Gold prices rose steadily and hit a seven-week high in the early trading session in the US on Friday. Silver prices also increased and set a new record of $64.955 an ounce in the overnight trading session, calculated according to the March silver futures contract on the Comex exchange.

The two precious metals are witnessing strong technical buying power and are supported by the unexpected loose stance of the US Federal Reserve (Fed), along with the weakening of the USD index.

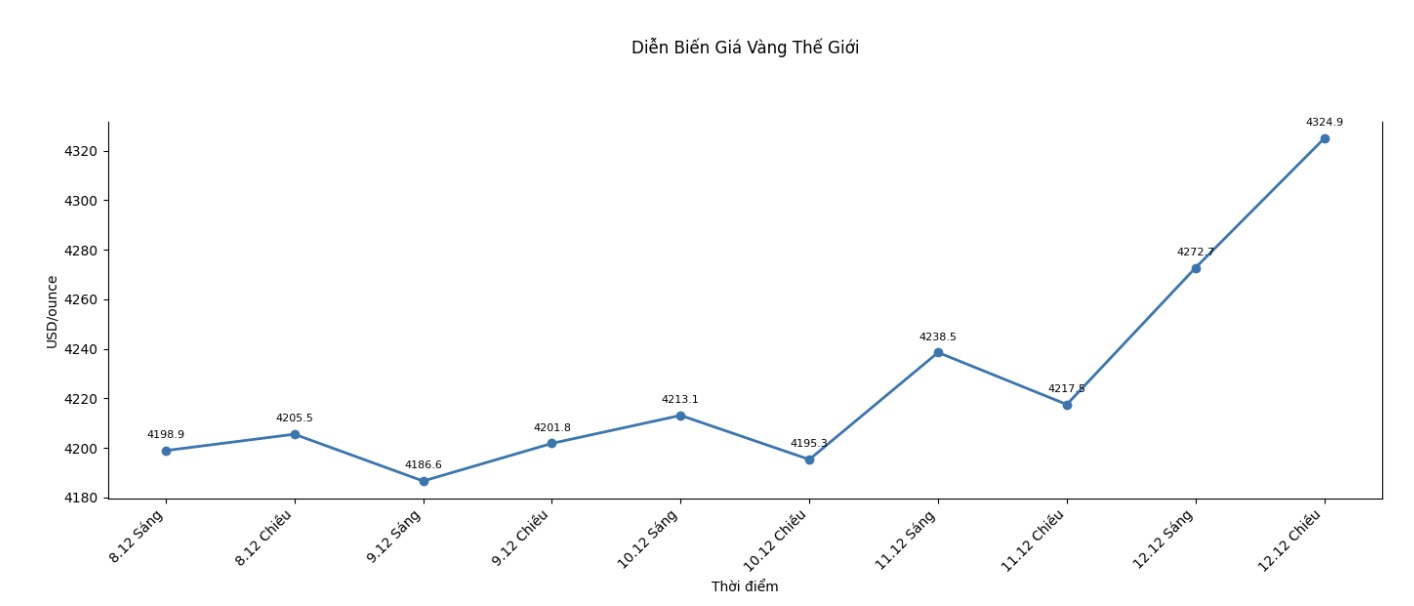

At the most recent time, February gold increased by 55.1 USD to 4,368.8 USD/ounce. March delivery silver price increased by 0.213 USD to 64.815 USD/ounce.

The global stock market mostly decreased in points in the overnight trading session. US stock indexes are expected to open down as they enter the day-to-day trading session in New York.

However, for the whole week, global stock markets still recorded a strong increase after the Fed confirmed that the monetary policy easing cycle was still maintained, paving the way for expectations of a year-end rally under the "Santa Claus rally" effect.

The European Stoxx 600 index at one point increased by 0.5% to a new record high. A representative index for the Asian market also increased to a historical peak, just less than 2%. The S&P 500 futures contract fell slightly after the base index just set a record high closing price this weekend.

Ms. Karen Georges - fund manager at Ecofi Investments (Paris), told Bloomberg: "Everyone is currently convincing themselves that there will be a price increase at Christmas, so it is likely that it will happen. To be honest, from now until the end of the year, there are almost no obvious negative catalysts".

She added that investors are actively buying backlog assets this year, considering this a favorable time to diversify their investment portfolio.

The USD index hit a six-week low on Thursday and is on track for a third consecutive week of decline. The greenback weakened after the Fed cut interest rates as expected and gave a less hawl outlook than the market predicted. Fed Chairman Jerome Powell said the possibility of another rate hike is uncertain, while Fed forecasts show only one rate cut next year.

Meanwhile, other major economies such as Australia, Canada and Europe are seeing an adjustment in expectations towards a tighter direction, continuing to put downward pressure on the USD. The greenback is expected to weaken against most major currencies this week, with the strongest decline coming against the euro.

On geopolitics, US President Donald Trump said the US is ready to support Ukraine within the framework of a security deal to end the conflict with Russia. Mr. Trump expressed his disappointment at the slow progress of negotiations.

Technically, buyers for February gold futures are aiming for the next upside target of closing above the strong resistance zone at $4,433/ounce, which is also a record high for the contract. On the other hand, the short-term bearish target for the bears is to push prices below the important technical support zone at $4,200/ounce.

The nearest resistance zone was determined at 4,400 USD/ounce, followed by 4,433 USD/ounce. The support levels were at 4,300 USD/ounce and the bottom recorded in the overnight trading session was 4,295.5 USD/ounce.

The world gold and silver market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.