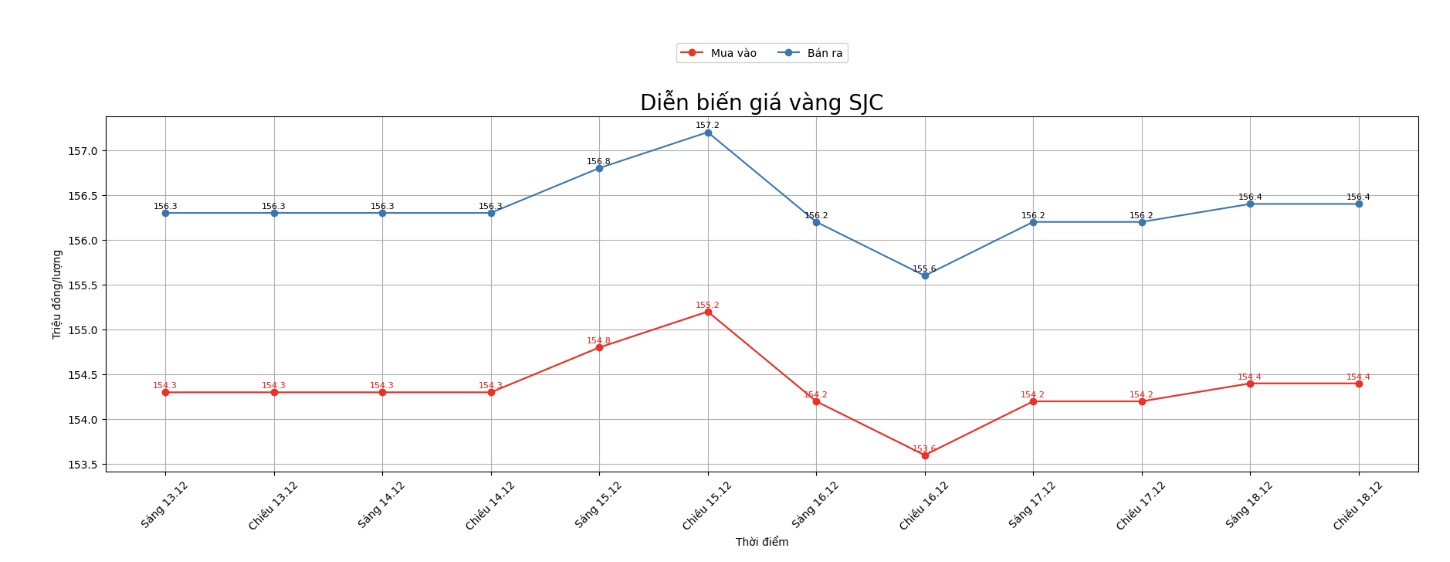

SJC gold bar price

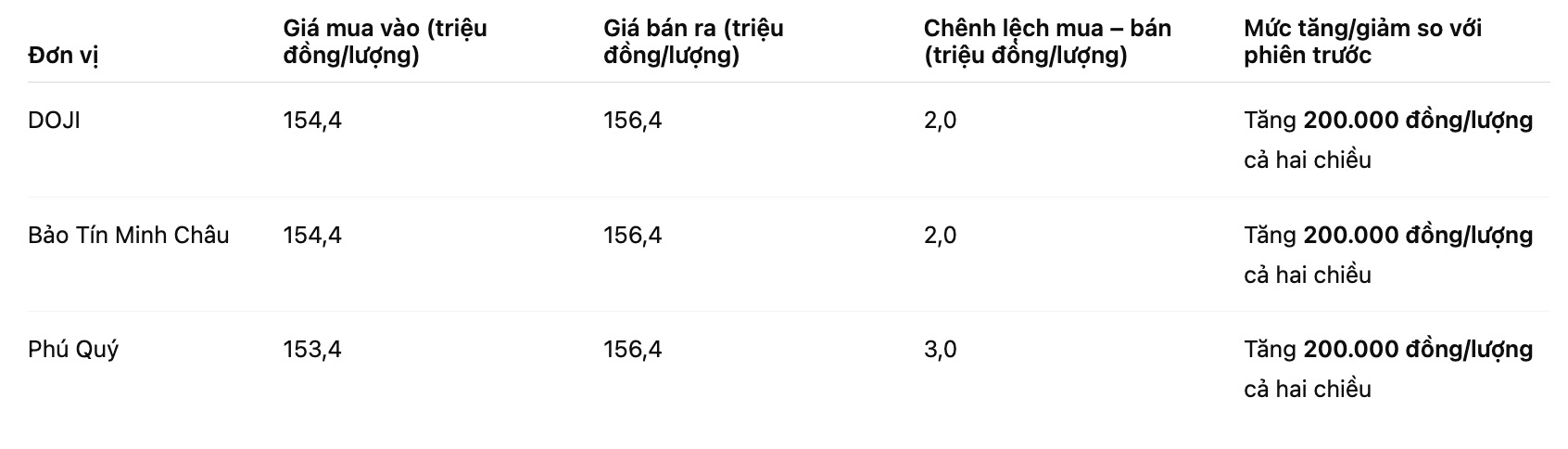

As of 5:15 p.m., DOJI Group listed the price of SJC gold bars at VND154.4-156.4 million/tael (buy in - sell out), an increase of VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.4-156.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.4-156.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

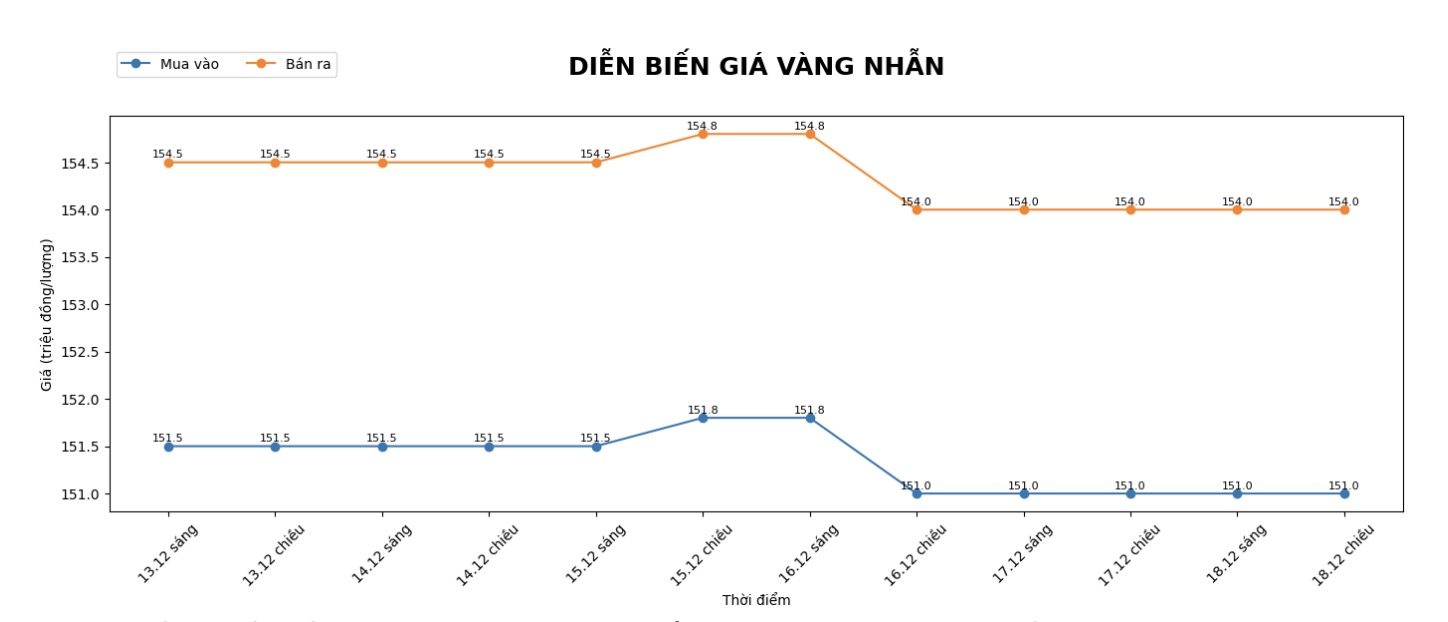

9999 gold ring price

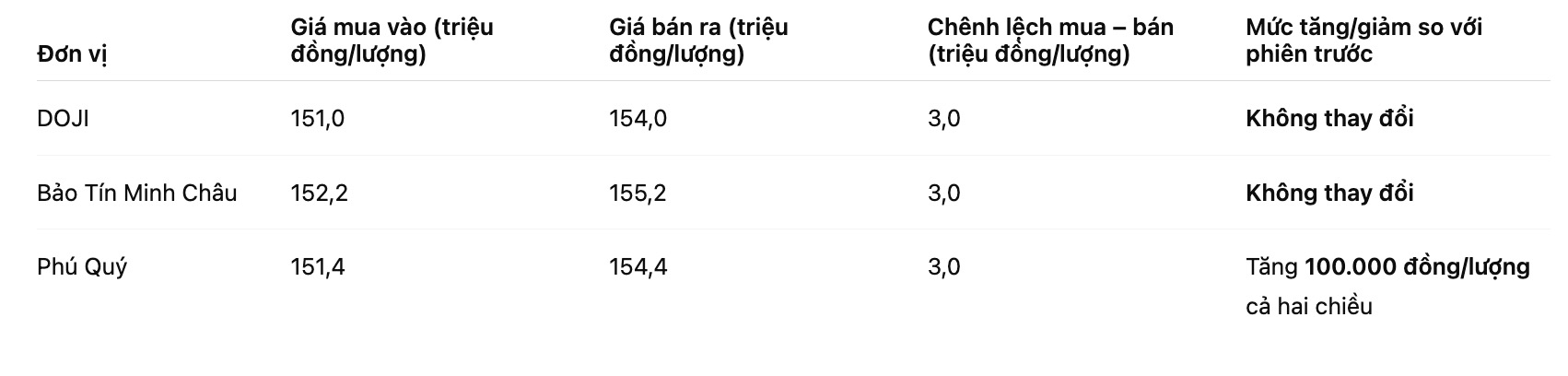

As of 5:20 p.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.4-154.4 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

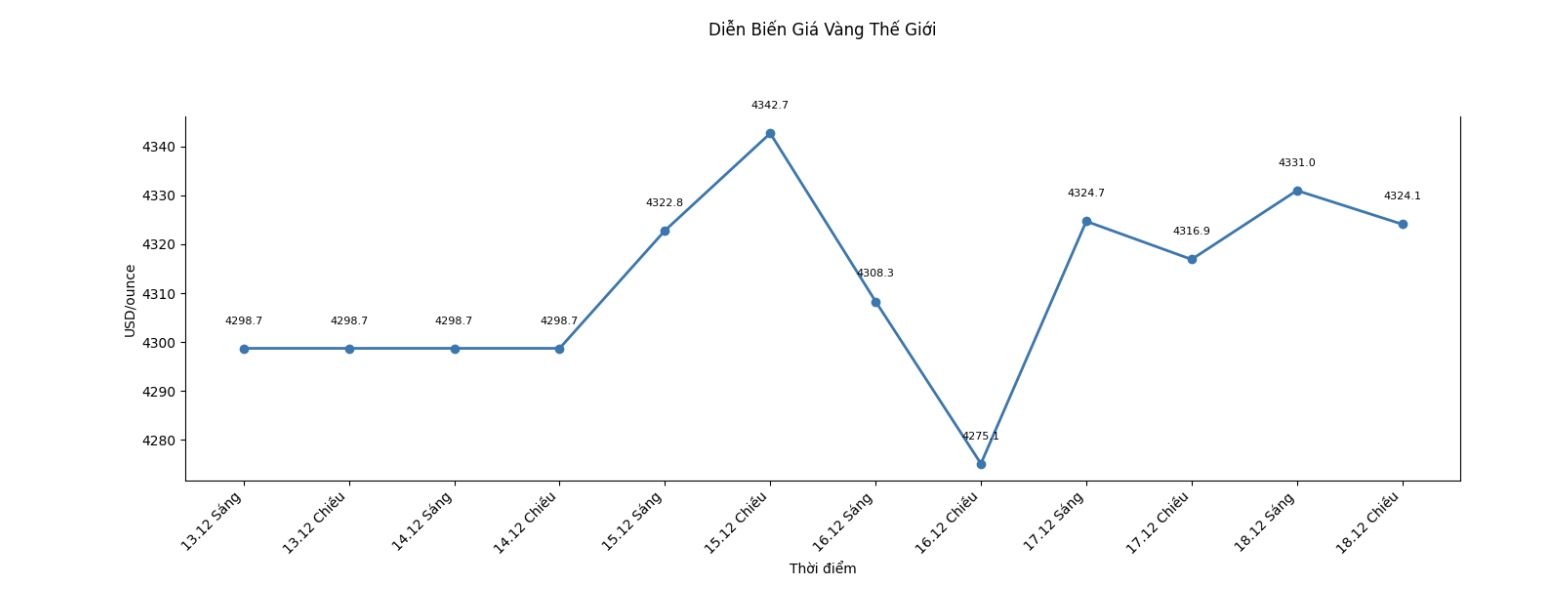

World gold price

The world gold price was listed at 5:10 p.m., at 4,324.1 USD/ounce, up 7.2 USD compared to a day ago.

Gold price forecast

Gold prices fluctuated in the trading session on Thursday, supported by dovish signals from the US Federal Reserve (Fed) but were pressured by the stronger USD, as investors waited for important US inflation data to be released this week.

In their official 2026 outlook report, commodity analysts at BMO Capital Markets said they expect gold prices to peak in the first half of the year, with an average price of $4,600/ounce, up 5% from the previous forecast. For the whole year, BMO forecasts gold prices to average around $4,550 an ounce, up 3% from the old estimate.

Although optimistic about the entire precious metals group, BMO analysts believe that gold will be the outstanding asset in 2026.

BMO stressed that gold prices continue to be strongly supported by macro factors, as falling interest rates next year put pressure on the USD - which is still vulnerable to the global "currencies" trend of "denominating the value of currencies" due to increased public debt.

Golds resilience after the October sell-off shows that the metals diversification and safe haven role remains intact, said analysts.

In a recent interview, Eric Strand - founder and portfolio manager of AuAg Funds - said that gold is still on track towards the long-term target of 10,000 USD/ounce and any price lower than that threshold next year can be considered a "bargain".

Looking forward to the next 12 months, Strand believes that 5,000 USD/ounce is a completely feasible target. However, instead of focusing too much on a specific number, he emphasized that investors should pay more attention to the trend, which he said will continue to increase.

Despite the strong increase, Strand noted that the proportion of gold in the portfolios of large organizations is still very low. Family offices and professional investors are now allocating less than 2% of their assets to gold a figure he believes could be increased to about 5% without showing any signs of a speculative bubble. This shift alone could create hundreds of billions of dollars in new and more important demand, according to Strand, this capital flow is no longer limited to the stock market.

See more news related to gold prices HERE...