US weekly jobless claims drop

Gold prices are trading near a new record high after better-than-expected US labor market data was released. The number of Americans filing for new unemployment benefits is lower than economists predicted.

The number of initial jobless claims to states in the week ended April 5 was 223,00, according to the US Department of Labor on Thursday. This figure is lower than expected, as experts predict it will be 226,000. Last week's figure was revised down to 219,000.

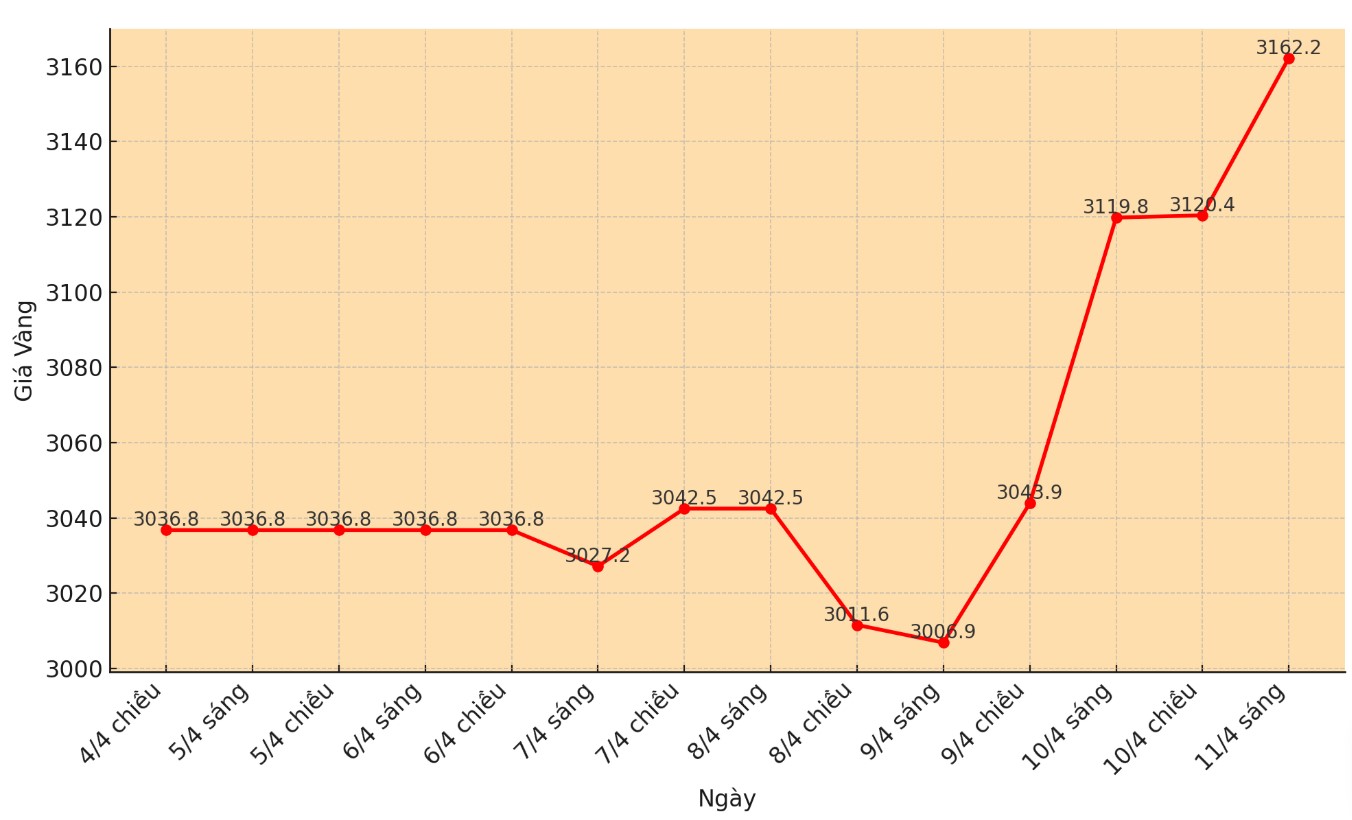

After the data was released (8:30 a.m. EDT), spot gold prices skyrocketed to a new record high of $3,134.41/ounce.

Meanwhile, the number of new unemployment claims calculated on a four-week average - considered a more reliable index of the labor market - reached 223,000, lower than the forecast of 226,000 and equal to the adjusted average of the previous week.

The number of people receiving continuous unemployment benefits was 1.85 million in the week ended on March 29, lower than the forecast of 1.915 million and also lower than the previous week's 1.893 million after adjustment.

US CPI drops more than expected

The market also received more data on US CPI. According to the US Bureau of Labor Statistics on Thursday (local time), the country's consumer price index (CPI) fell 0.1% last month, after rising 0.2% in February. This inflation data is lower than expected, as economists expect the CPI to increase by 0.1%.

The report said that overall inflation in the past 12 months increased by 2.4%, down sharply from 2.9% in February. Economic experts have forecast annual inflation to increase by 2.5%.

The core CPI, which excludes food and energy prices, rose 0.1% over the past month, was also lower than expected. Economists have forecast a 0.3% increase in core CPI.

The report said core annual inflation rose 2.8% over the past month, below expectations of 3.0%. Core inflation has increased in the past 12 months at the slowest pace since March 2021, the report said.

US inflation is becoming a complex problem for the gold market. High consumer prices force the US Federal Reserve (FED) to maintain a neutral monetary policy, keeping interest rates unchanged, which increases the opportunity cost of holding gold; however, high inflation also increases the risk of the US falling into recession, which supports demand for gold as a safe asset.

Weaker inflation data gives the Fed space to cut interest rates, but also eases concerns about prolonged stagflation.

falling oil and gas prices are a major factor in falling inflation. The report said the energy index fell 2.4% over the past month, with gasoline prices falling 6.3%. However, food prices remained high, up 0.4% in March.

The report also showed inflationary pressures mixed in with core consumer prices.

The indicators that increased in the past month included personal care, healthcare, education, clothing and new vehicles. The indicators of airfares, motor vehicle insurance, used cars and entertainment were the main indicators decreasing in the month of the three months, the report said.

Looking ahead, economic experts say there is great uncertainty surrounding inflation expectations. Economists say US tariffs will push consumer prices higher, but the constant change in policy makes it difficult to determine the level of inflation increase.