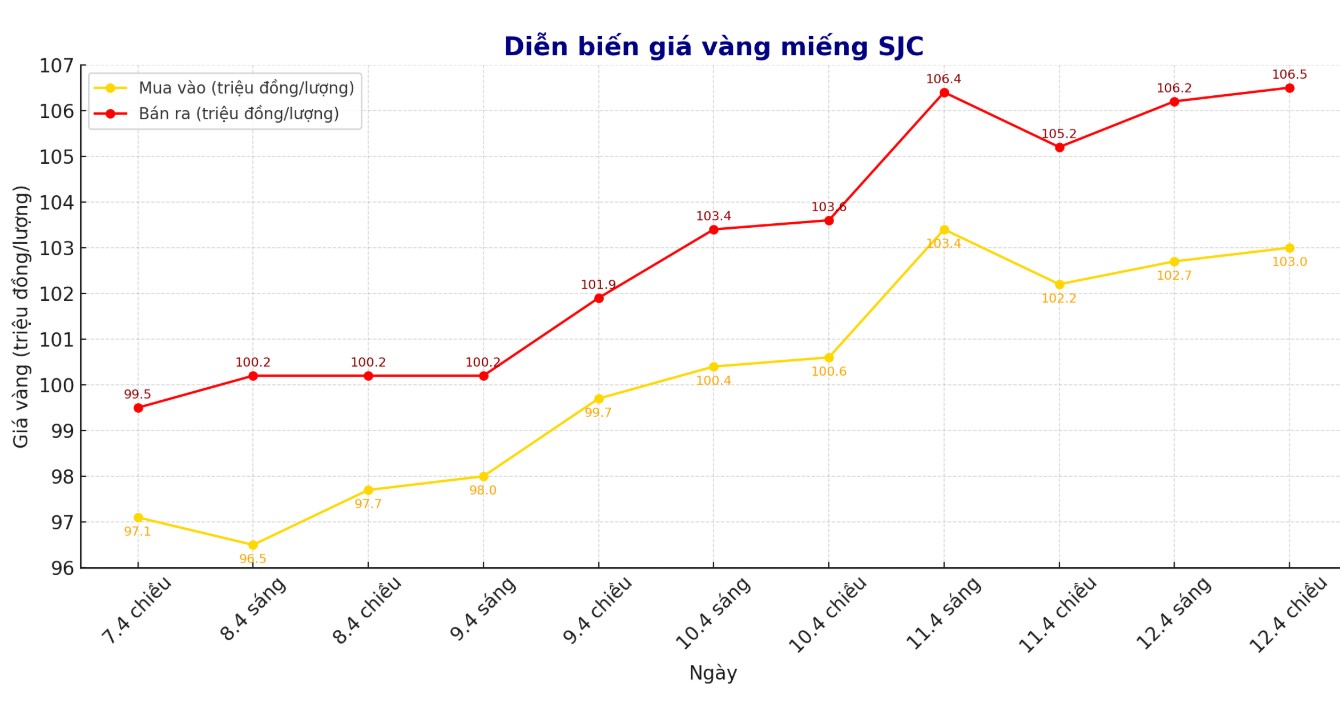

Updated SJC gold price

As of 440 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 103-106.5 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 1.3 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at 103-106.5 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 1.3 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 103-106.5 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 1.3 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

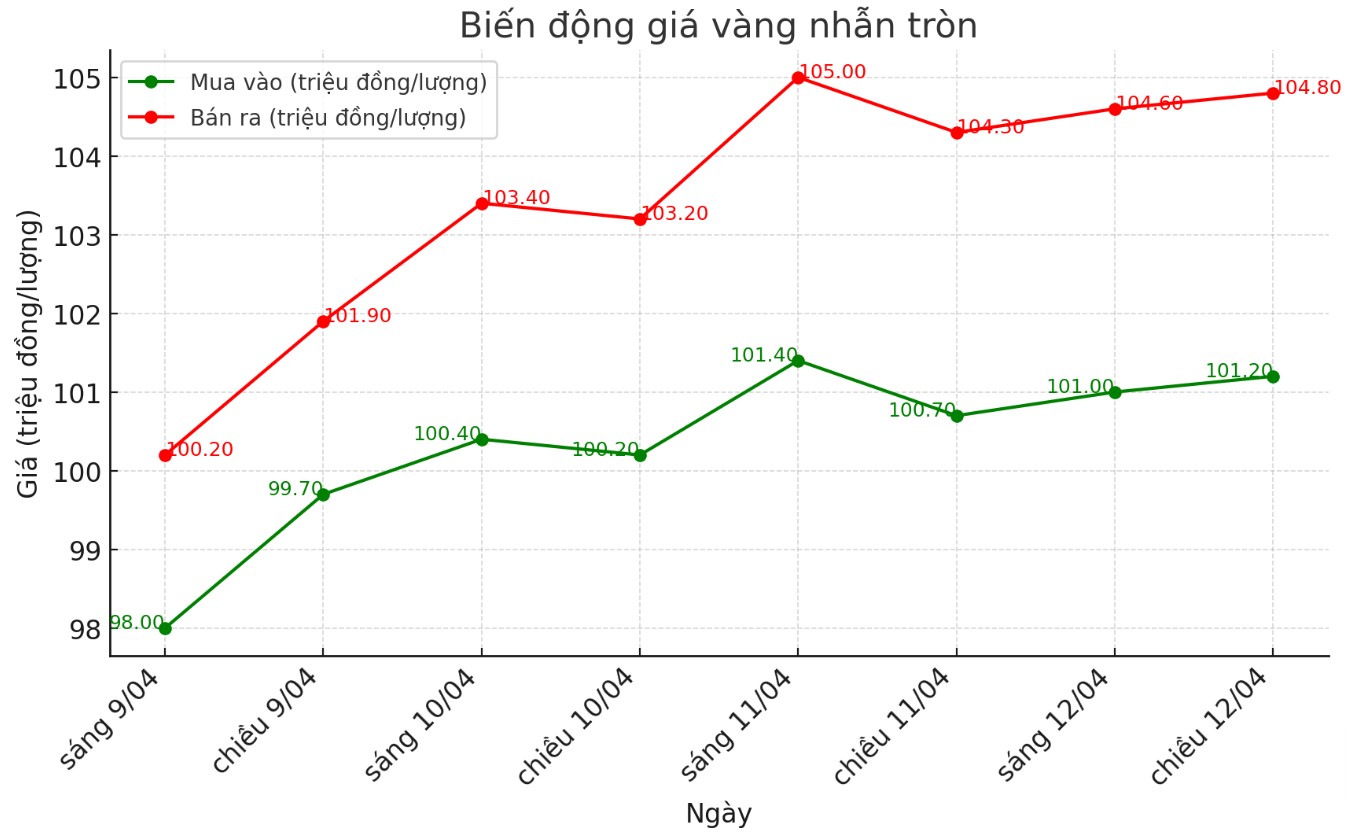

9999 round gold ring price

As of 4:40 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 101.2-104.8 million VND/tael (buy - sell); an increase of 500,000 VND/tael for both buying and selling compared to early in the morning. The difference between buying and selling prices is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 101.6-105.1 million VND/tael (buy - sell); an increase of 700,000 VND/tael for buying and an increase of 600,000 VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3.5 million VND/tael.

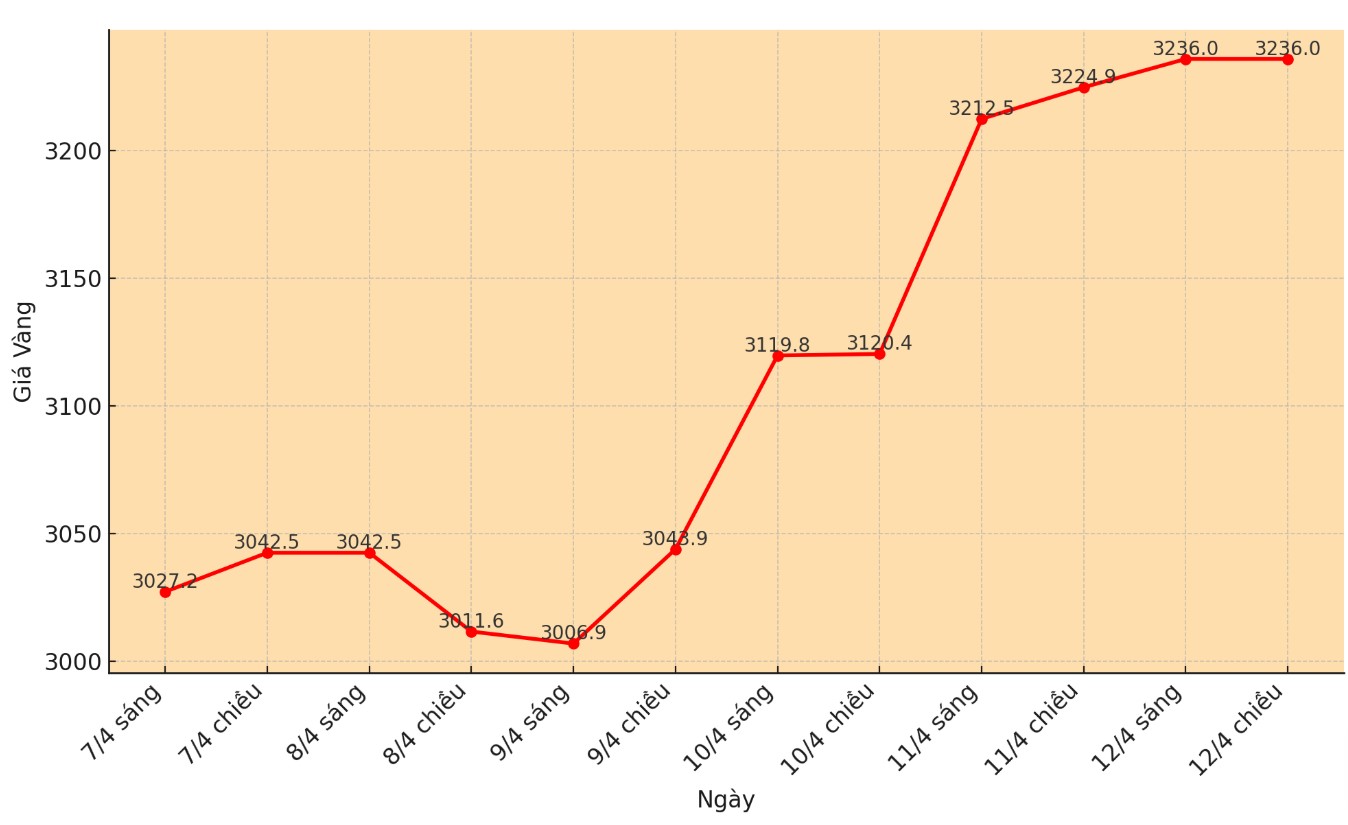

World gold price

As of 16:35, the world gold price was listed at 3,236 USD/ounce, up 11.1 USD.

Gold price forecast

The latest weekly gold survey from Kitco News shows that industry experts are more optimistic about gold than ever. While retail investors are gradually expecting more positiveness as most other assets weaken.

This week, 16 analysts participated in the Kitco News survey. Wall Street is almost in agreement that gold prices will continue to increase in the short term.

15 people (94%) predict gold prices will increase next week, no one thinks gold will decrease. Only 1 person (6%) believes that gold will stay at its current high without increasing further.

Meanwhile, 275 investors participated in Kitco's online survey. The sentiment of retail investors is also more positive as other assets have decreased in price.

189 people (69%) see gold prices rising next week. 50 people (18%) predict gold will fall, while the remaining 36 people (13%) see prices moving sideways.

According to the latest report from the World Gold Council (WGC), concerns about slowing US economic growth and rising inflation have prompted investors to turn to gold as a safe haven.

Since the beginning of the year, gold-based exchange-traded funds (ETFs) have recorded a stable flow of money. In March alone, cash flow increased sharply in all major regions.

According to the WGC, ETFs in North America account for 61% of total cash flow into gold, while Europe accounts for about 22% and Asia accounts for 16%.

Europe has been a weak link in the gold market in recent times, but now there are signs of catching up. Cash flow into European gold funds in the first quarter reached 4.6 billion USD - the highest level since the first quarter of 2020 - the report said.

In March alone, 92 tons of $8.6 billion worth of gold fell into global ETFs. In the first quarter, a total of 226 tons of gold (equivalent to $21 billion) flowed into ETFs - the second highest in history, after only the second quarter of 2020.

According to Jonas Goltermann - Deputy Director of Market Economics at Capital Economics, the USD is fluctuating strongly due to the global economy reacting to the tariff policies of US President Donald Trump. Although it is too early to assess the long-term impact, he said the US dollar's safe-haven role is weakening, giving gold an advantage.

In this context, Jerry Prior - CEO of Mount Lucas Management commented that gold's new peak is not surprising and prices may continue to increase.

Lukman Otunuga - market analyst at FXMT commented that increased trade tensions lead to concerns about global growth and the possibility of central banks cutting interest rates. This has weakened the US dollar and supported gold prices to increase. On the technical chart, gold has gained more than 6% for the week, bringing the total increase since the beginning of the year to 23%, with buyers dominating.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...