As of 10:00 a.m. this morning (Vietnam time), world gold prices set a new record of 3,034 USD/ounce, up 34 USD compared to the same time yesterday. Since the beginning of the year, the precious metal has increased by more than 15%.

In the domestic market, the price of SJC gold bars was listed by Saigon Jewelry Company at VND96.7-98.2 million/tael (buy - sell), an increase of VND1.9 million/tael for buying and VND2.1 million/tael for selling. This is also an all-time high.

On the other hand, the global stock market and the digital market both recorded a decrease. At the end of the trading session on March 18 (US time), the Dow Jones index lost 260.32 points, equivalent to a decrease of 0.62%, to 41,581.31 points; The S&P 500 index decreased by 1.07%, to 5,614.66 points; Nasdaq index decreased by 1.71%, to 17,504.12 points.

According to Mr. David Meger - Director of Precious metals trading at High Ridge Futures, Israel's surprise airstrikes across the Gaza Strip and US bombing of the Houthis, in the context of the Russia-Ukraine conflict not having many important steps forward, have further increased market instability. Demand for shelter has caused precious metals such as gold and silver to continue to increase.

Meanwhile, bonds and digital currencies are considered to have high risk, causing cash flow flow into these two markets to decrease sharply.

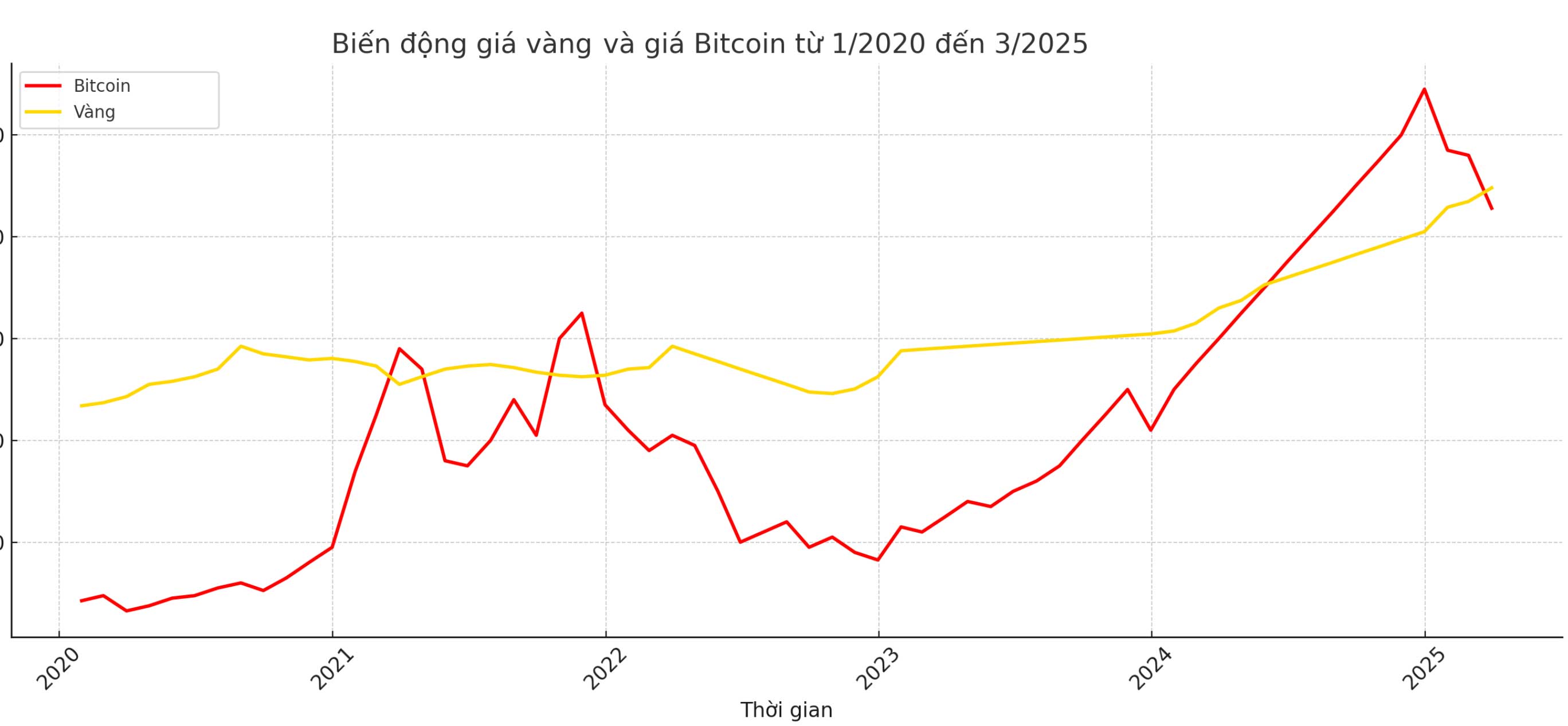

For many years, Bitcoin has been hailed by investors as digital gold - an asset that can preserve value during times of crisis. However, recent statistics show that Bitcoin is increasingly losing this feature.

If Bitcoin used to be independent, now the fluctuations of the world's most valuable digital currency are increasingly synchronized with the stock market, especially technology stocks.

This is most clearly demonstrated through the correlation data between Bitcoin and Nasdaq - the world's largest stock exchange, where many leading technology companies such as Apple, Microsoft, Google (Alphabet), Amazon, Tesla and Meta ( Facebook) are listed.

Since the beginning of 2025, when conflicts between countries escalated, along with President Donald Trump imposing new tax policies, the world financial market has reacted.

Instead of being seen as a safe haven asset, Bitcoin fell into a downward spiral with stocks.

Bitcoin has dropped from $95,000 to just $82,000. Meanwhile, gold increased from $2,623 to $3,034 per ounce.

Although Bitcoin can still act as a long-term investment with high profit potential, in terms of safe-haven assets, this digital currency is gradually losing its independence.

In major crises, gold is always the top choice for investors. What about Bitcoin? It is reacting more and more like a technology stock than a sustainable store of value asset.

If this trend continues, Bitcoin may no longer be considered "digital gold" but simply a high-risk investment asset, going up and down according to the market's sentiment.

In Vietnam, representatives of the State Bank have repeatedly sent out the message: Bitcoin and other similar virtual currencies are not legal currencies and payment methods.

However, in the recently issued Directive No. 05/CT-TTg, Prime Minister Pham Minh Chinh directed the Ministry of Finance and the State Bank to submit a proposal for a legal framework on digital currency in March.