Domestic silver price

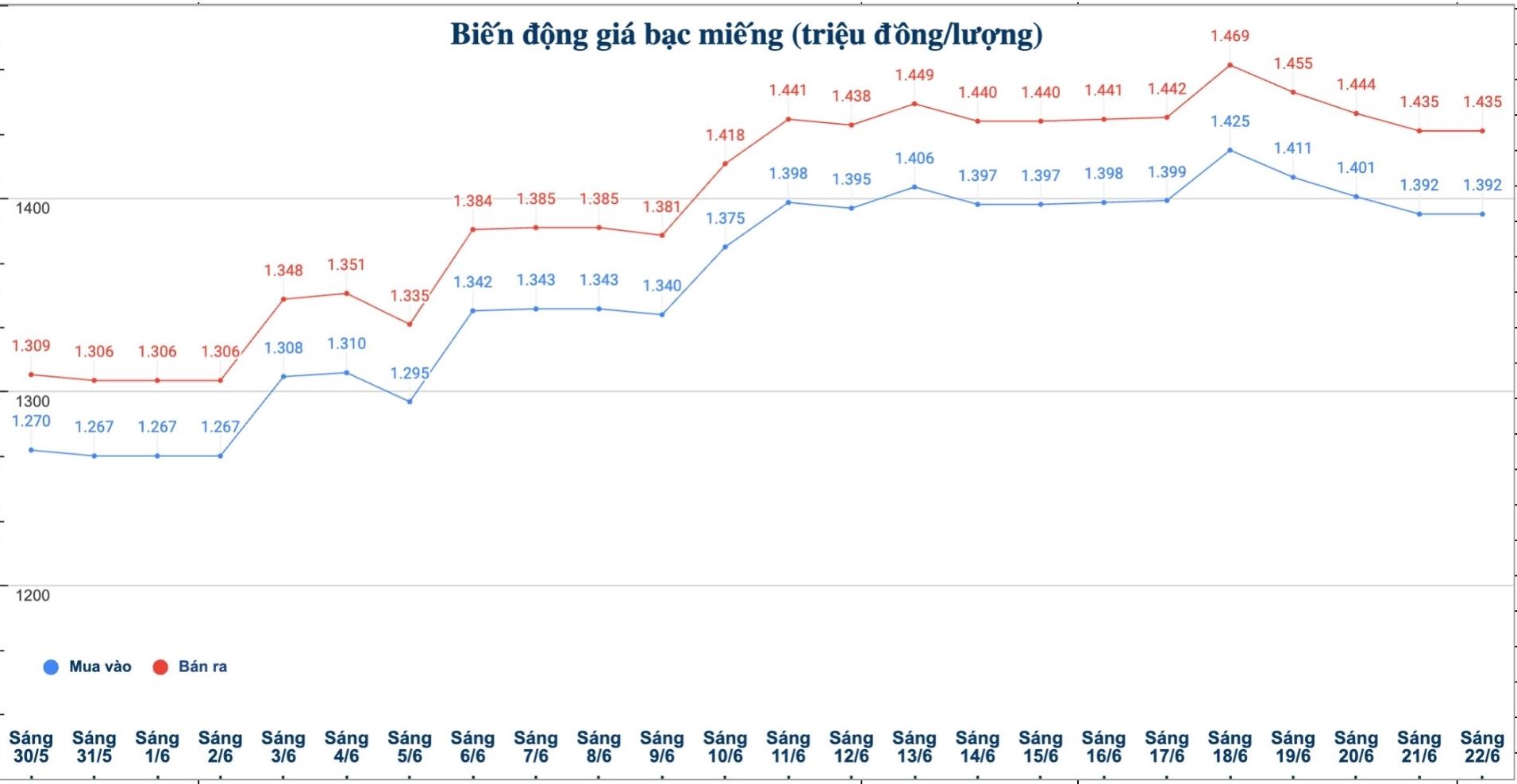

As of 9:05 a.m. on June 22, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.392 - 1.435 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.392 - 1.435 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.119 - 38.266 million VND/kg (buy - sell); unchanged in both buying and selling directions compared to early this morning.

In the trading session last week (morning of June 15, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 37.253 - 38.399 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on June 15 and selling it this morning (6, 22), buyers will lose up to 1.280 million VND/kg.

World silver price

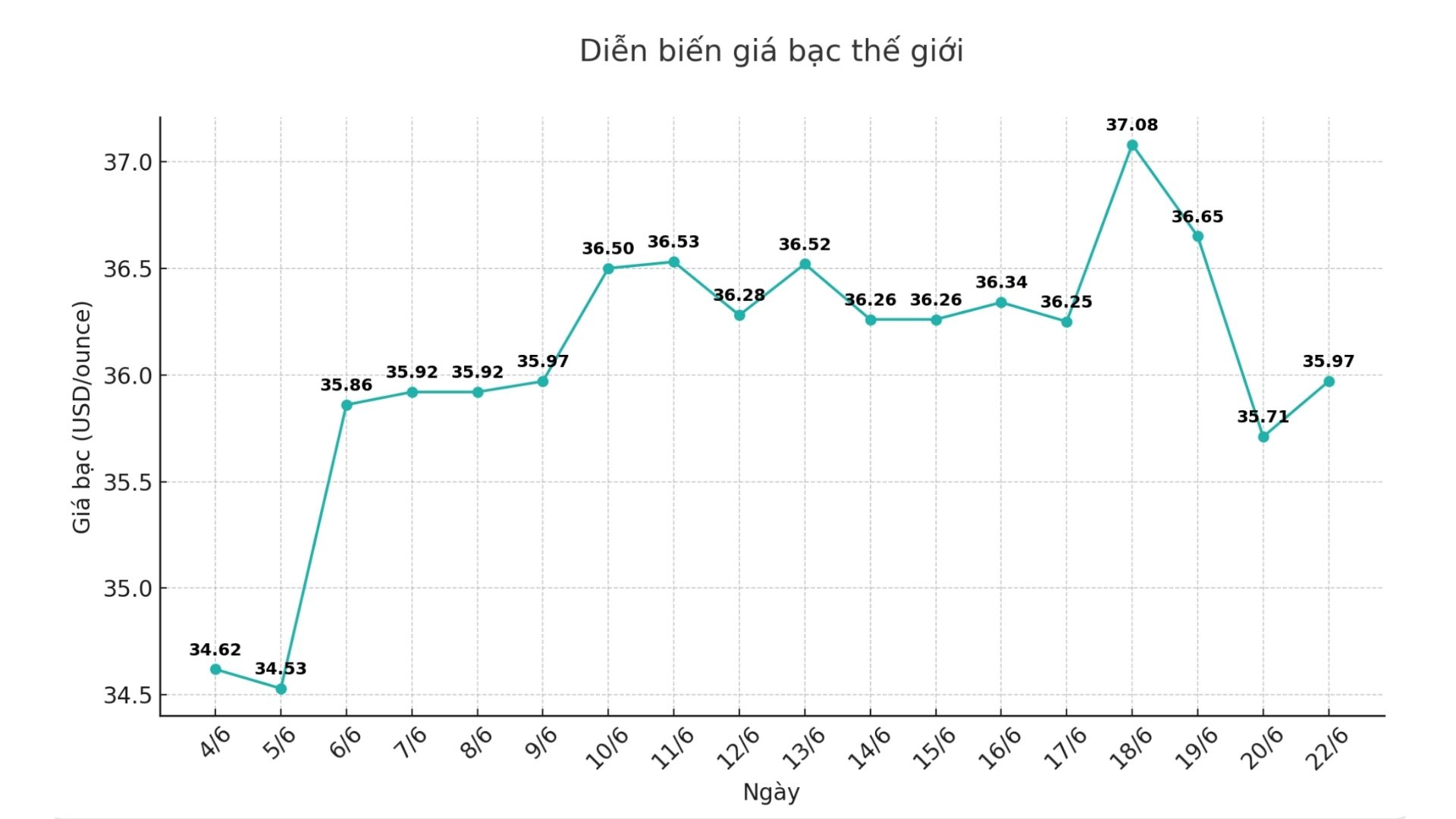

On the world market, as of 9:10 a.m. on June 22 (Vietnam time), the world silver price was listed at 35.97 USD/ounce.

Causes and predictions

The precious metals market has experienced many significant fluctuations, as both gold and silver are under downward pressure as investors have adjusted their views after information from the policy meeting of the US Federal Reserve (FED).

Gary Wagner - technical market analyst - commented: "The FED's message has prompted part of investors to take profits with precious metals positions, but the decline is not too strong, showing that core demand is still strong. Traders seem to be only adjusting expectations about monetary policy, not giving up a positive view on the precious metal."

He added that the precious metal picture is further complicated partly due to escalating geopolitical tensions in the Middle East.

"The diplomatic deadlock has increased the risk of a conflict spreading, keeping safe-haven demand for precious metals high," Gary Wagner said.

According to the expert, persistent geopolitical risks suggest that any decline in gold and silver prices may be temporary, as investors often look to precious metals as global instability increases.

"The combination of monetary policy factors and geopolitical risks will create a complex context for precious metal prices in the coming weeks," Gary Wagner said.

See more news related to silver prices HERE.