up 0.03 USD compared to yesterday morning.

Causes and predictions

The silver market is currently being affected by many supporting factors: continued tightening supply, record high industrial demand and dovish policies from the US Federal Reserve (FED) have helped silver prices maintain their upward momentum, despite facing resistance around 35 - 37 USD/ounce.

"Unbalanced supply and demand are still the main driver for silver prices," said James Hyerczyk, a market analyst. The Silver Institute predicts that the market will be short for the fifth consecutive year in 2025, with mining output falling to 835 million ounces, down 7.23% from 2016. Although the amount of recycled silver has increased to 195 million ounces, this increase still cannot offset the demand of nearly 1.2 billion ounces per year".

According to him, industrial demand continues to explode, especially from solar power projects and automobile electrification, AI, high-performance computing, making silver an important raw material beyond traditional investment roles. Despite some hurdles in the US, global demand is still expanding.

"In addition, the dovish signals from the Fed about interest rate cuts make silver more attractive due to low holding opportunity costs, combined with a weak USD and inflation concerns that help the metal increase in value as a safe haven channel," the expert said.

Technically, James Hyerczyk believes that silver prices are fluctuating and stabilizing around 35.40 - 36.39 USD/ounce.

"If silver breaks above 36.39 USD/ounce, the rally could extend to 37.32 USD/ounce and beyond. With limited supply, strong demand and supportive policies, silver is assessed to still have room to move towards the mark of 40 USD/ounce in the coming time" - James Hyerczyk assessed.

See more news related to silver prices HERE.