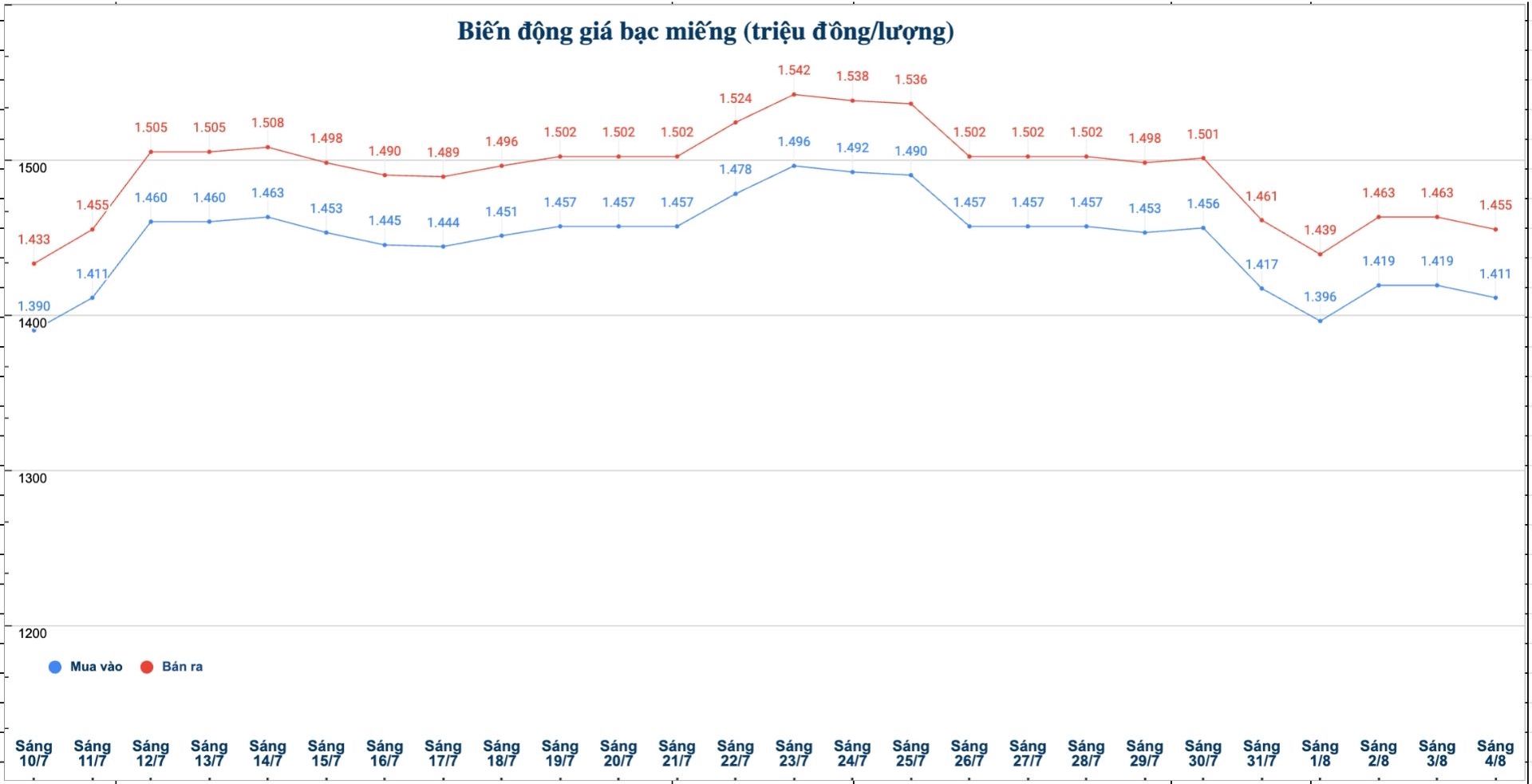

Domestic silver price

As of 10:00 on August 4, the price of 999 silver bars at Ancrat Silver Joint Stock Company was listed at 1.395 - 1.430 million VND/tael (buy - sell); down 13,000 VND/tael for both buying and selling compared to yesterday morning.

The price of silver bars in 2025 Ancarat 999 (1kg) Ancrat Silver Joint Stock Company was listed at 36.595 - 37.585 million VND/kg (buy - sell); down 355,000 VND/tael for both buying and selling compared to yesterday morning.

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.411 - 1.455 million VND/tael (buy - sell); down 8,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.411 - 1.455 million VND/tael (buy - sell); down 8,000 VND/tael for both buying and selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 37.626 - 38.799 million VND/kg (buy - sell); down 213,000 VND/kg for buying and down 214,000 VND/kg for selling compared to yesterday morning.

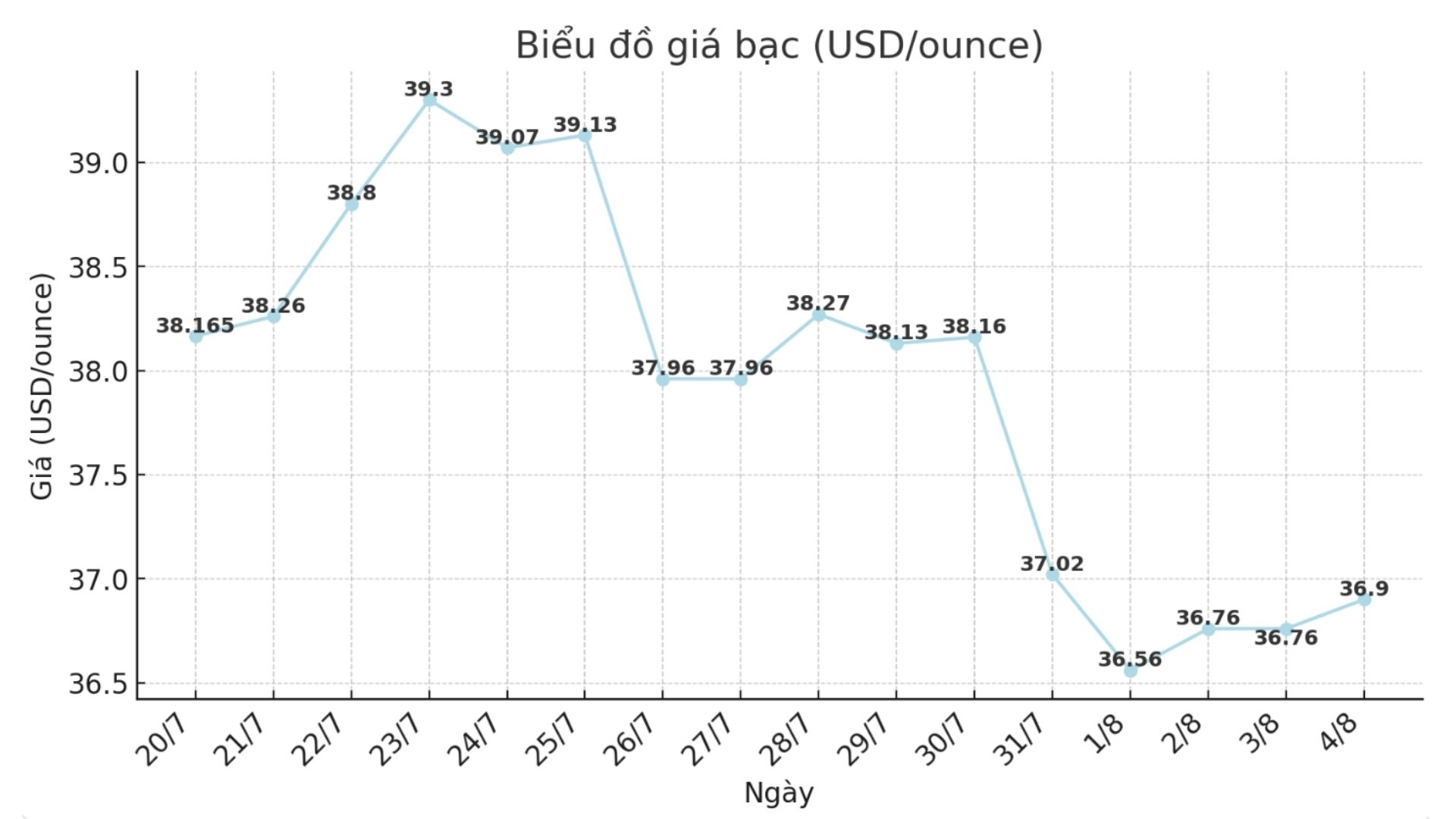

World silver price

On the world market, as of 10:00 a.m. on August 4 (Vietnam time), the world silver price was listed at 36.9 USD/ounce; up 0.14 USD compared to yesterday morning.

Causes and predictions

Gold prices increased thanks to weak US employment data, raising expectations for the possibility of interest rate cuts. Meanwhile, silver prices have not benefited accordingly, showing that the market is paying more and more attention to the demand for silver in industry - a field that is very vulnerable to the current trade situation.

The cooling of silver prices reflects growing concerns about global industrial demand, said market analyst James Hyerczyk. The US imposition of new tariffs - 15% on goods from Korea and 50% on imports from Brazil - is adding pressure on the manufacturing supply chain.

However, China is the key factor. Weak production output and a disappointing PMI from Beijing are worrying the silver traders, as China plays a key role in global industrial metal consumption."

He said that although silver often fluctuates in the same direction as gold in major currency events, the recent detachment of silver prices from this trend clearly reflects the pressure from the economic downturn.

"The metal remains stuck in a narrow trading range, lacking the appeal of a safe-haven asset - a factor that has driven gold prices to skyrocket. In addition, high US government bond yields and trade risks are also holding back the silver recovery momentum," said James Hyerczyk.

Economic data to watch this week

Tuesday: ISM Service PMI

Wednesday: 10-year US Treasury bond auction

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

See more news related to silver prices HERE...