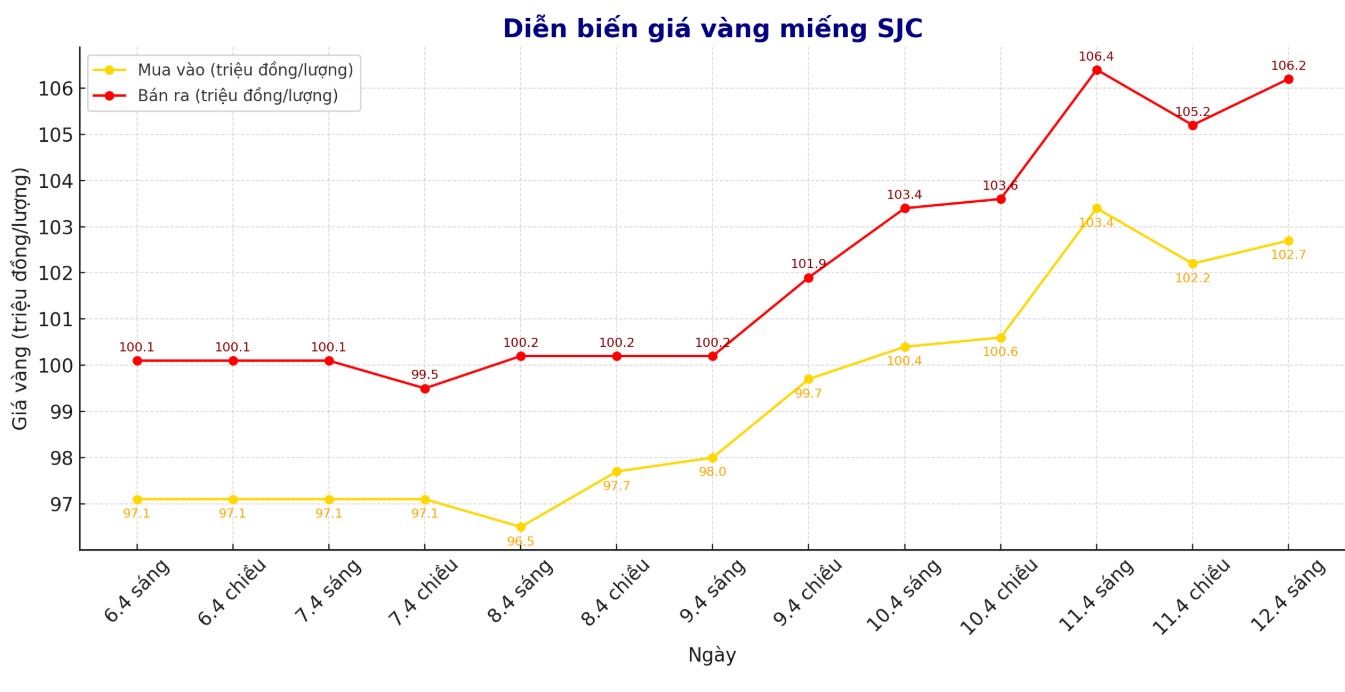

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND102.7-106.2 million/tael (buy - sell), down VND700,000/tael for buying and down VND200,000/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 102.8-106.2 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 3.4 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 102.7-106.2 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 200,000 VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

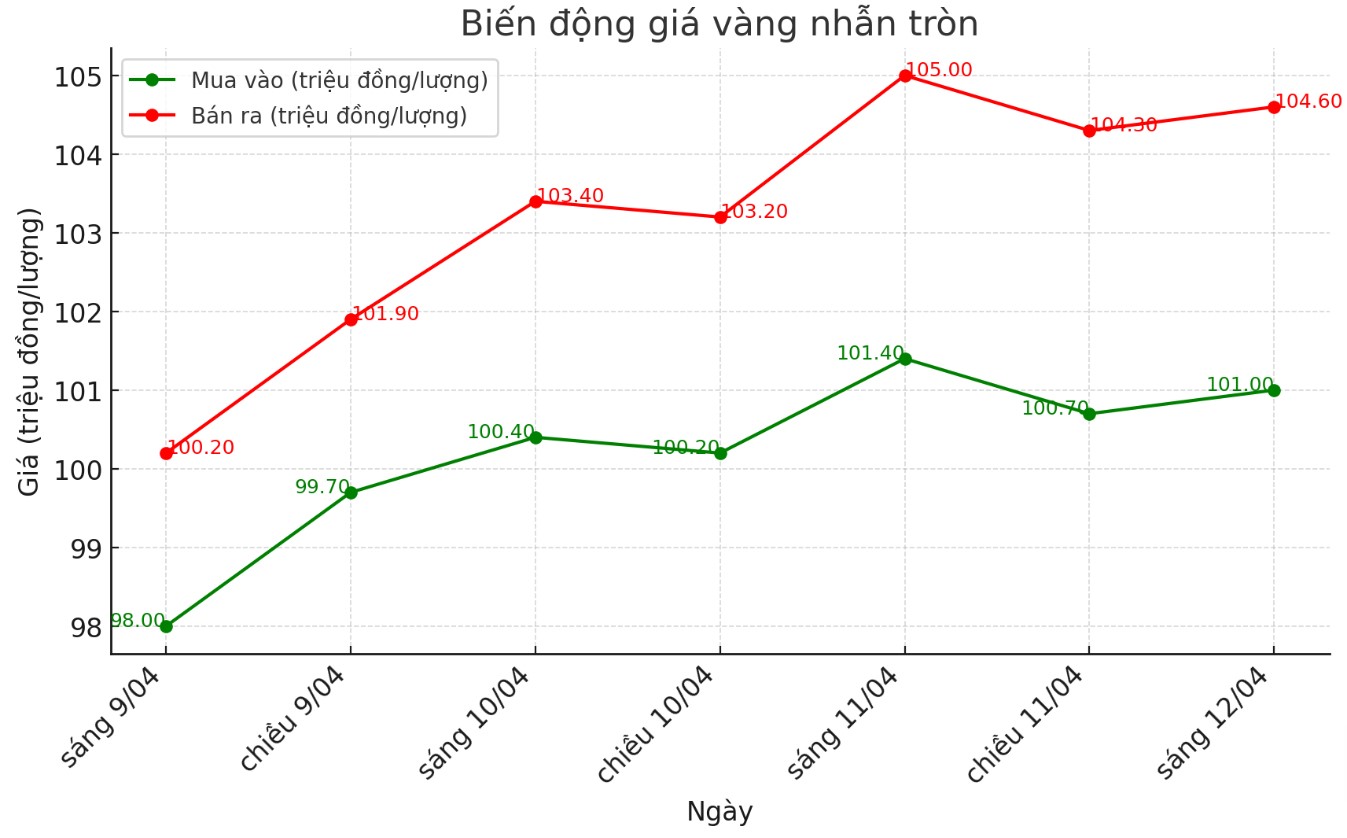

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 101-104.6 million VND/tael (buy - sell), down 400,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 101.5-105 million VND/tael (buy - sell), down 1 million VND/tael for buying and down 1.4 million VND/tael for selling. The difference between buying and selling is 3.5 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

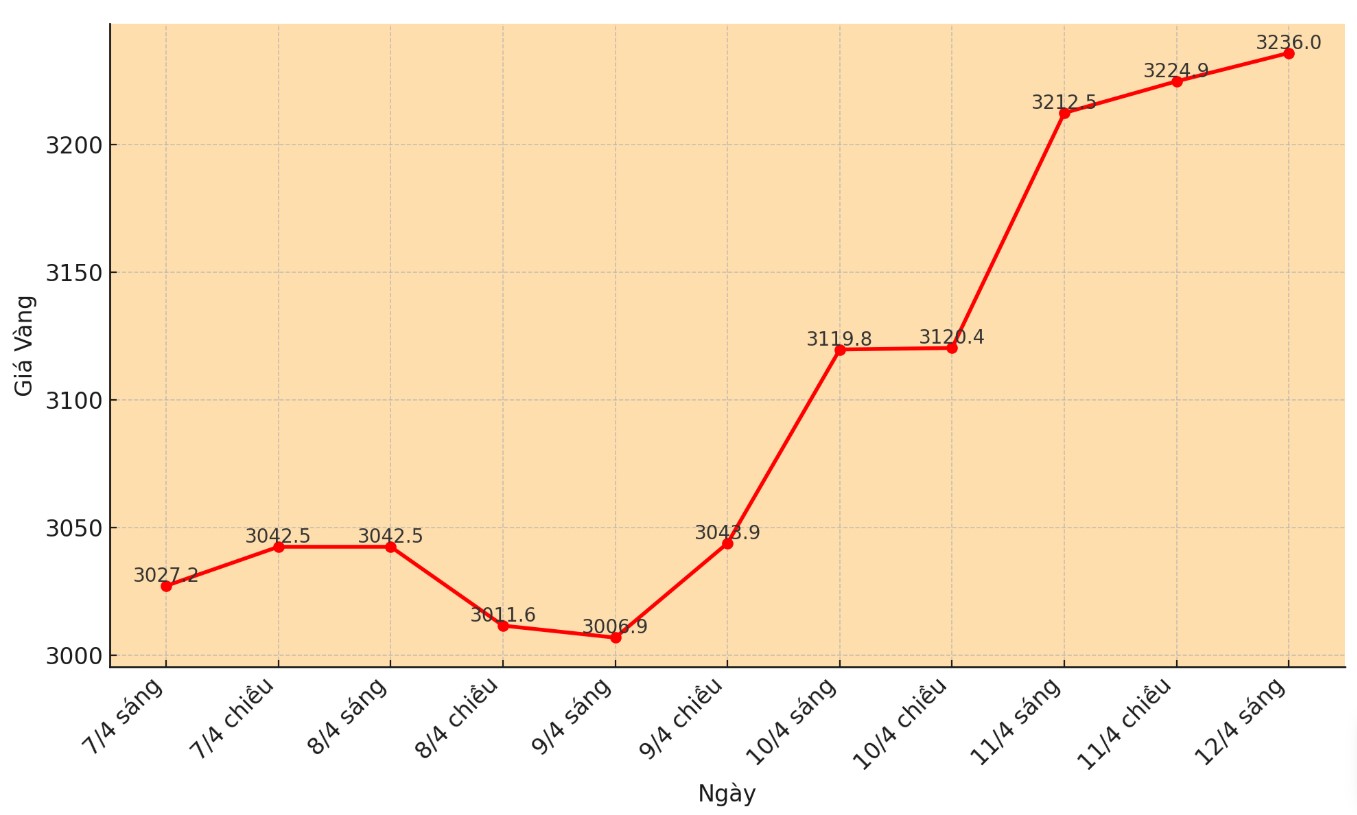

World gold price

At 9:00 a.m., the world gold price listed on Kitco was around 3,236 USD/ounce, up 23.5 USD compared to the beginning of the trading session yesterday morning.

Gold price forecast

According to Kitco, the latest report from the World Gold Council (WGC) shows that concerns about slowing US economic growth and rising inflation have caused investors to turn to gold as a safe haven.

Since the beginning of the year, gold-based exchange-traded funds (ETFs) have recorded a stable flow of money. In March alone, cash flow increased sharply in all major regions.

According to the WGC, ETFs in North America account for 61% of total cash flow into gold, while Europe accounts for about 22% and Asia accounts for 16%.

Europe has been a weak spot in the gold market in recent times, but now there are signs of catching up. Cash flow into European gold funds in the first quarter reached 4.6 billion USD - the highest level since the first quarter of 2020 - the report said.

In March alone, 92 tons of $8.6 billion worth of gold fell into global ETFs. In the first quarter, a total of 226 tons of gold (equivalent to $21 billion) flowed into ETFs - the second highest in history, after only the second quarter of 2020.

The weakening of the stock market due to concerns about growth and declining liquidity - in the context of central banks still tightening monetary policy - has further caused investors to seek gold as a safe asset.

Investors are tending to keep gold longer and do not want to sell because the current policy situation is too unpredictable. This could create a strong push for gold prices.

Looking back at history, this increase is not large or prolonged. Even compared to the peaks in 2011 and 2020, the current gold price support platform is more solid, said the WGC.

Alexander Zumpfe - precious metals trading expert at Heraeus Metals Germany - commented: "The risk of recession is growing, bond yields are increasing strongly, while the USD is continuously weakening. These factors are continuing to push gold to maintain its position as a hedge against crises and inflation.

Nitesh Shah - commodity strategist at WisdomTree - said that gold still plays a popular safe haven role, in the context of the world being turned around by trade tensions.

Tai Wong - an independent metals trader - believes that gold may adjust slightly in the short term, but the main trend is still up. Recent consumer and producer price data is reinforcing the possibility of the Federal Reserve continuing to cut interest rates. That will continue to put pressure on the USD, thereby supporting the gold rally, he said.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...