Domestic silver price

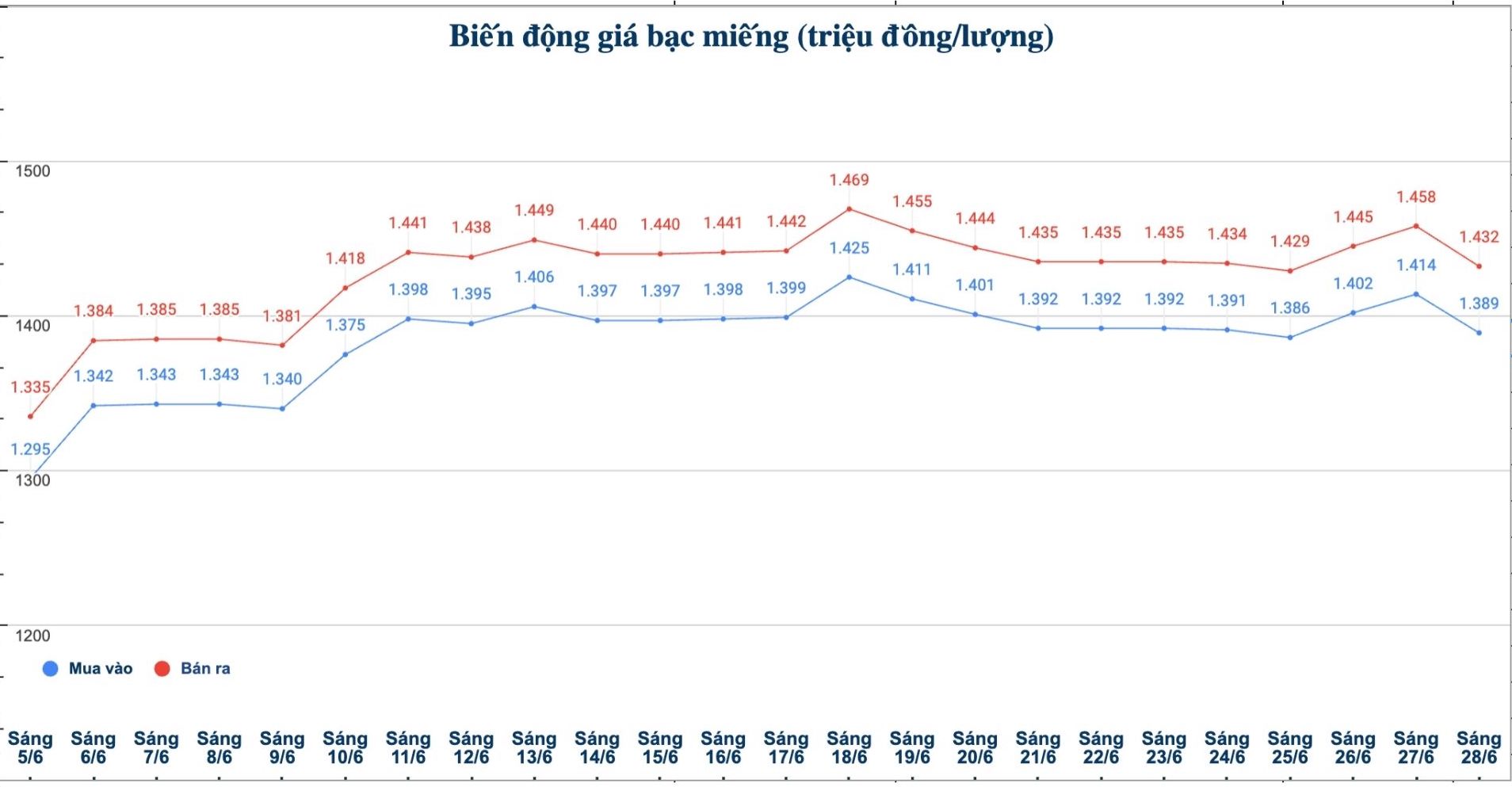

As of 9:20 a.m. on June 28, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.389 - 1.432 million/tael (buy - sell); down VND25,000/tael for buying and down VND26,000/tael for selling compared to early this morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.389 - 1.432 million VND/tael (buy - sell); down 25,000 VND/tael for buying and down 26,000 VND/tael for selling compared to early this morning.

At the same time, the price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37,039 - 38,186 million VND/kg (buy - sell); down 667,000 VND/kg for buying and down 693,000 VND/kg for selling compared to early this morning.

World silver price

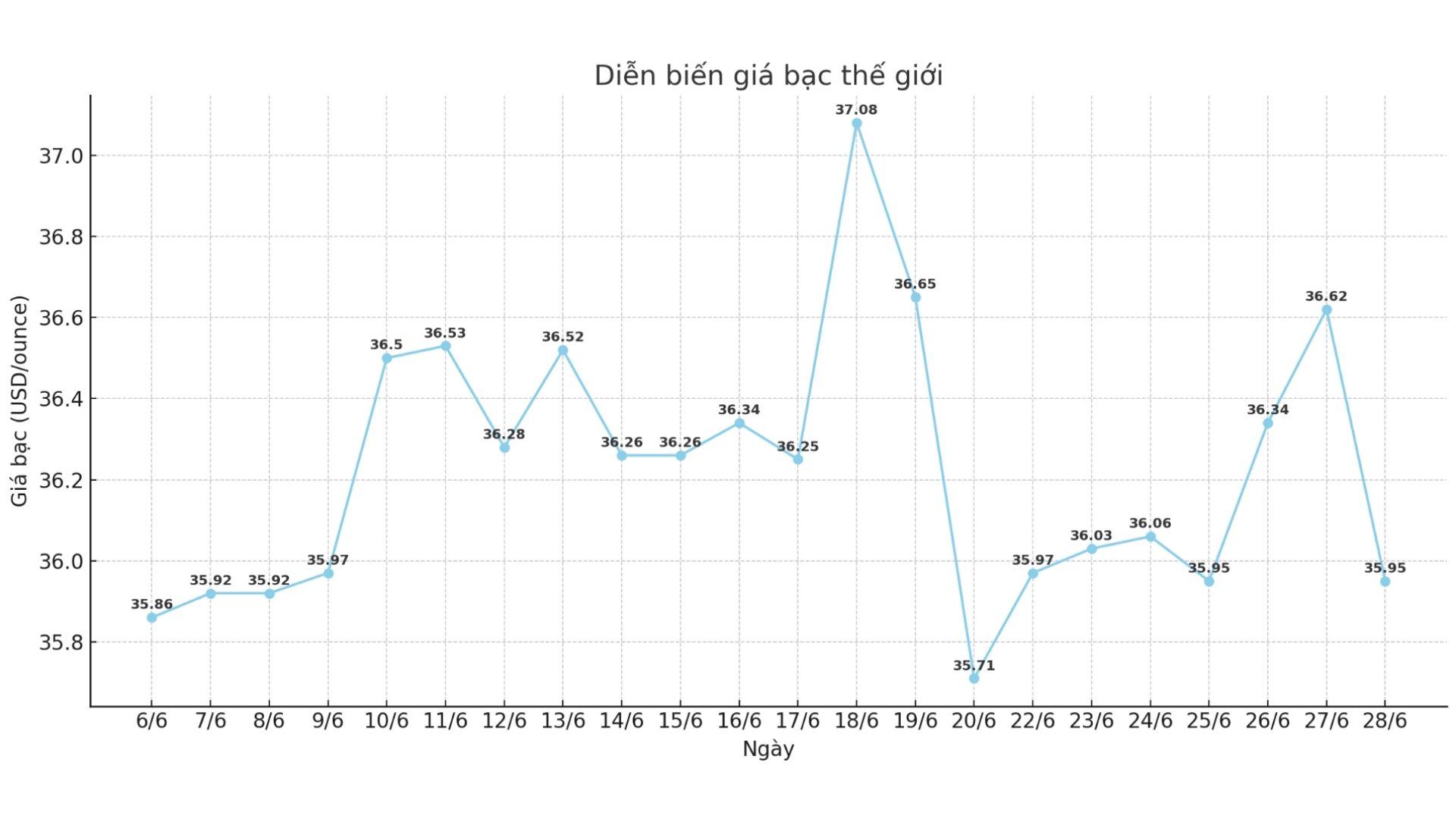

On the world market, as of 9:25 a.m. on June 28 (Vietnam time), the world silver price was listed at 35.95 USD/ounce; down 0.67 USD compared to yesterday morning.

Causes and predictions

Silver suddenly plummeted, falling below the threshold of 36.30 USD/ounce. This decline reflects a clear sign of weakness, as the market is affected by a strong wave of adjustments after the US core PCE data exceeded forecasts.

Accordingly, the PCE price index - a favorite inflation measure of the US Federal Reserve (FED) - increased, causing the USD and bond yields to rise together, increasing pressure on silver.

Treasury yields increased after the release of PCE data, a stronger US dollar, which put more pressure on non-yielding assets like silver, said James Hyerczyk, a market analyst.

He added that the higher PCE index has reduced the prospect of the Fed cutting interest rates soon, strengthening the view of maintaining a tight monetary policy that traders must consider when positioning.

"In addition, gold prices fell below the important support level, adding to the pressure on silver" - James Hyerczyk said.

The expert said that gold prices have fallen below the threshold of 3,323.80 USD/ounce, highlighting the loss of safe-haven cash flow - which indirectly supports silver during times of geopolitical tensions.

"Gold prices have now fallen more than 2% for the week and the slide from their record high in April has further weakened the psychology of metal trading, further weakening silver as traders escape overbought positions," he said.

In the short term, James Hyerczyk emphasized that the trend is leaning towards depreciation, with many upcoming risks.

"Traders should monitor upcoming data and the Fed's comments, consider selling when prices recover to the 36.30 - 36.84 USD/ounce range.

At the same time, it is necessary to closely monitor the important support levels at 35.28 USD/ounce and 34.10 USD/ounce to identify signs of increased selling pressure. In the context of high interest rates and declining safe-haven demand, silver will need a strong enough catalyst to restore price increase" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...