Domestic silver price

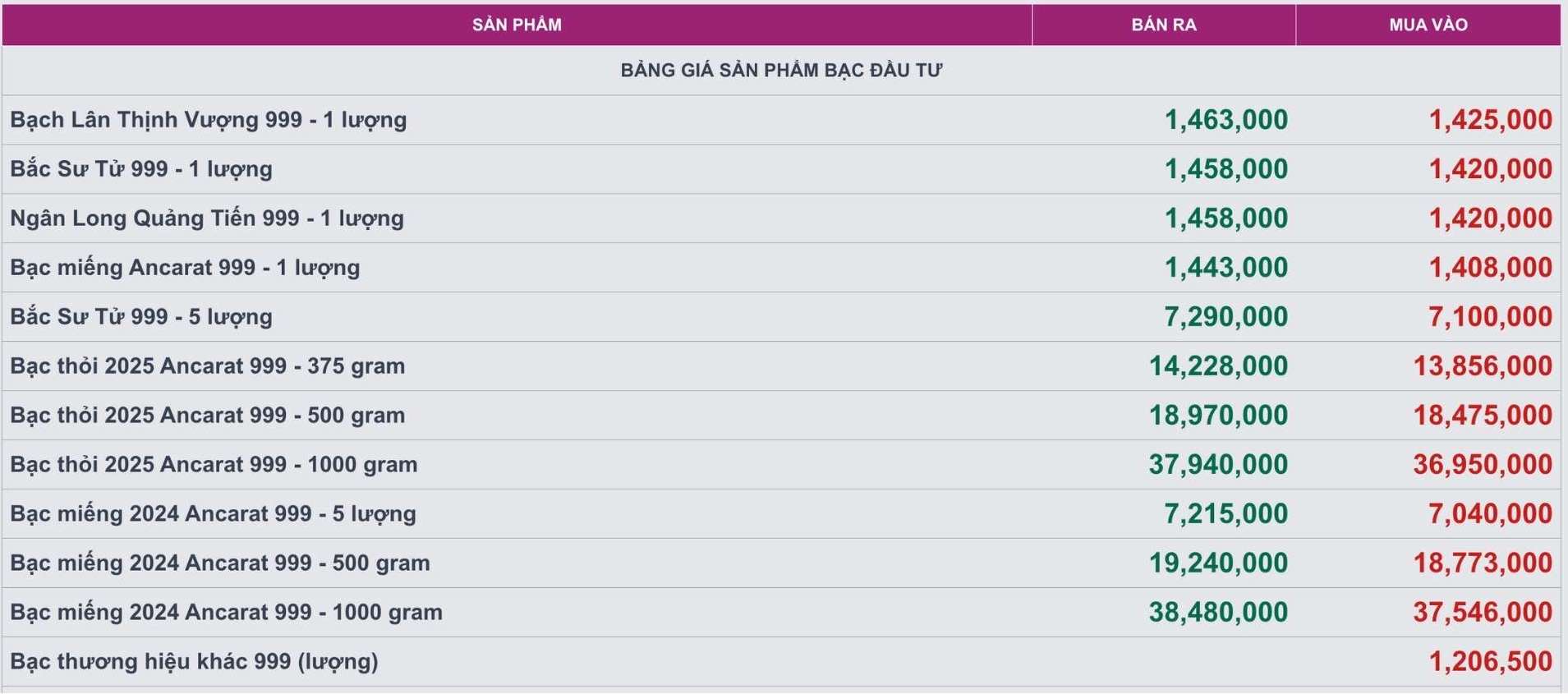

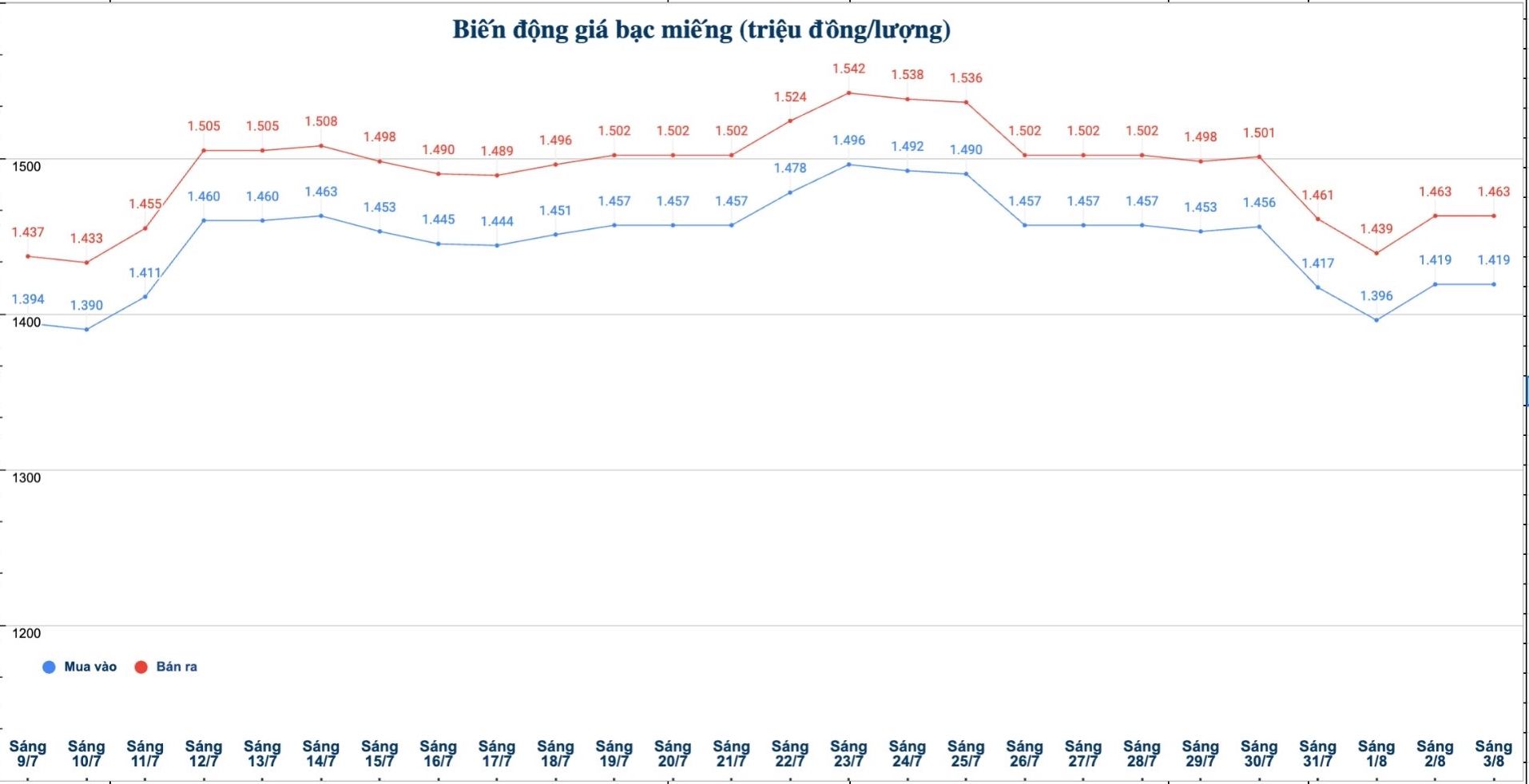

As of 9:50 a.m. on August 3, the price of 999 silver bars at Ancrat Silver JSC was listed at VND1.408 - 1.443 million/tael (buy - sell); both buying and selling prices remained unchanged compared to yesterday morning.

The price of silver bars in 2025 Ancarat 999 (1kg) Ancrat Silver Joint Stock Company was listed at 36,950 - 37.940 million VND/kg (buy - sell); both buying and selling prices remained unchanged compared to yesterday morning.

At the same time, the price of 999 silver bars at Phu Quy Jewelry Group was listed at 1.419 - 1.463 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to yesterday morning.

The price of 999 gold bars at Phu Quy Jewelry Group was listed at 1.419 - 1.463 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 37.839 - 39.013 million VND/kg (buy - sell); both buying and selling prices remained unchanged compared to yesterday morning.

In the trading session last week (morning of July 27, 2025), the price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 38.853 - 40.053 million VND/kg (buy - sell).

Thus, if buying 999 taels of silver (1kg) at Phu Quy Jewelry Group on July 27 and selling it this morning (8/ 3), buyers will lose 2.214 million VND/kg.

World silver price

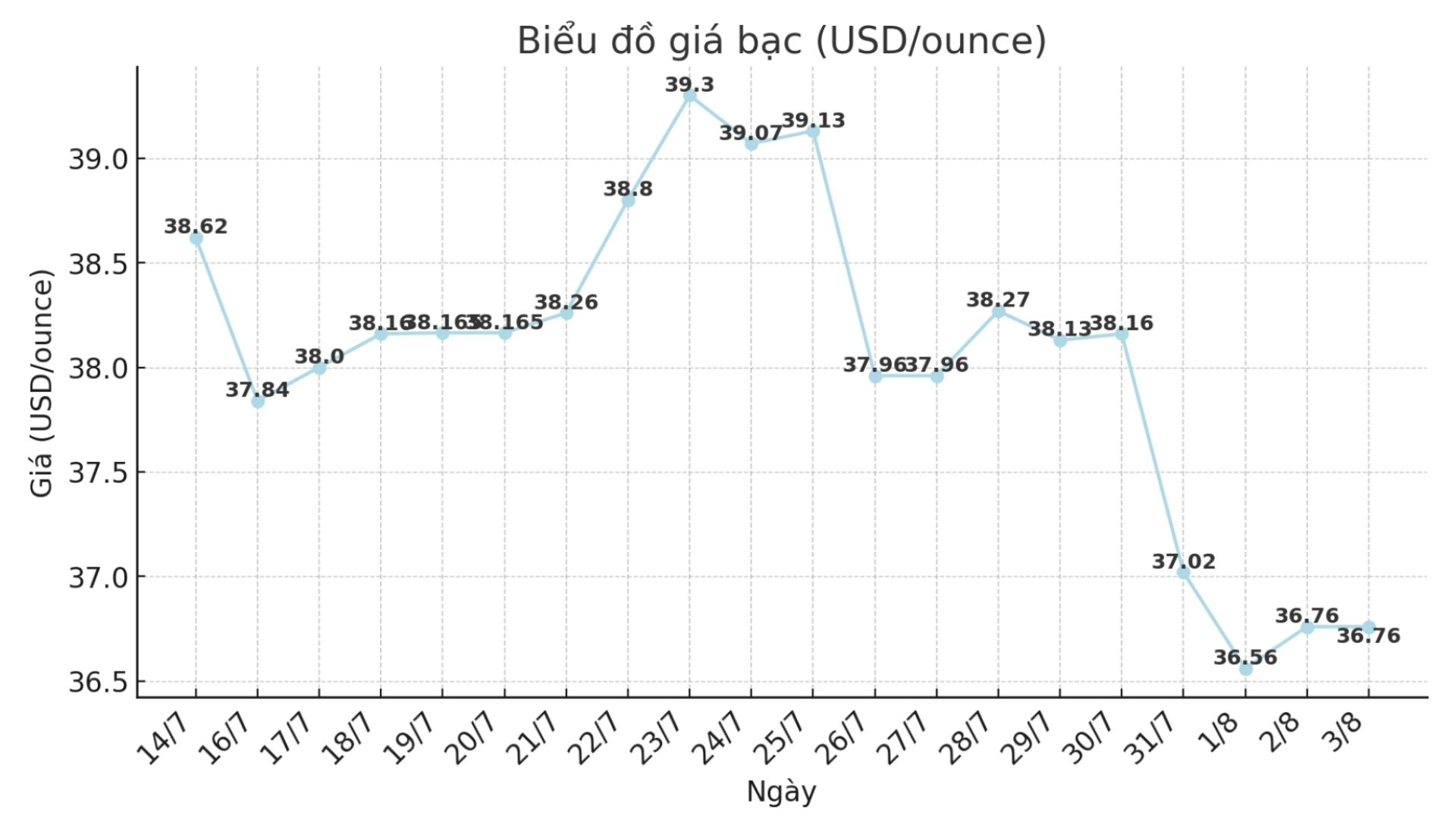

On the world market, as of 10:00 a.m. on August 3 (Vietnam time), the world silver price was listed at 36.76 USD/ounce; unchanged from yesterday morning.

Causes and predictions

Despite a tense start to the week, silver has regained its recovery momentum towards the end of the week, ending the trading week with a more positive signal.

This came after the US non-farm payrolls report was released, showing the economy created just 73,000 new jobs in the month - much lower than expected at 106,000.

According to senior market analyst Christopher Lewis, this disappointing data has put pressure on the US dollar (USD) and become a catalyst for the recovery of silver prices in the short term.

"Technically, if silver falls below $36 an ounce, it will be a negative signal. Because as the US labor market weakens, industrial demand for silver - which is widely used in production - could also decline," Christopher Lewis analyzed.

However, if the price breaks above the 37.50 USD/ounce mark, Christopher Lewis believes that it will be a very positive signal, showing the possibility of silver continuing to increase strongly.

"However, the market still needs more time to confirm a clearer trend," said Christopher Lewis.

Economic data to watch next week:

Tuesday: ISM Service PMI

Wednesday: 10-year US Treasury bond auction

Thursday: Bank of England monetary policy decision, US weekly jobless claims

See more news related to silver prices HERE...